512 67 Stat. 577.

PUBLIC LAW 93-143-OCT. 30, 1973

[87 STAT.

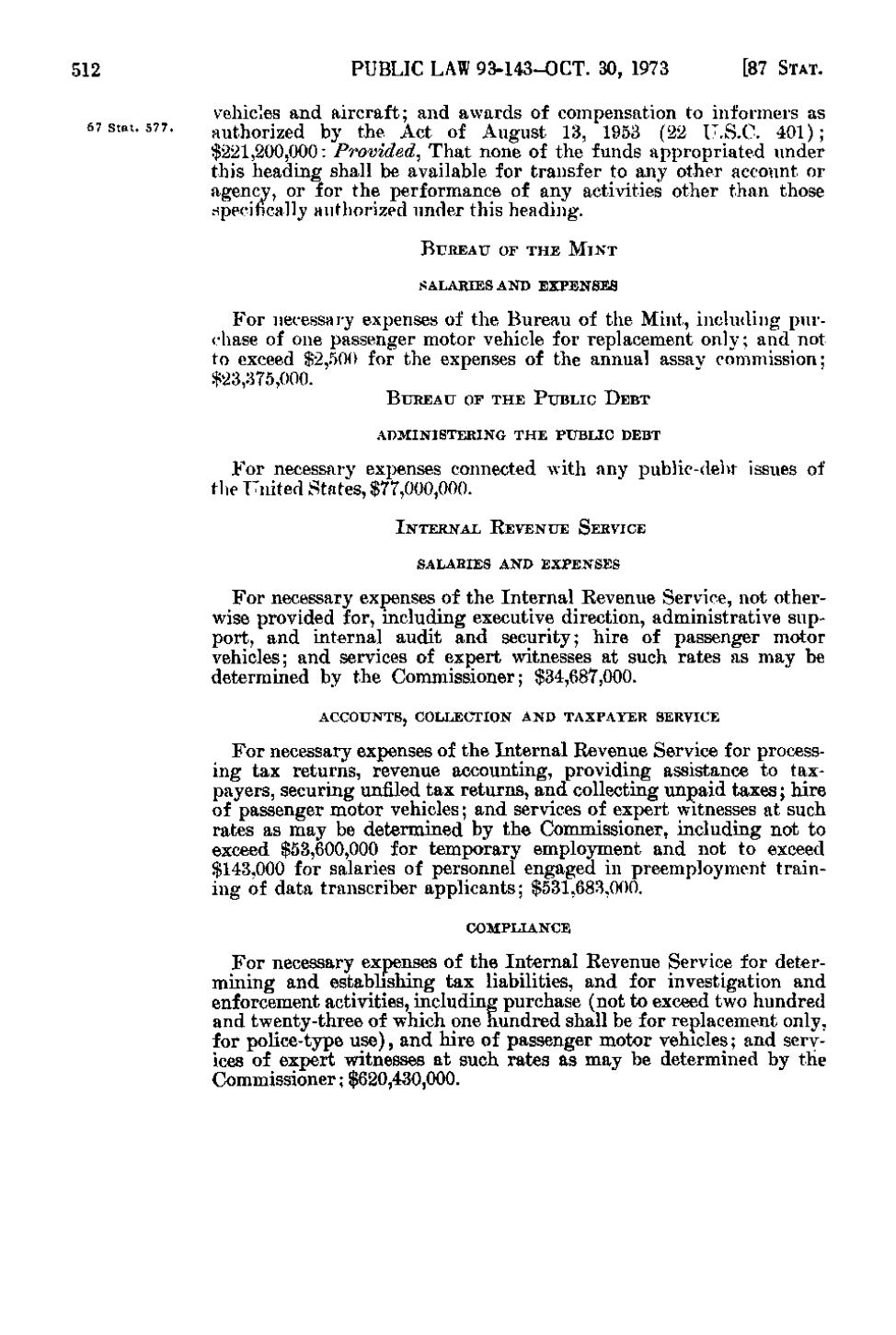

vehicles and aircraft; and awards of compensation to informers as authorized by the Act of August 13, 1953 (22 U.S.C. 401); $221,200,000: Provided, That none of the funds appropriated under this heading shall be available for transfer to any other account or agency, or for the performance of any activities other than those specifically authorized under this heading. BUREAU OF THE M I N T SALARIES AND EXPENSES

For necessary expenses of the Bureau of the Mint, including purchase of one passenger motor vehicle for replacement only; and not to exceed $2,500 for the expenses of the annual assay commission; $23,375,000. BUREAU OF THE PUBLIC DEBT ADMINISTERING THE PUBLIC DEBT

For necessary expenses connected with any public-debt issues of the United States, $77,000,000. INTERNAL REVENUE SERVICE SALARIES AND EXPENSES

For necessary expenses of the Internal Revenue Service, not otherwise provided for, including executive direction, administrative support, and internal audit and security; hire of passenger motor vehicles; and services of expert witnesses at such rates as may be determined by the Commissioner; $34,687,000. ACCOUNTS, C O L L E C T I O N A N D T A X P A Y E R SERVICE

For necessary expenses of the Internal Revenue Service for processing tax returns, revenue accounting, providing assistance to taxpayers, securing unfiled tax returns, and collecting unpaid taxes; hire of passenger motor vehicles; and services of expert witnesses at such rates as may be determined by the Commissioner, including not to exceed $53,600,000 for temporary employment and not to exceed $143,000 for salaries of personnel engaged in premployment training of data transcriber applicants; $531,683,000. COMPLIANCE

For necessary expenses of the Internal Revenue Service for determining and establishing tax liabilities, and for investigation and enforcement activities, including purchase (not to exceed two hundred and twenty-three of which one hundred shall be for replacement only, for police-type use), and hire of passenger motor vehicles; and services of expert witnesses at such rates as may be determined by the Commissioner; $620,430,000.

�