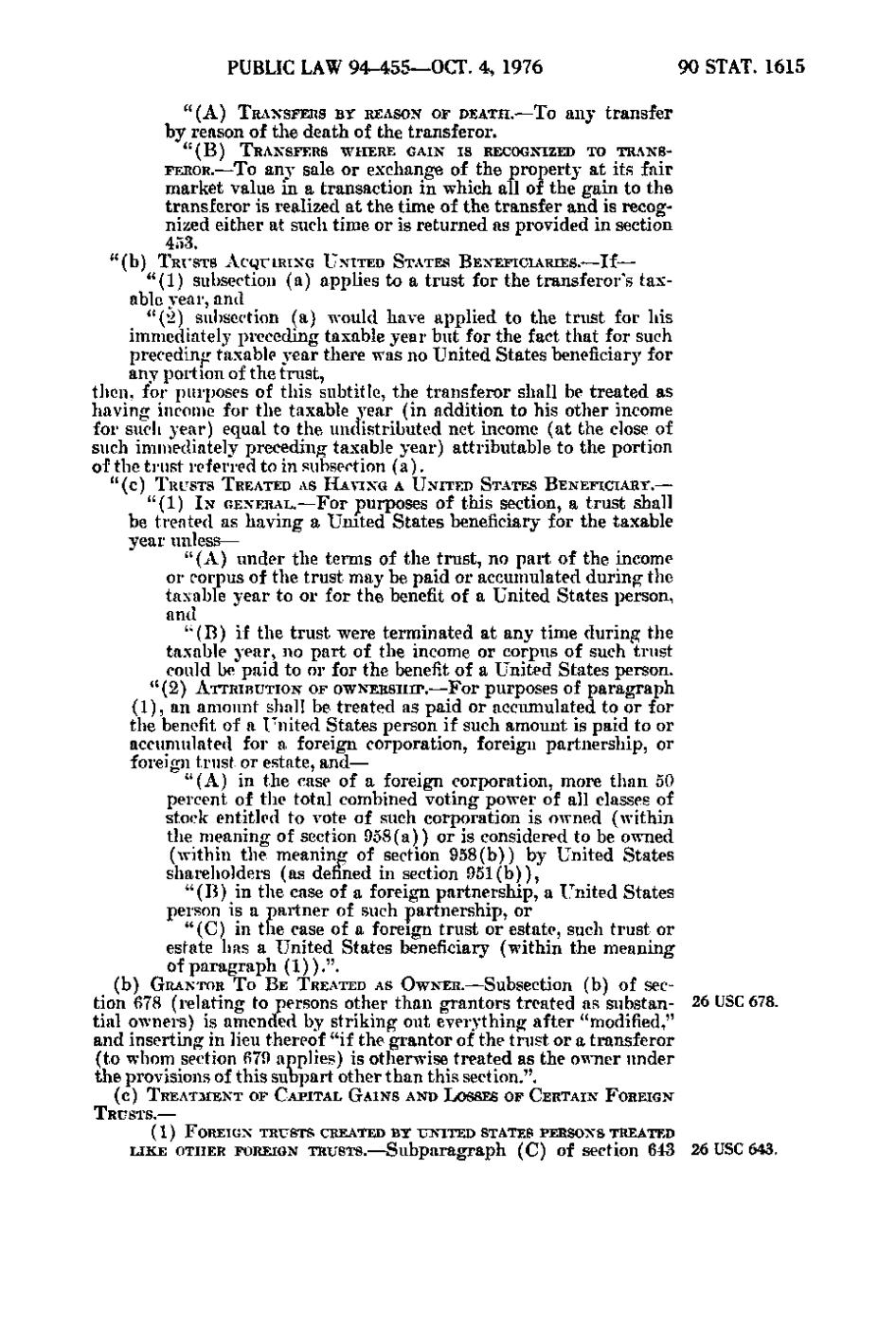

PUBLIC LAW 94-455—OCT. 4, 1976 "(A)

TRANSFERS BY REASON OF DEATH.—To any

9 0 STAT. 1615 transfer

by reason of the death of the transferor. "(B)

TRANSFERS WHERE GAIN I S RECOGNIZED TO TRANS-

FEROR.—To any sale or exchange of the property at its fair market value in a transaction i n which all of the gain to the transferor is realized a t the time of the transfer and is recognized either at such time or is returned as provided in section 453. " (b) TRUSTS ACQUIRING UNITED STATES B E N E F I C I A R I E S. — I f —

" (1) subsection (a) applies to a trust for the transferor's taxable year, and " (2) subsection (a) would have applied to the trust for his immediately preceding taxable year b u t for the fact that for such preceding taxable year there Avas no United States beneficiar}^ for any portion of the trust, then, for purposes of this subtitle, the transferor shall be treated as h a v i n g income for the taxable year (in addition to his other income for such year) equal to the undistributed n e t income ( a t the close of such immediately preceding taxable year) attributable to the portion of the trust referred to in subsection (a).

" (c) TRUSTS TREATED AS HAVING A UNITED STATES BENEFICIARY.—

" (1) IN GENERAL.—For purposes of this section, a trust shall be treated as h a v i n g a United States beneficiary for the taxable year unless— " (A) under the terms of the trust, no part of the income or corpus of the trust may be paid or accumulated during the taxable year to or for the benefit of a United States person, and " (B) if the trust were terminated a t any time during the taxable year, n o part of the income or corpus of such trust could be paid to or for the benefit of a United States person. " (2) ATTRIBUTION OF O W N E R S H I P. — For purposes of paragraph

(1), an amount shall be treated as paid or accumulated to or for the benefit of a United States person if such amount is paid to or accumulated for a foreign corporation, foreign partnership, or foreign trust or estate, and— " (A) in the case of a foreign corporation, more than 50 percent of the total combined voting power of all classes of stock entitled to vote of such corporation is OAvned (within the meaning of section 9 5 8 (a)) or is considered to be owned (within the meaning of section 9 5 8 (b)) by United States shareholders (as defined in section 9 5 1 (b)), " (B) in the case of a foreign partnership, a United States person is a part n e r of such partnership, or " (C) in the case of a foreign trust or estate, such trust o r estate has a United States beneficiary (within the meaning of paragraph (1)). ". (b) GRANTOR To B E TREATED AS OWNER.—Subsection (b) of sec-

tion 678 (relating to persons other than grantors treated as substan- 26 USC 678. tial OAvners) is amended by striking out everything after "modified," and inserting in lieu thereof "if the g r a n to r of the trust or a transferor (to whom section 679 applies) is otherwise treated as the owner under the provisions of this subpart other than this section.". (c) TREATMENT OF CAPITAL G A I N S AND LOSSES OF CERTAIN FOREIGN TRUSTS.— (1) FOREIGN TRUSTS CREATED BY UNITED STATES PERSONS TREATED LIKE OTHER FOREIGN TRUSTS.—Subparagraph (C) of section 643

26 USC 643.

�