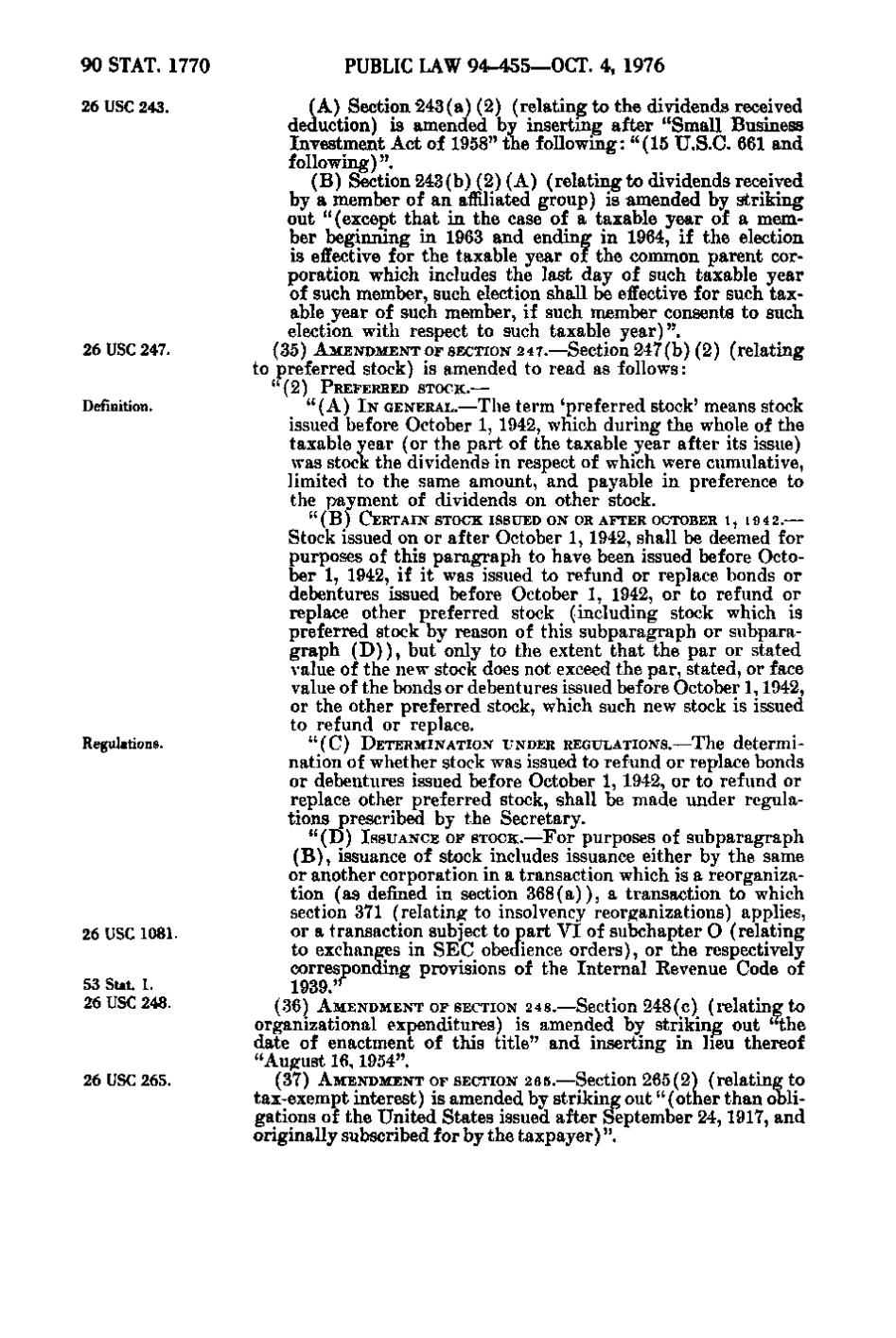

90 STAT. 1770 26 USC 243.

26 USC 247.

PUBLIC LAW 94-455—OCT. 4, 1976 (A) Section 243(a)(2) (relating to the dividends received deduction) is amended by inserting after "Small Business Investment Act of 1958" the following: "(16 U.S.C. 661 and following)". (B) Section 243(b)(2)(A) (relating to dividends received by a member of an affiliated group) is amended by striking out "(except that in the case of a taxable year of a member beginning in 1963 and ending in 1964, if the election is effective for the taxable year of the common parent corporation which includes the last day of such taxable year of such member, such election shall be effective for such taxable year of such member, if such member consents to such election with respect to such taxable year)". (35) AMENDMENT OF SECTION 247.—Section 247(b)(2) (relating to preferred stock) is amended to read as follows: "(2) PREFERRED STOCK.—

Definition.

"(A) IN GENERAL.—The term 'preferred stock' means stock issued before October 1, 1942, which during the whole of the taxable year (or the part of the taxable year after its issue) was stock the dividends in respect of which were cumulative, limited to the same amount, and payable in preference to the payment of dividends on other stock. "(B)

CERTAIN S TO C K I S S U E D O N OR A F T E R OCTOBER 1, 1942.—

Stock issued on or after October 1, 1942, shall be deemed for purposes of this paragraph to have been issued before October 1, 1942, if it was issued to refund or replace bonds or debentures issued before October 1, 1942, or to refund or replace other preferred stock (including stock which is preferred stock by reason of this subparagraph or subparagraph (D)), but only to the extent that the par or stated value of the new stock does not exceed the par, stated, or face value of the bonds or debentures issued before October 1, 1942, or the other preferred stock, which such new stock is issued to refund or replace. Regulations.

26 USC 1081. 53 Stat. 1. 26 USC 248.

26 USC 265.

"(C) DETERMINATION TINDER REGULATIONS.—The determi-

nation of whether stock was issued to refund or replace bonds or debentures issued before October 1, 1942, or to refund or replace other preferred stock, shall be made under regulations prescribe by the Secretary. "(D) ISSUANCE OF STOCK.—For purposes of subparagraph (B), issuance of stock includes issuance either by the same or another corporation in a transaction which is a reorganization (as defined in section 368(a)), a transaction to which section 371 (relating to insolvency reorganizations) applies, or a transaction subject to part VI of subchapter O (relating to exchanges in SEC obedience orders), or the respectively corresponding provisions of the Internal Revenue Code of 1939." (36) AMENDMENT OF SECTION 2 4 8.—Section 248(c) (relating to organizational expenditures) is amended b^^ striking out "the date of enactment of this title" and inserting in lieu thereof "August 16, 1954". (37) AMENDMENT OF SECTION 26 5.—Section 265(2) (relating to tax-exempt interest) is amended by striking out" (other than obligations of the United States issued after September 24, 1917, and originally subscribed for by the taxpayer)".

�