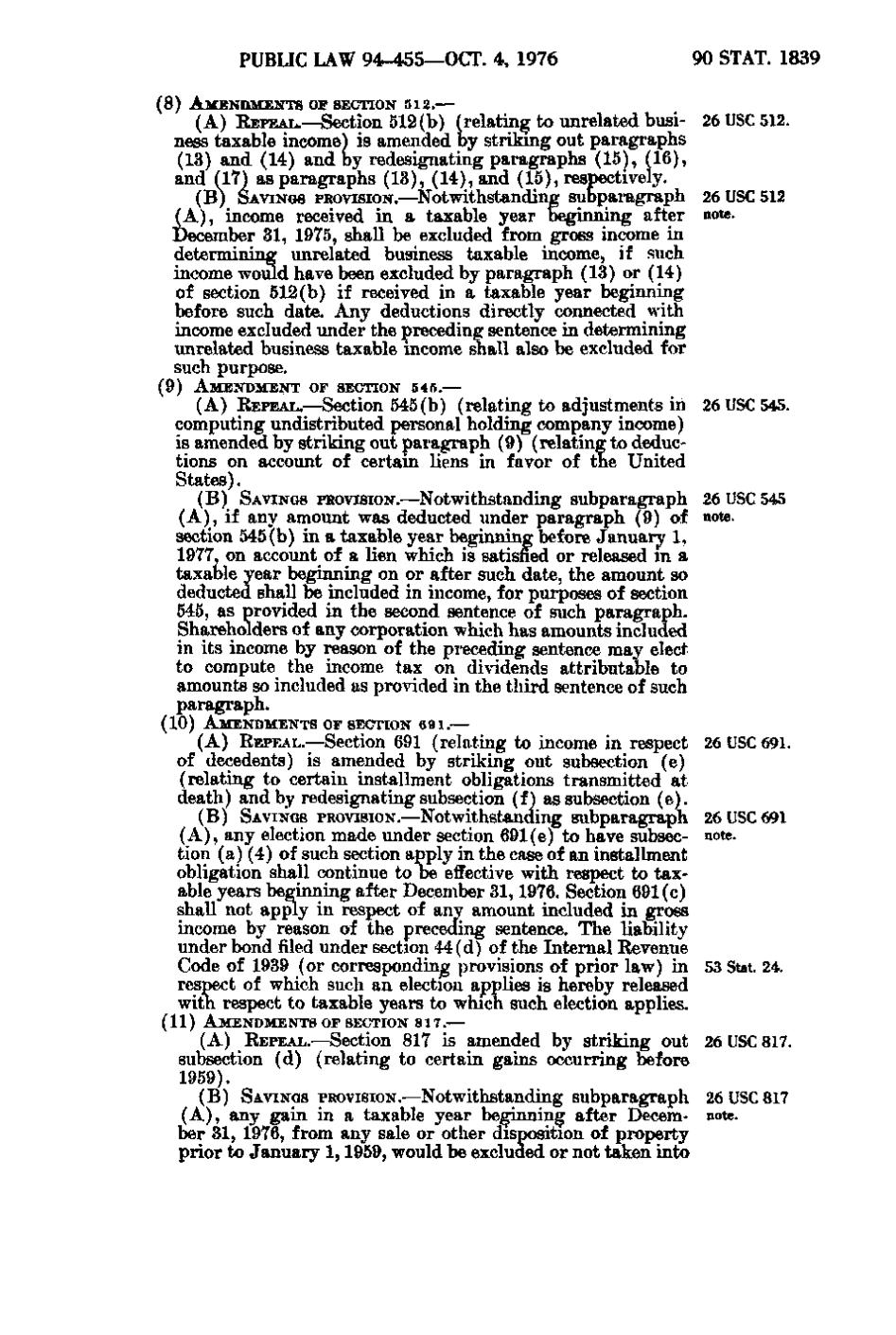

PUBLIC LAW 94-455—OCT. 4, 1976 (8)

90 STAT. 1839

A M B N II M E N T S OF S E C T I O N 512.

(A) EEPEAL.—Section 512(b) (relating to unrelated business taxable income) is amended by striking out paragraphs (13) and (14) and by redesignating paragraphs (15), (16), and (17) as paragraphs (13), (14), and (15), respectively. (B) SAVINGS PROVISION.—Notwithstanding subparagraph (A), income received in a taxable year beginning after December 31, 1975, shall be excluded from gross income in determining unrelated business taxable income, if such income would have been excluded by paragraph (13) or (14) of section 512(b) if received in a taxable year beginning before such date. Any deductions directly connected with income excluded under the preceding sentence in determining unrelated business taxable income shall also be excluded for such purpose. (9) AMENDMENT OF SECTION 545.— (A) REPEAL.—Section 545(b) (relating to adjustments in computing undistributed personal holding company income) is amended by striking out paragraph (9) (relating to deductions on account of certain liens in favor of the United States). (B) SAVINGS PROVISION.—Notwithstanding subparagraph (A), if any amount was deducted under paragraph (9) of section 545(b) in a taxable year beginning before January 1, 1977, on account of a lien which is satisfied or released m a taxaole year beginning on or after such date, the amount so deducted shall be included in income, for purposes of section 545, as provided in the second sentence of such paragraph. Shareholders of any corporation which has amounts included in its income by reason of the preceding sentence may elect to compute the income tax on dividends attributable to amounts so included as provided in the third sentence of such paragraph.

26 USC 512.

26 USC 512 note.

26 USC 545.

26 USC 545 note,

(10) AMENDMENTS or SECTION 691.—

(A) REPEAL.—Section 691 (relating to income in respect of decedents) is amended by striking out subsection (e) (relating to certain installment obligations transmitted at death) and by redesignating subsection (f) as subsection (e). (B) SAVINGS PROVISION.—Notwithstanding subparagraph (A), any election made under section 691(e) to have subsection (a)(4) of such section apply in the case of an installment obligation shall continue to be effective with respect to taxable years beginning after December 31, 1976. Section 691(c) shall not apply in respect of any amount included in gross income by reason of the preceding sentence. The liability under bond filed under section 44(d) of the Internal Revenue Code of 1939 (or corresponding provisions of prior law) in respect of which such an election applies is hereby released with respect to taxable years to which such elex^tion applies.

26 USC 691.

26 USC 691 note.

53 Stat. 24.

(11) AMENDMENTS or SECTION 817.—

(A) REPEAL.—Section 817 is amended by striking out 26 USC 817. subsection (d) (relating to certain gains occurring Itefore 1959). (B) SAVINGS PROVISION.—Notwithstanding subparagraph 26 USC 817 (A), any gain in a taxable year beginning after Decern- note. ber 31, 1976, from any sale or other disposition of property prior to January 1, 1959, would be excluded or not taken into

�