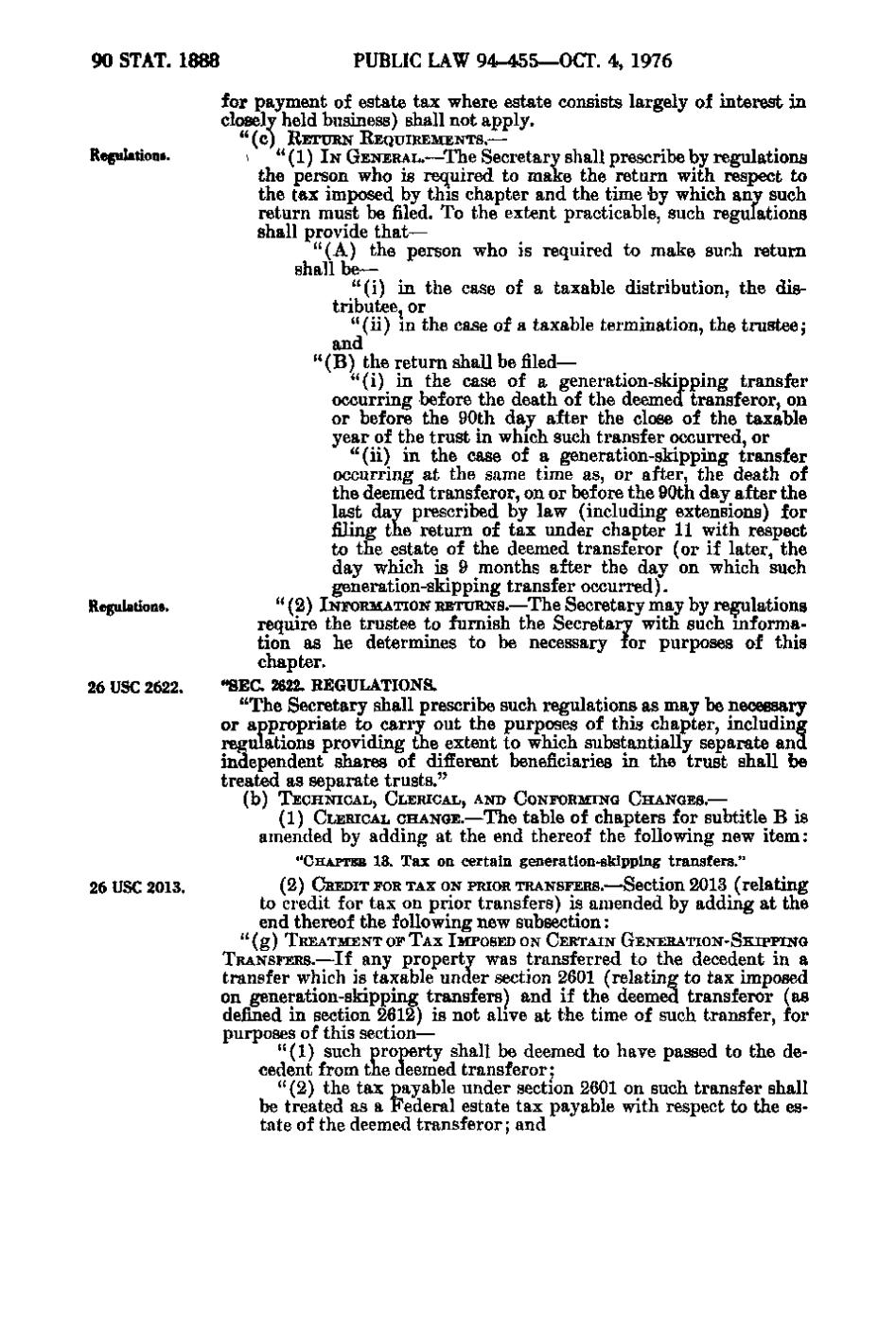

PUBLIC LAW 94-455—OCT. 4, 1976

90 STAT. 1888

for payment of estate tax where estate consists largely of interest in closely held business) shall not apply. "(c)

Regulations.

,

Regulations.

26 USC 2622.

RETURN REQUIREMENTS.—

\

" (1) IN GENERAL.—The Secretary shall prescribe by regulations the person who is required to make the return with respect to the tax imposed by this chapter and the time by which any such return must be filed. To the extent practicable, such regulations shall provide that— "(A) the person who is required to make such return shall be— "(i) in the case of a taxable distribution, the distributee^ or "(ii) in the case of a taxable termination, the trustee; and "(B) the return shall be filed— "(i) in the case of a generation-skipping transfer occurring before the death of the deemed transferor, on or before the 90th day after the close of the taxable year of the trust in which such transfer occurred, or "(ii) in the case of a generation-skipping transfer occurring at the same time as, or after, the death of the deemed transferor, on or before the 90th day after the last day prescribed by law (including extensions) for filing the return of tax under chapter 11 with respect to the estate of the deemed transferor (or if later, the day which is 9 months after the day on which such generation-skipping transfer occurred). " (2) INFORMATION RETURNS.—The Secretary may by reflations require the trustee to furnish the Secretary with such information as he determines to be necessary tor purposes of this chapter. "SEC. 2622. REGULATIONS. "The Secretary shall prescribe such regulations as may be necessary or appropriate to carry out the purposes of this chapter, including regulations providing the extent to which substantially separate and independent shares of different beneficiaries in the trust shall be treated as separate trusts." (b) TECHNICAL, CLERICAL, AND CONFORMING CHANGES.— (1) CLERICAL CHANGE.—The table of chapters for subtitle

B is amended by adding at the end thereof the following new item: "OHAPTEE 13. Tax on certain generation-skipping transfers."

26 USC 2013.

(2) CREDIT FOR TAX ON PRIOR TRANSFERS.—Section 2013 (relating

to credit for tax on prior transfers) is amended by adding at the end thereof the following new subsection: " (g) TREATMENT OF TAX IMPOSED ON CERTAIN GENERATION-SKIPPING

'

TRANSFERS.—If any property was transferred to the decedent in a transfer which is taxable under section 2601 (relating to tax imposed on generation-skipping transfers) and if the deemed transferor (as defined in section 2612) is not alive at the time of such transfer, for purposes of this section— "(1) such property shall be deemed to have passed to the decedent from the deemed transferor; " (2) the tax payable under section 2601 on such transfer shall be treated as a Federal estate tax payable with respect to the estate of the deemed transferor; and

�