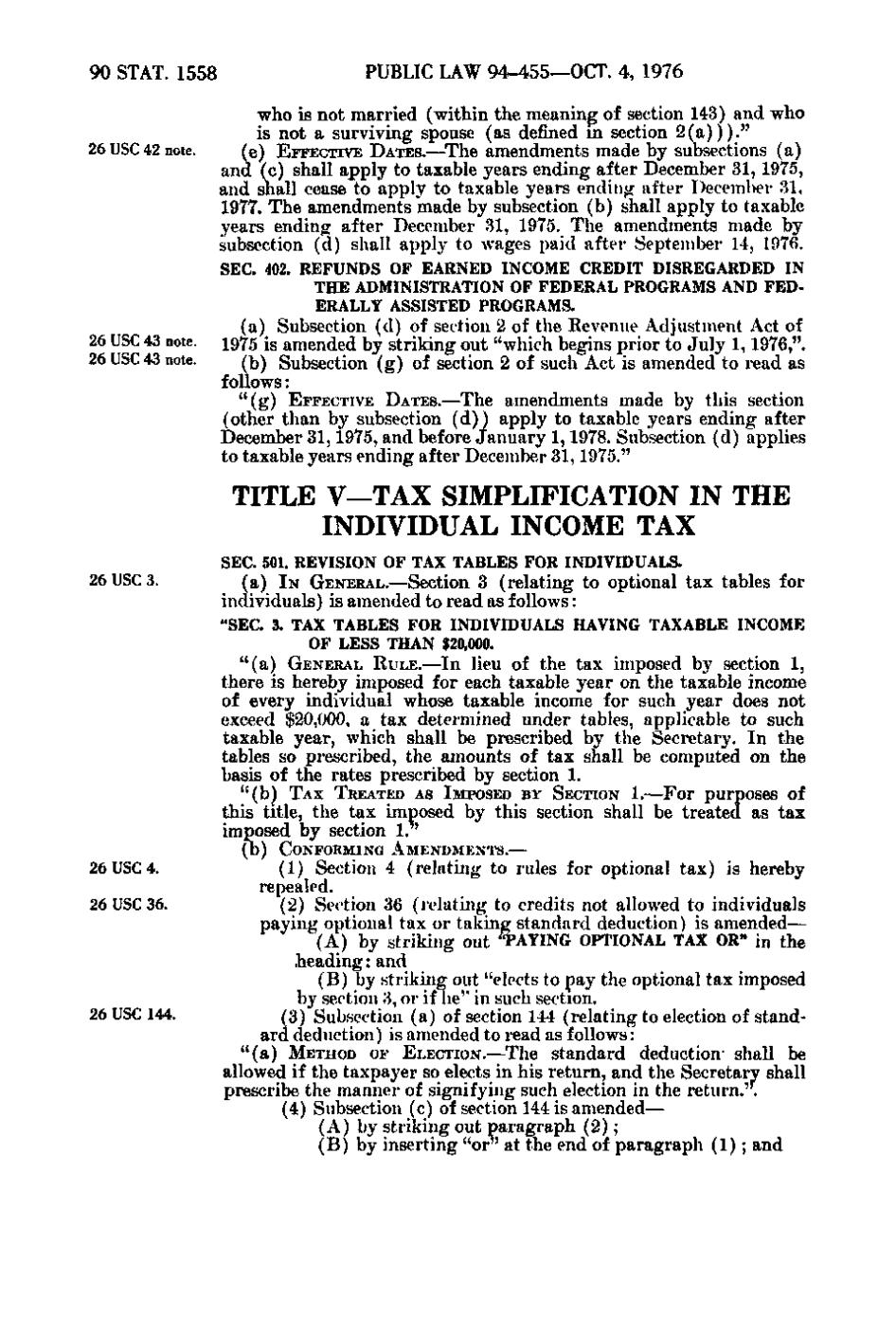

90 STAT. 1558

26 USC 42 note.

26 USC 43 note. 26 USC 43 note.

1 „ ^

PUBLIC LAW 94-455—OCT. 4, 1976 who is not married (within the meaning of section 143) and who is not a surviving spouse (as defined in section 2(a))). " (e) EFFECTIVE DATES.—The amendments made by subsections (a) and (c) shall apply to taxable years ending after December 31, 1975, and shall cease to apply to taxable years ending after December 31, 1977. The amendments made by subsection (b) shall apply to taxable years ending after December 31, 1975. The amendments made by subsection (d) shall apply to wages paid after September 14, 1976. SEC. 402. REFUNDS OF EARNED INCOME CREDIT DISREGARDED IN THE ADMINISTRATION OF FEDERAL PROGRAMS AND FEDERALLY ASSISTED PROGRAMS. (a) Subsection (d) of section 2 of the Revenue Adjustment Act of 1975 jg amended by striking out "which begins prior to July 1, 1976,". (b) Subsection (g) of section 2 of such Act is amended to read as follows: " (g) EFFECTIVE DATES.—The amendments made by this section (other than by subsection (d)) apply to taxable years ending after December 31, 1975, and before January 1, 1978. Subsection (d) applies to taxable years ending after December 31, 1975."

TITLE V—TAX SIMPLIFICATION IN THE INDIVIDUAL INCOME TAX 26 USC 3.

SEC. 501. REVISION OF TAX TABLES FOR INDIVIDUALS. (a) IN GENERAL.—Section 3 (relating to optional tax tables for individuals) is amended to read as follows: "SEC. 3. TAX TABLES FOR INDIVIDUALS HAVING TAXABLE INCOME OF LESS THAN $20,000. "(a)

GENERAL RULE. — I n lieu of the tax imposed by section 1,

there is hereby imposed for each taxable year on the taxable income of every individual whose taxable income for such year does not exceed $20,000, a tax determined under tables, applicable to such taxable year, which shall be prescribed by the Secretary. I n the tables so prescribed, the amounts of tax shall be computed on the basis of the rates prescribed by section 1. " (b) T A X TREATED AS IMPOSED BY SECTION 1.—For purposes of

this title, the tax imposed by this section shall be treated as tax imposed by section 1." (b) CONFORMING AMENDMENTS. —

26 USC 4. 26 USC 36.

26 USC 144.

(1) Section 4 (relating to rules for optional tax) is hereby repealed. (2) Section 36 (relating to credits not allowed to individuals paying optional tax or taking standard deduction) is amended— (A) by striking out "PAYING OPTIONAL TAX OR" in the heading; and (B) by striking out "elects to pay the optional tax imposed by section 3, or if he'* in such section. (3) Subsection (a) of section 144 (relating to election of standard deduction) is amended to read as follows: " (a) METHOD

OF ELECTION. — The

standard

deduction

shall

be

allowed if the taxpayer so elects in his return, and the Secretary shall prescribe the manner of signifying such election in the return.. (4) Subsection (c) of section 144 is amended— (A) by striking out paragraph (2); (B) by inserting "or" at the end of paragraph (1); and

�