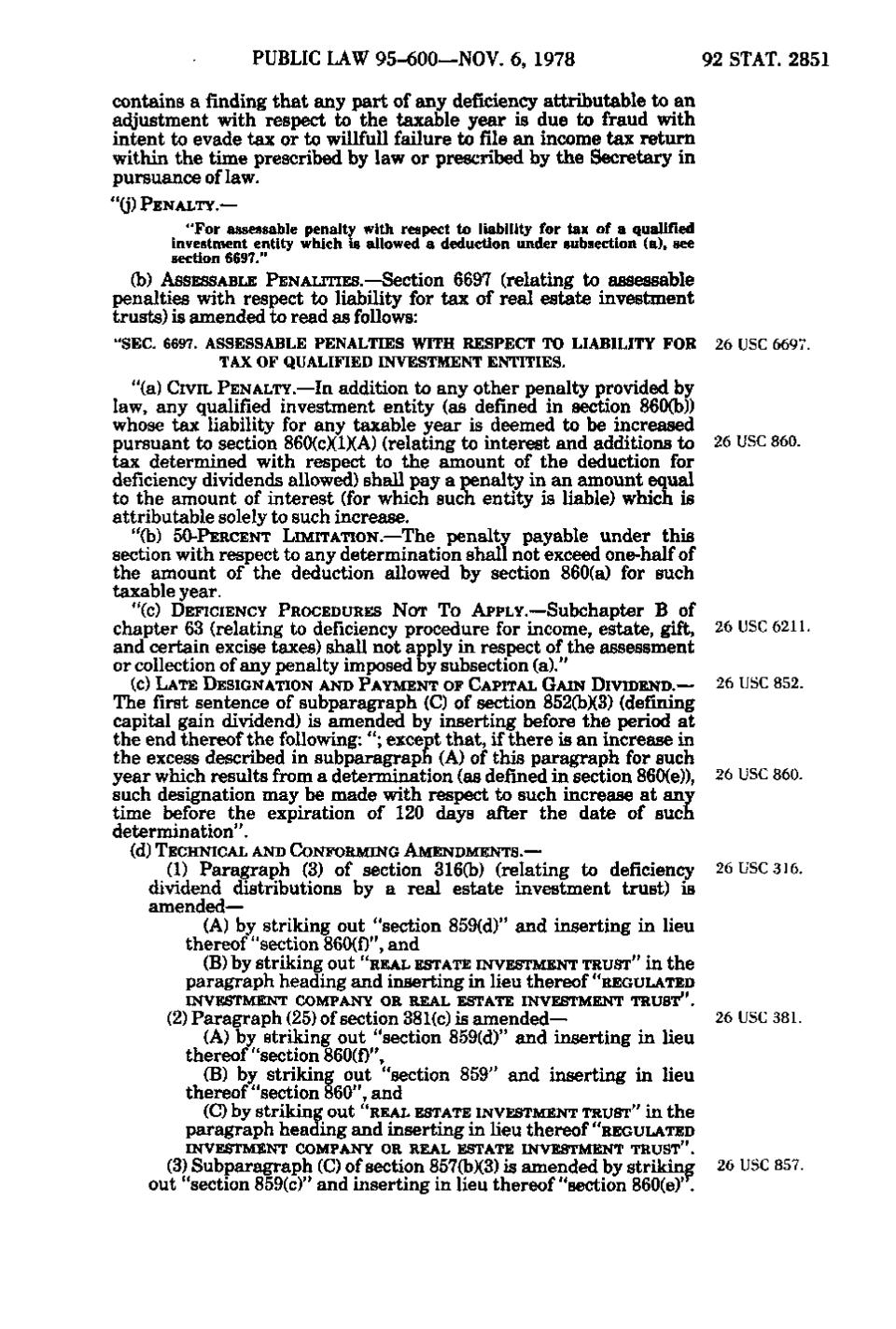

PUBLIC LAW 95-600—NOV. 6, 1978

92 STAT. 2851

contains a finding that any part of any deficiency attributable to an adjustment with respect to the taxable year is due to fraud with intent to evade tax or to willfuU failure to file an income tax return within the time prescribed by law or prescribed by the Secretary in pursuance of law. "(j) PENALTY.—

"For assessable penalty with respect to liability for tax of a qualified investment entity whicii is allowed a deduction under subsection (a), see section 6697." (b) ASSESSABLE PENALITIES.—Section 6697 (relating to assessable

penalties with respect to liability for tax of real estate investment trusts) is amended to read as follows:

. _,. ^ ^ !, "

"SEC. 6697. ASSESSABLE PENALTIES WITH RESPECT TO LIABILITY FOR 26 USC 6697. TAX OF QUALIFIED INVESTMENT ENTITIES.

"(a) CIVIL PENALTY.—In addition to any other penalty provided by law, any qualified investment entity (as defined in section 860(b)) whose tax liability for any taxable year is deemed to be increased pursuant to section 860(c)(1)(A) (relating to interest and additions to 26 USC 860. tax determined with respect to the amount of the deduction for deficiency dividends allowed) shall pay a penalty in an amount equal to the amount of interest (for which such entity is liable) which is attributable solely to such increase. "(b) 50-PERCENT LIMITATION.—The penalty payable under this section with respect to any determination shall not exceed one-half of the amount of the deduction allowed by section 860(a) for such taxable year. "(c) DEFICIENCY PROCEDURES NOT TO APPLY.—Subchapter B of

chapter 63 (relating to deficiency procedure for income, estate, gift, and certain excise taxes) shall not apply in respect of the assessment or collection of any penalty imposed by subsection (a)." (c) LATE DESIGNATION AND PAYMENT OF CAPITAL GAIN DIVIDEND.—

The first sentence of subparagraph (C) of section 852(b)(3) (defining capital gain dividend) is amended by inserting before the period at the end thereof the following: "; except that, if there is an increase in the excess described in subparagraph (A) of this paragraph for such year which results from a determination (as defined in section 860(e)), such designation may be made with respect to such increase at any time before the expiration of 120 days after the date of such determination ".

26 USC 6211. 26 USC 852.

•-

26 USC 860.

(d) TECHNICAL AND CONFORMING AMENDMENTS.—

(1) Paragraph (3) of section 316(b) (relating to deficiency dividend distributions by a real estate investment trust) is amended— (A) by striking out "section 859(d)" and inserting in lieu thereof "section 860(0", and Ei

(B) by striking out "REAL ESTATE INVESTMENT TRUST" in the paragraph heading and inserting in lieu thereof "REGULATED INVESTMENT COMPANY OR REAL ESTATE INVESTMENT TRUST".

(2) Paragraph (25) of section 381(c) is amended— (A) by striking out "section 859(d)" and inserting in lieu thereof "section 860(f)", (B) by striking out "section 859" and inserting in lieu thereof "section 860", and

26 USC 316.

- -

26 USC 381.

(C) by striking out "REAL ESTATE INVESTMENT TRUST" in the paragraph heading and inserting in lieu thereof "REGULATED INVESTMENT COMPANY OR REAL ESTATE INVESTMENT TRUST".

(3) Subparagraph (C) of section 85705)(3) is amended by striking out "section 859(c)" and inserting in lieu thereof "section 860(e).

26 USC 857.

-.:

�