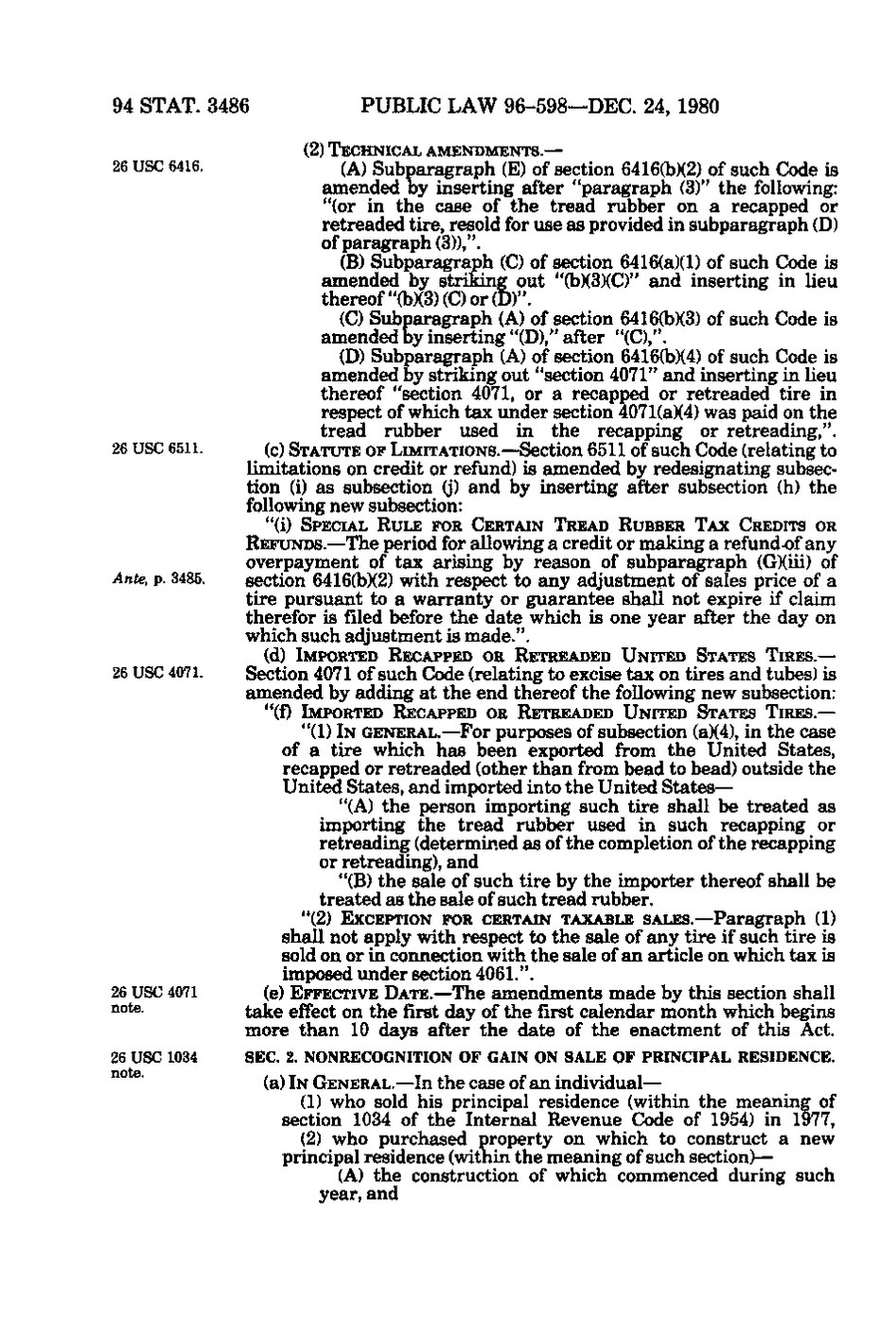

94 STAT. 3486

PUBLIC LAW 96-598—DEC. 24, 1980 (2) TECHNICAL AMENDMENTS.—

26 USC 6416.

26 USC 6511.

(A) Subparagraph (E) of section 6416(b)(2) of such Code is amended by inserting after "paragraph (3)" the following: "(or in the case of the tread rubber on a recapped or retreaded tire, resold for use as provided in subparagraph (D) of paragraph (3)),". (B) Subparagraph (C) of section 6416(a)(1) of such Code is amended by striking out "(b)(3)(C)" and inserting in lieu thereof "(b)(3)(C) or (D)". (C) Subparagraph (A) of section 6416(b)(3) of such Code is amended by inserting "(D)," after "(C),". (D) Subparagraph (A) of section 6416(b)(4) of such Code is amended by striking out "section 4071" and inserting in lieu thereof "section 4071, or a recapped or retreaded tire in respect of which tax under section 4071(a)(4) was paid on the tread rubber used in the recapping or retreading,". (c) STATUTE OF LIMITATIONS.—Section 6511 of such Code (relating to limitations on credit or refund) is amended by redesignating subsection (i) as subsection 0) and by inserting after subsection (h) the following new subsection: "(i) SPECIAL RULE FOR CERTAIN TREAD RUBBER TAX CREDITS OR

Ante, p. 3485.

REFUNDS.—The period for allowing a credit or making a refund-of any overpayment of tax arising by reason of subparagraph (G)(iii) of section 6416(b)(2) with respect to any adjustment of sales price of a tire pursuant to a warranty or guarantee shall not expire if claim therefor is filed before the date which is one year after the day on which such adjustment is made.". (d) IMPORTED RECAPPED OR RETREADED UNITED STATES TIRES.—

26 USC 4071.

Section 4071 of such Code (relating to excise tax on tires and tubes) is amended by adding at the end thereof the following new subsection: "(0 IMPORTED RECAPPED OR RETREADED UNITED STATES TIRES.—

"(1) IN GENERAL.—For purposes of subsection (a)(4), in the case of a tire which has been exported from the United States, recapped or retreaded (other than from bead to bead) outside the United States, and imported into the United States— "(A) the person importing such tire shall be treated as ,:,,; importing the tread rubber used in such recapping or J retreading (determined as of the completion of the recapping or retreading), and "(B) the sale of such tire by the importer thereof shall be treated as the sale of such tread rubber. "(2) EXCEPTION FOR CERTAIN TAXABLE SALES.—Paragraph (1)

26 USC 4071 ^°^26 USC 1034

shall not apply with respect to the sale of any tire if such tire is sold on or in connection with the sale of an article on which tax is imposed under section 4061.". (e) EFFECTIVE DATE.—The amendments made by this section shall take effect on the first day of the first calendar month which begins more than 10 days after the date of the enactment of this Act. SEC. 2. NONRECOGNITION OF GAIN ON SALE OF PRINCIPAL RESIDENCE.

(a) IN GENERAL.—In the case of an individual— (1) who sold his principal residence (within the meaning of section 1034 of the Internal Revenue Code of 1954) in 1977, (2) who purchased property on which to construct a new principal residence (within the meaning of such section)— (A) the construction of which commenced during such year, and

�