96 STAT. 434

PUBLIC LAW 97-248—SEPT. 3, 1982 "(2) METHOD OF COST RECOVERY.—The deduction allowable

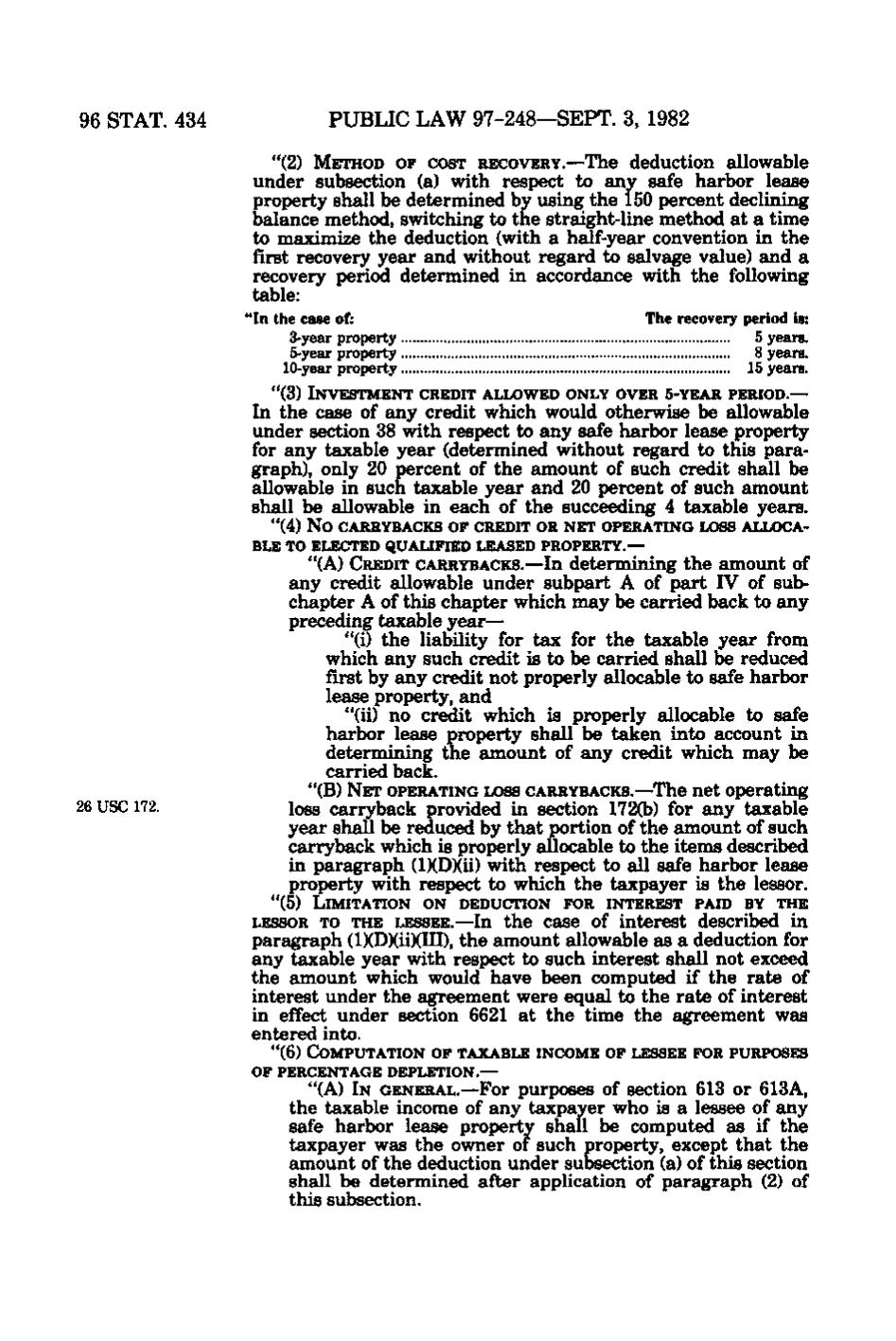

under subsection (a) with respect to any safe harbor lease property shall be determined by using the 150 percent declining balance method, switching to the straight-line method at a time to maximize the deduction (with a half-year convention in the first recovery year and without regard to salvage value) and a recovery period determined in accordance with the following table: "In the case of: The recovery period is: 3-year property 5 years. 5-year property 8 years. 10-year property 15 years. "(3) INVESTMENT CREDIT ALLOWED ONLY OVER 5-YEAR PERIOD.—

In the case of any credit which would otherwise be allowable under section 38 with respect to any safe harbor lease property for any taxable year (determined without regard to this paragraph), only 20 percent of the amount of such credit shall be allowable in such taxable year and 20 percent of such amount shall be allowable in each of the succeeding 4 taxable years. "(4) N o CARRYBACKS OF CREDIT OR NET OPERATING LOSS ALLOCABLE TO ELECTED QUALIFIED LEASED PROPERTY.— "(A) CREDIT CARRYBACKS.—In determining the amount of

any credit allowable under subpart A of part IV of subchapter A of this chapter which may be carried back to any preceding taxable year— "(i) the liability for tax for the taxable year from which any such credit is to be carried shall be reduced first by any credit not properly allocable to safe harbor lease property, and "(ii) no credit which is properly allocable to safe harbor lease property shall be taken into account in determining the amount of any credit which may be carried back. "(B) NET OPERATING LOSS CARRYBACKS.—The net operating

26 USC 172.

loss carryback provided in section 172(b) for any taxable year shall be reduced by that portion of the amount of such carryback which is properly allocable to the items described in paragraph (IXDXii) with respect to all safe harbor lease property with respect to which the taxpayer is the lessor. "(5) LIMITATION ON DEDUCTION FOR INTEREST PAID BY THE

LESSOR TO THE LESSEE.—In the case of interest described in paragraph (l)(D)(ii)(III), the amount allowable as a deduction for any taxable year with respect to such interest shall not exceed the amount which would have been computed if the rate of interest under the agreement were equal to the rate of interest in effect under section 6621 at the time the agreement was entered into. "(6) COMPUTATION OF TAXABLE INCOME OF LESSEE FOR PURPOSES OF PERCENTAGE DEPLETION.—

"(A) IN GENERAL.—For purposes of section 613 or 613A, the taxable income of any taxpayer who is a lessee of any safe harbor lease property shall be computed as if the taxpayer was the owner of such property, except that the amount of the deduction under subsection (a) of this section shall be determined after application of paragraph (2) of this subsection.

�