PUBLIC LAW 97-424—JAN. 6, 1983

96 STAT. 2177

(A) Chapter 31 is amended by striking out the chapter heading and inserting in lieu thereof the following:

"CHAPTER 31—RETAIL EXCISE TAXES "SUBCHAPTER A. Special fuels. "SUBCHAPTER B. Heavy trucks and trailers.

"Subchapter A—Special Fuels". (B) The table of chapters for subtitle D is amended by striking out the item relating to chapter 31 and inserting in lieu thereof the following new item: "Chapter 31. Retail excise taxes." (C) Paragraph (2) of section 6416(b), as amended by this 26 USC 6416. Act, is amended by inserting "or under section 4051" after "section 4041(a)". (D) Paragraph (1) of section 6416(a) is amended by striking out "chapter 31 (special fuels)" and inserting in lieu thereof "chapter 31 (relating to retail excise taxes)". (3) EFFECTIVE DATE.—The amendments made by this subsec- 26 USC 4051 tion shall take effect on April 1, 1983. "°^SEC. 513. HEAVY TRUCK USE TAX.

(a) INCREASE IN RATE OF TAX.—Subsection (a) of section 4481 (relating to imposition of tax) is amended to read as follows:

26 USC 4481.

"(a) IMPOSITION OF TAX.—A tax is hereby imposed on the use of any

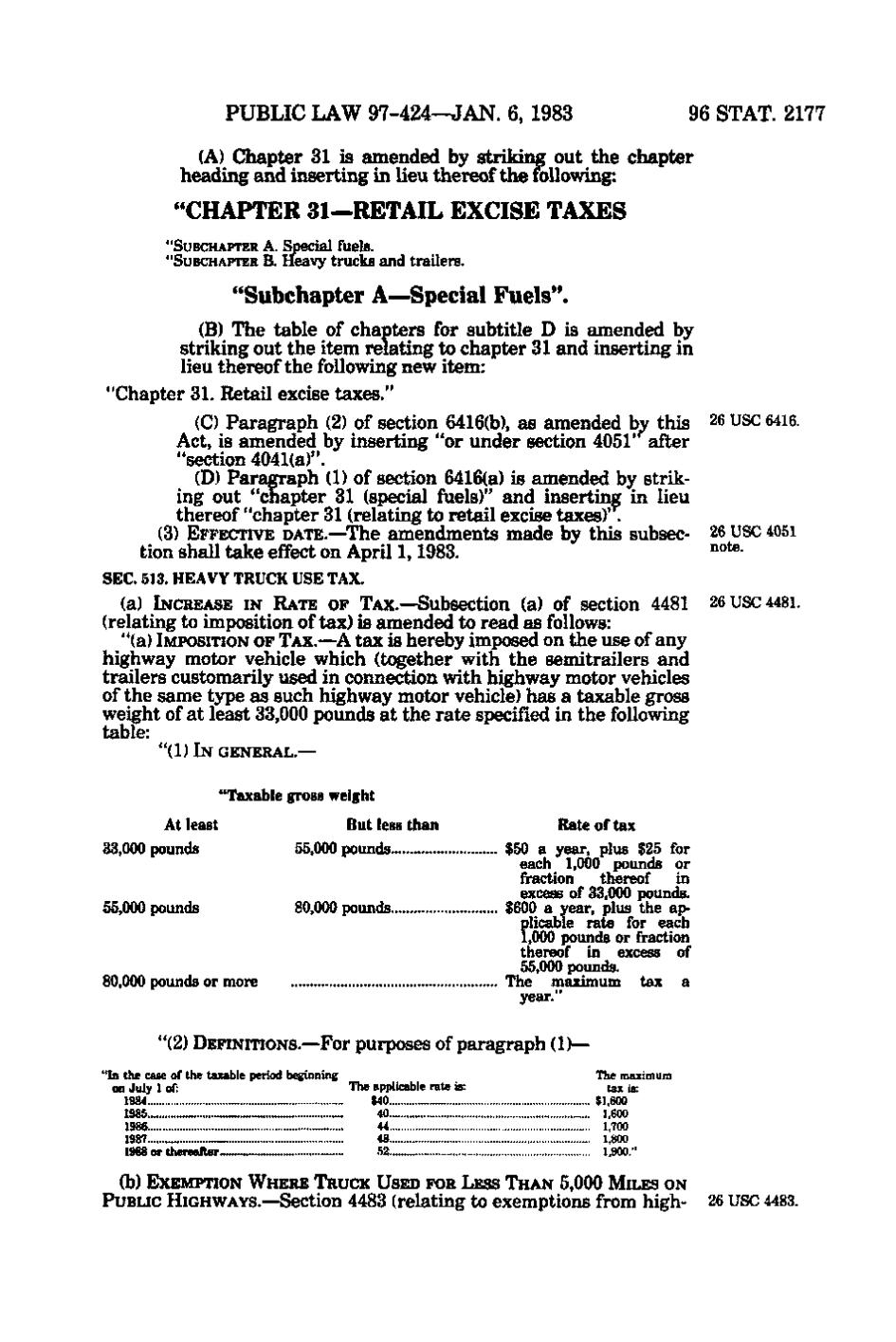

highway motor vehicle which (together with the semitrailers and trailers customarily used in connection with highway motor vehicles of the same type as such highway motor vehicle) has a taxable gross weight of at least 33,000 pounds at the rate specified in the following table: "(1) IN GENERAL.— "Taxable gross weight At least 33,000 pounds

But less than 55,000 pounds

55,000 pounds

80,000 pounds

80,000 pounds or more

Rate of tax $50 a year, plus $25 for each 1,000 pounds or fraction thereof in excess of 33,000 pounds. $600 a year, plus the applicable rate for each 1,000 pounds or fraction thereof in excess of 55,000 pounds. The maximum tax a year."

"(2) DEFINITIONS.—For purposes of paragraph (1)— "In the case of the taxable period beginning on July 1 of: The applicable rate is: 1984 $40 1985 40 1986. 44 1987 48 1988 or thereafter .52

The maximum tax is: $1,600 1,600 1,700 1,800 1,900."

(b) EXEMPTION WHERE TRUCK USED FOR LESS THAN 5,000 MILES ON PUBLIC HIGHWAYS.—Section 4483 (relating to exemptions from high- 26 USC 4483.

�