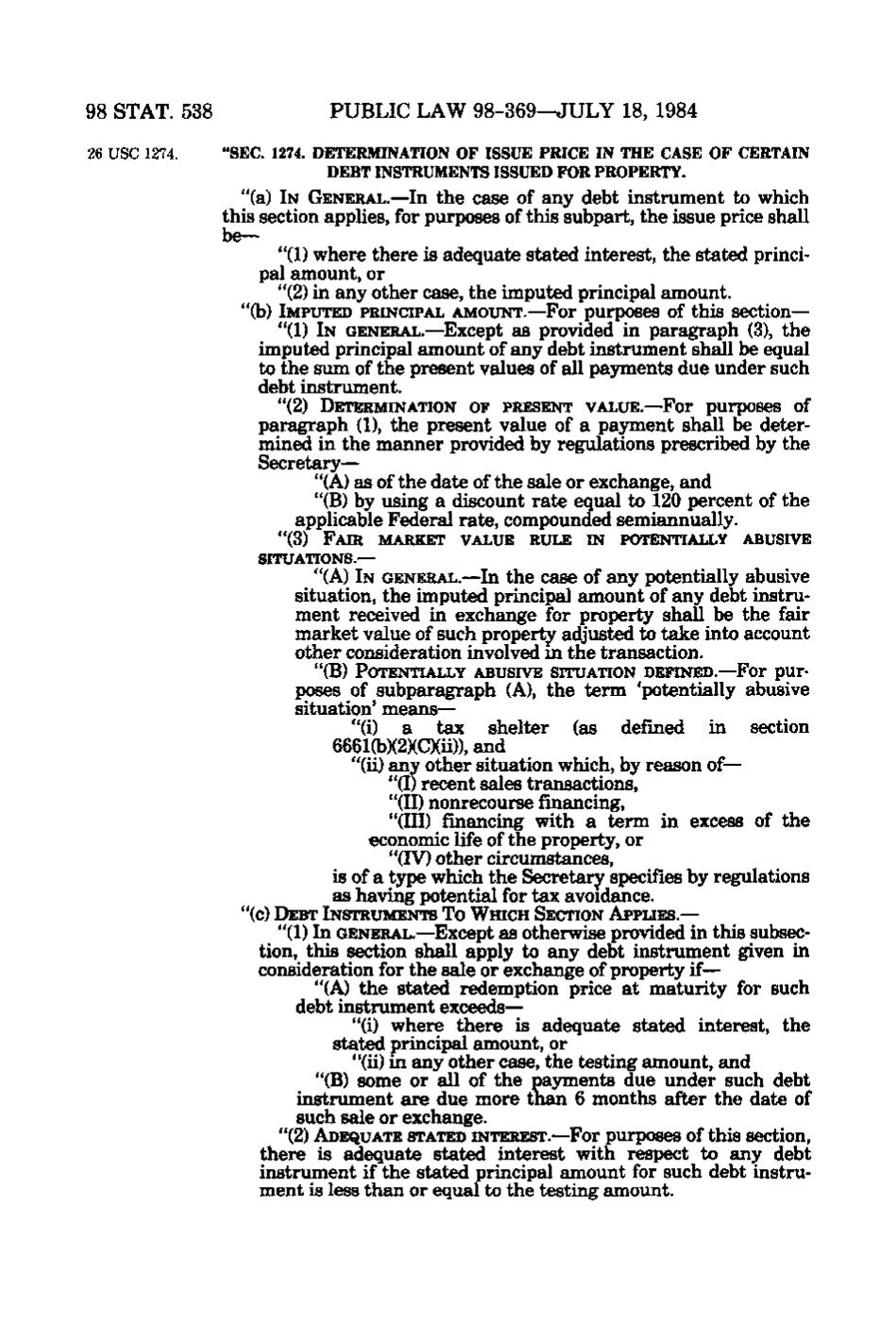

98 STAT. 538 26 USC 1274.

PUBLIC LAW 98-369—JULY 18, 1984 "SEC. 1274. DETERMINATION OF ISSUE PRICE IN THE CASE OF CERTAIN DEBT INSTRUMENTS ISSUED FOR PROPERTY. "(a) IN GENERAL.—In the case of any debt instrument to which this section appHes, for purposes of this subpart, the issue price shall be— "(1) where there is adequate stated interest, the stated principal amount, or "(2) in any other CEise, the imputed principal amount. "(h) IMPUTED PRINCIPAL AMOUNT.—For purposes of this section— "(1) IN GENERAL.—Except as provided in paragraph (3), the imputed principal amount of any debt instrument shall be equal to the sum of the present values of all payments due under such debt instrument. "(2)

DETERMINATION OF PRESENT VALUE.—For purposes of

paragraph (1), the present value of a payment shall be determined in the manner provided by regulations prescribed by the Secretary— "(A) as of the date of the sale or exchange, and "(B) by using a discount rate equal to 120 percent of the applicable Federal rate, compounded semiannually. "(3) FAIR MARKET VALUE RULE IN POTENTIALLY ABUSIVE SITUATIONS.—

"(A) IN GENERAL.—In the case of any potentially abusive situation, the imputed principal amount of any debt instrument received in exchange for property shall be the fair market value of such property adjusted to take into account other consideration involved in the transaction. "(B) POTENTIALLY ABUSIVE SITUATION DEFINED.—For pur-

,c,,

,^ '•^

poses of subparagraph (A), the term 'potentially abusive situation' means— "(i) a tax shelter (as defined in section 6661(b)(2)(C)(ii)), and "(ii) any other situation which, by reason of— "(I) recent sales transactions, "(II) nonrecourse financing, "(III) financing with a term in excess of the economic life of the property, or "(IV) other circumstances, is of a type which the Secretary specifies by regulations as having potential for tax avoidance.

"(c) DEBT INSTRUMENTS TO WHICH SECTION APPLIES.—

"(1) In GENERAL.—Except as otherwise provided in this subsection, this section shall apply to any debt instrument given in consideration for the sale or exchange of property if— "(A) the stated redemption price at maturity for such debt instrument exceeds— "(i) where there is adequate stated interest, the stated principal amount, or "(ii) in any other case, the testing amount, and "(B) some or all of the payments due under such debt instrument are due more than 6 months after the date of such sale or exchange. "(2) ADEQUATE STATED INTEREST.—For purposes of this section, there is adequate stated interest with respect to any debt instrument if the stated principal amount for such debt instrument is less than or equal to the testing amount.

�