98 STAT. 564

Post, p. 567.

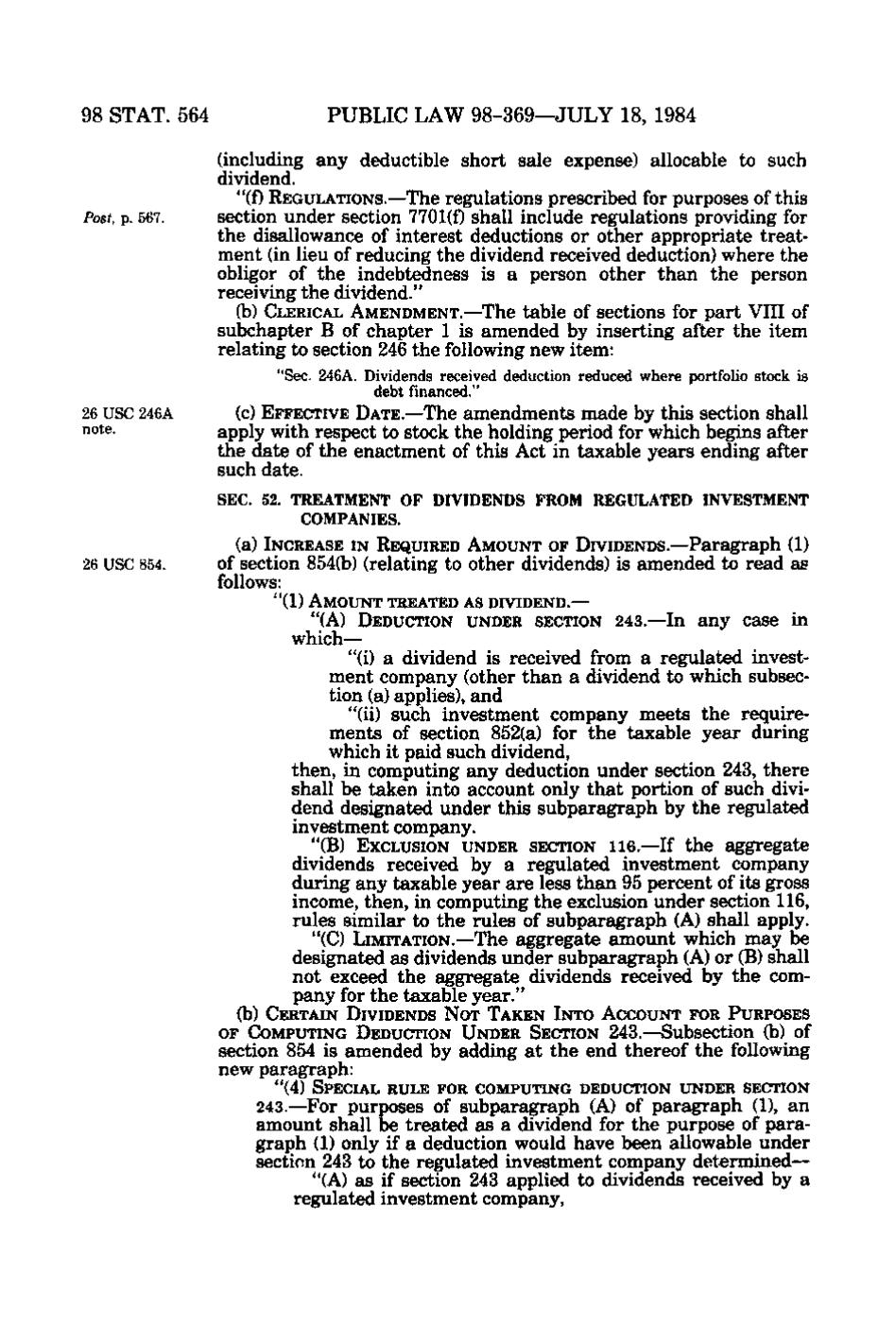

PUBLIC LAW 98-369—JULY 18, 1984 (including any deductible short sale expense) allocable to such dividend. "(f) REGULATIONS.—The regulations prescribed for purposes of this section under section 7701(f) shall include regulations providing for the disallowance of interest deductions or other appropriate treatment (in lieu of reducing the dividend received deduction) where the obligor of the indebtedness is a person other than the person receiving the dividend." (b) CLERICAL AMENDMENT.—The table of sections for part VIII of subchapter B of chapter 1 is amended by inserting after the item relating to section 246 the following new item: "Sec. 246A. Dividends received deduction reduced where portfolio stock is debt financed."

26 USC 246A "°*^-

(c) EFFECTIVE DATE.—The amendments made by this section shall apply with respect to stock the holding period for which begins after the date of the enactment of this Act in taxable years ending after such date. SEC. 52. TREATMENT OF DIVIDENDS FROM REGULATED INVESTMENT COMPANIES.

26 USC 854.

of section 854(b) (relating to other dividends) is amended to read as follows:

(a) INCREASE IN REQUIRED AMOUNT OF DIVIDENDS.—Paragraph (1)

"(1) AMOUNT TREATED AS DIVIDEND.— "(A) DEDUCTION UNDER SECTION

243.—In any case in which— "(i) a dividend is received from a regulated investment company (other than a dividend to which subsection (a) applies), and "(ii) such investment company meets the requirements of section 852(a) for the taxable year during which it paid such dividend, then, in computing any deduction under section 243, there shall be taken into account only that portion of such dividend designated under this subparagraph by the regulated investment company. "(B) EXCLUSION UNDER SECTION II6.—If the

aggregate

dividends received by a regulated investment company during any taxable year are less than 95 percent of its gross income, then, in computing the exclusion under section 116, rules similar to the rules of subparagraph (A) shall apply. "(C) LIMITATION.—The aggregate amount which may be designated as dividends under subparagraph (A) or (B) shall not exceed the aggregate dividends received by the company for the taxable year." (b) CERTAIN DIVIDENDS NOT TAKEN INTO ACCOUNT FOR PURPOSES

OF COMPUTING DEDUCTION UNDER SECTION 243.—Subsection (b) of section 854 is amended by adding at the end thereof the following new paragraph: "(4) SPECIAL RULE FOR COMPUTING DEDUCTION UNDER SECTION

243.—For purposes of subparagraph (A) of paragraph (1), an amount shall be treated as a dividend for the purpose of paragraph (1) only if a deduction would have been allowable under section 243 to the regulated investment company determined— "(A) as if section 243 applied to dividends received by a regulated investment company,

�