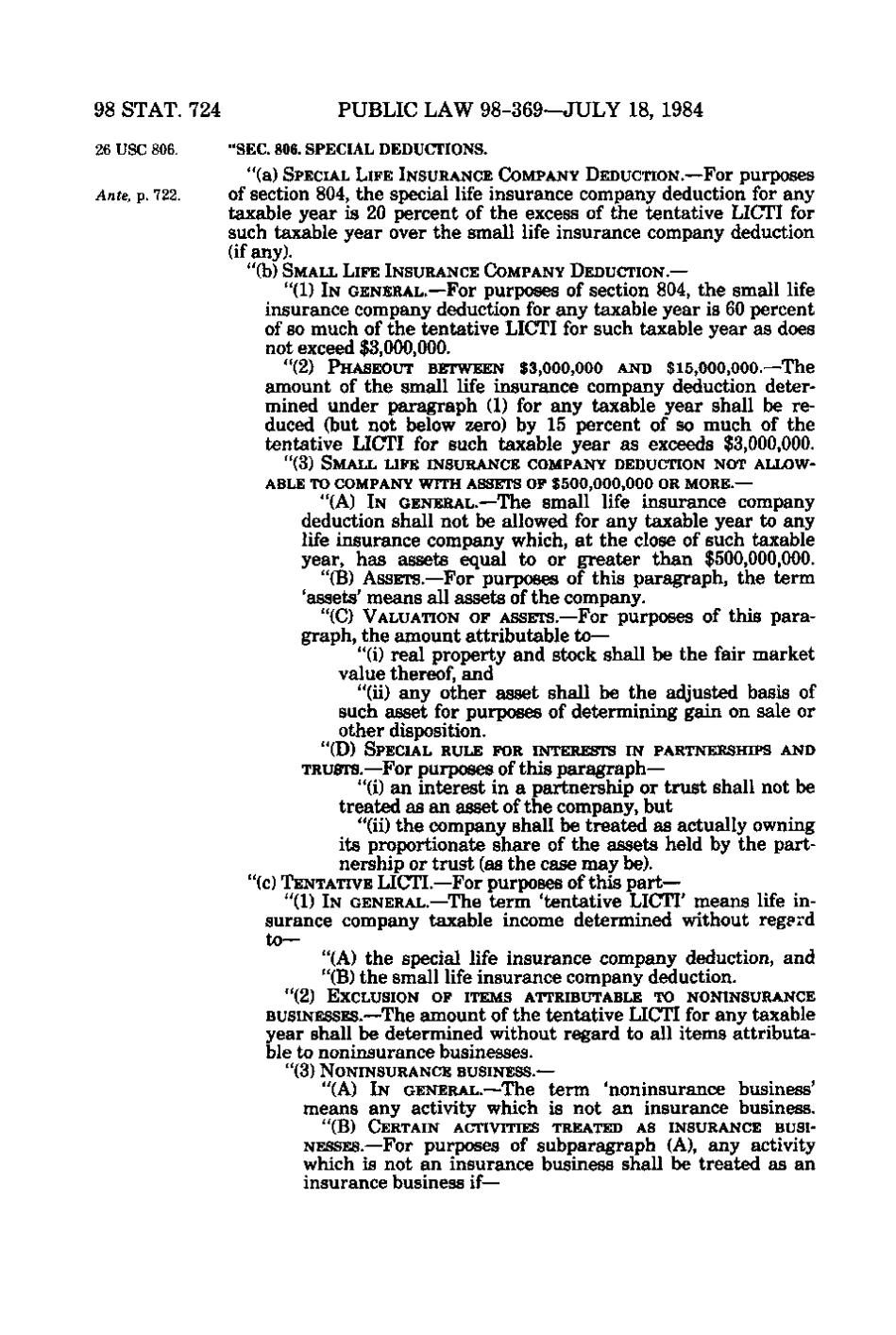

98 STAT. 724 26 USC 806.

PUBLIC LAW 98-369—JULY 18, 1984 "SEC. 806. SPECIAL DEDUCTIONS.

"(a) SPECIAL LIFE INSURANCE COMPANY DEDUCTION.—For purposes of section 804, the special life insurance company deduction for any taxable year is 20 percent of the excess of the tentative LICTI for such taxable year over the small life insurance company deduction (if any).

Ante, p. 722.

"(h) SMAIX LIFE INSURANCE COMPANY DEDUCTION.—

"(1) IN GENERAL.—For purposes of section 804, the small life insurance company deduction for any taxable year is 60 percent of so much of the tentative LICTI for such taxable year as does not exceed $3,000,000. "(2) PHASEOUT

BETWEEN

$3,OOO,OOO

A N D $15,000,000.—The

amount of the small life insurance company deduction determined under paragraph (1) for any taxable year shall be reduced (but not below zero) by 15 percent of so much of the tentative LICTI for such taxable year as exceeds $3,000,000. "(3) SMALL U F E INSURANCE COMPANY DEDUCTION NOT ALLOWABLE TO COMPANY WITH ASSETS OP $500,000,000 OR MORE.—

"(A) IN GENERAL.—The small life insurance company deduction shall not be allowed for any taxable year to any life insurance company which, at the close of such taxable year, has assets equal to or greater than $500,000,000. "(B) ASSETS.—For purposes of this paragraph, the term 'assets' means all assets of the company. "(C) VALUATION OF ASSETS.—For purposes of this paragraph, the amount attributable to— "(i) real property and stock shall be the fair market value thereof, and "(ii) any other asset shall be the adjusted basis of such asset for purposes of determining gain on sale or other disposition. "(D) SPECIAL RULE FOR INTERESTS IN PARTNERSHIPS AND

TRUSTS.—For purposes of this paragraph— "(i) an interest in a partnership or trust shall not be treated as an asset of the company, but "(ii) the company shall be treated as actually owning its proportionate share of the assets held by the partnership or trust (as the case may be). "(c) TENTATIVE LICTI.—For purposes of this part— "(1) IN GENERAL.—The term 'tentative LICTI' means life insurance company taxable income determined without regard to— "(A) the special life insurance company deduction, and "(B) the small life insurance company deduction. "(2) EXCLUSION OF ITEMS ATTRIBUTABLE TO NONINSURANCE

BUSINESSES.—The amount of the tentative LICTI for any taxable year shall be determined without regard to all items attributable to noninsurance businesses.

^, ^ ' ' * ••' "

"

"(3) NONINSURANCE BUSINESS.—

"v

- '

"(A) IN GENERAL.—The term 'noninsurance business' means any activity which is not an insurance business. "(B)

CERTAIN ACTIVITIES TREATED AS INSURANCE BUSI-

NESSES.—For purposes of subparagraph (A), any activity which is not an insurance business shall be treated as an insurance business if—

�