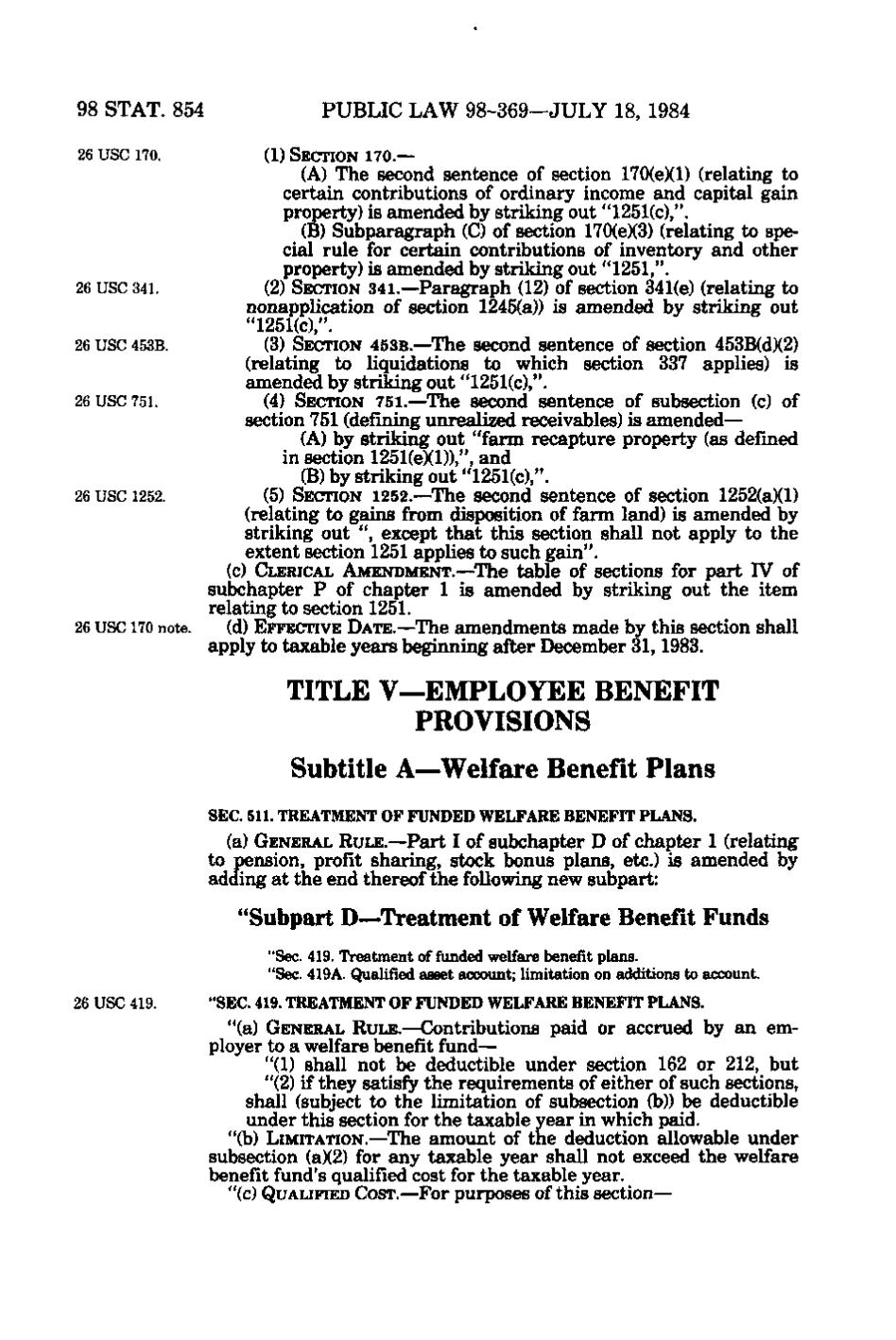

98 STAT. 854 26 USC 170.

PUBLIC LAW 98-369—JULY 18, 1984 (1) SECTION I70.—

(A) The second sentence of section 170(e)(1) (relating to certain contributions of ordinary income and capital gain property) is amended by striking out "1251(c),". (B) Subparagraph (C) of section 170(e)(3) (relating to special rule for certain contributions of inventory and other property) is amended by striking out "1251,". 26 USC 341. (2) SECTION 341.—Paragraph (12) of section 341(e) (relating to nonapplication of section 1245(a)) is amended by striking out "1251(c),". 26 USC 453B. (3) SECTION 453B.—The second sentence of section 453B(d)(2) (relating to liquidations to which section 337 applies) is amended by striking out "1251(c),". 26 USC 751. (4) SECTION 751.—The second sentence of subsection (c) of section 751 (defining unrealized receivables) is amended— (A) by striking out "farm recapture property (as defined in section 1251(e)(l)),", and (B) by striking out "1251(c),". 26 USC 1252. (5) SECTION 1252.—The second sentence of section 1252(a)(1) (relating to gains from disposition of farm land) is amended by striking out ", except that this section shall not apply to the extent section 1251 applies to such gain". (c) CLERICAL AMENDMENT.—The table of sections for part IV of subchapter P of chapter 1 is amended by striking out the item relating to section 1251. 26 USC 170 note. (d) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 1983.

TITLE V—EMPLOYEE BENEFIT PROVISIONS Subtitle A—Welfare Benefit Plans SEC. 511. TREATMENT OF FUNDED WELFARE BENEFIT PLANS.

(a) GENERAL RULE.—Part I of subchapter D of chapter 1 (relating to pension, profit sharing, stock bonus plans, etc.) is amended by adding at the end thereof the following new subpart:

"Subpart D—Treatment of Welfare Benefit Funds "Sec. 419. Treatment of funded welfare benefit plans. "Sec. 419A. Qualified asset account; limitation on additions to account. 26 USC 419.

"SEC. 419. TREATMENT OF FUNDED WELFARE BENEFIT PLANS.

"(a) GENERAL RULE.—Contributions paid or accrued by an employer to a welfare benefit fund— "(1) shall not be deductible under section 162 or 212, but "(2) if they satisfy the requirements of either of such sections, shall (subject to the limitation of subsection (b)) be deductible under this section for the taxable year in which paid. "(b) LIMITATION.—The amount of the deduction allowable under subsection (a)(2) for any taxable year shall not exceed the welfare benefit fund's qualified cost for the taxable year. "(c) QUALIFIED COST.—For purposes of this section—

�