Appropriations

Chapter 13

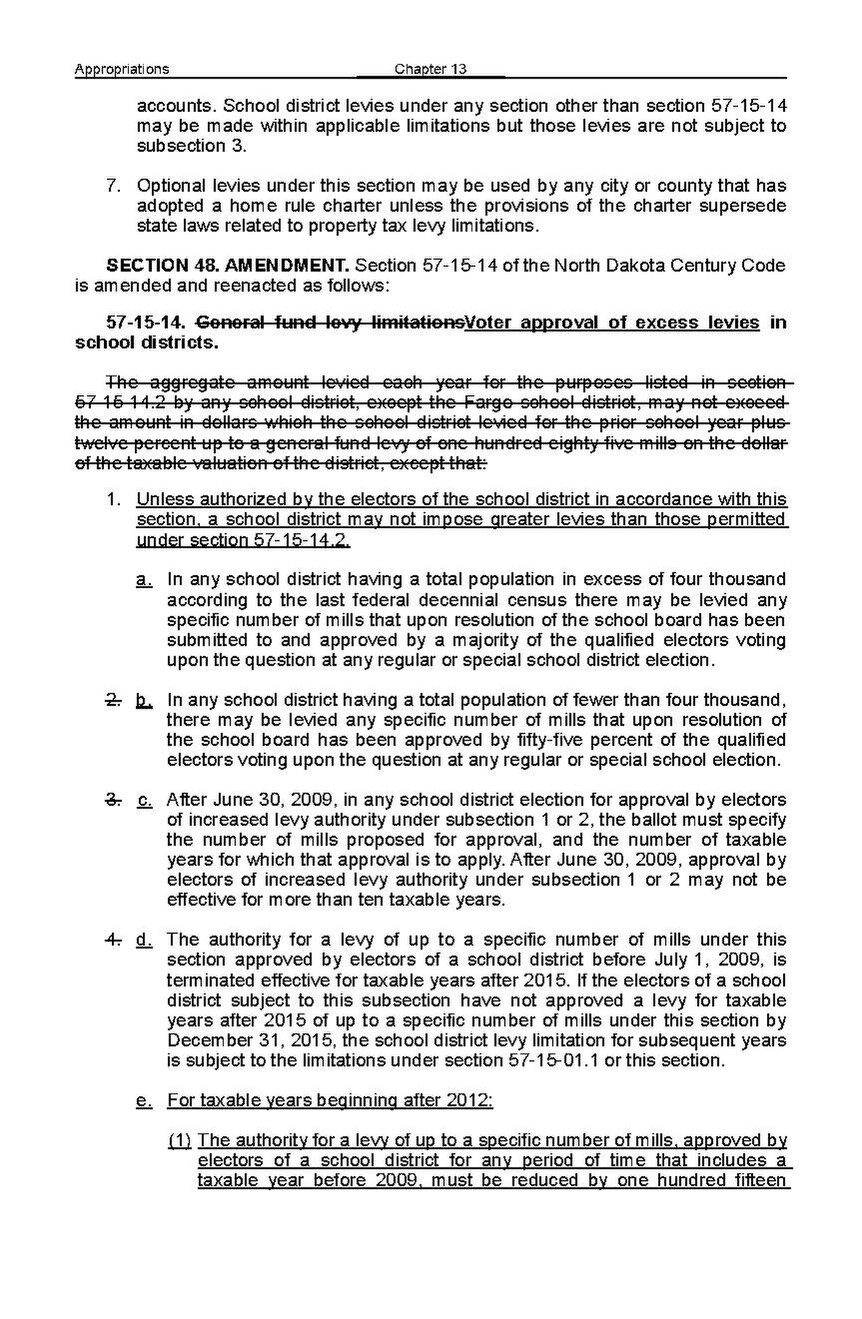

accounts. School district levies under any section other than section 57-15-14 may be made within applicable limitations but those levies are not subject to subsection 3. 7. Optional levies under this section may be used by any city or county that has adopted a home rule charter unless the provisions of the charter supersede state laws related to property tax levy limitations. SECTION 48. AMENDMENT. Section 57-15-14 of the North Dakota Century Code is amended and reenacted as follows: 57-15-14. General fund levy limitationsVoter approval of excess levies in school districts. The aggregate amount levied each year for the purposes listed in section 57-15-14.2 by any school district, except the Fargo school district, may not exceed the amount in dollars which the school district levied for the prior school year plus twelve percent up to a general fund levy of one hundred eighty-five mills on the dollar of the taxable valuation of the district, except that: 1. Unless authorized by the electors of the school district in accordance with this section, a school district may not impose greater levies than those permitted under section 57-15-14.2. a. In any school district having a total population in excess of four thousand according to the last federal decennial census there may be levied any specific number of mills that upon resolution of the school board has been submitted to and approved by a majority of the qualified electors voting upon the question at any regular or special school district election. 2. b. In any school district having a total population of fewer than four thousand, there may be levied any specific number of mills that upon resolution of the school board has been approved by fifty-five percent of the qualified electors voting upon the question at any regular or special school election. 3. c. After June 30, 2009, in any school district election for approval by electors of increased levy authority under subsection 1 or 2, the ballot must specify the number of mills proposed for approval, and the number of taxable years for which that approval is to apply. After June 30, 2009, approval by electors of increased levy authority under subsection 1 or 2 may not be effective for more than ten taxable years. 4. d. The authority for a levy of up to a specific number of mills under this section approved by electors of a school district before July 1, 2009, is terminated effective for taxable years after 2015. If the electors of a school district subject to this subsection have not approved a levy for taxable years after 2015 of up to a specific number of mills under this section by December 31, 2015, the school district levy limitation for subsequent years is subject to the limitations under section 57-15-01.1 or this section. e. For taxable years beginning after 2012: (1) The authority for a levy of up to a specific number of mills, approved by electors of a school district for any period of time that includes a taxable year before 2009, must be reduced by one hundred fifteen