PUBLIC LAW 100-647—NOV. 10, 1988

102 STAT. 3775

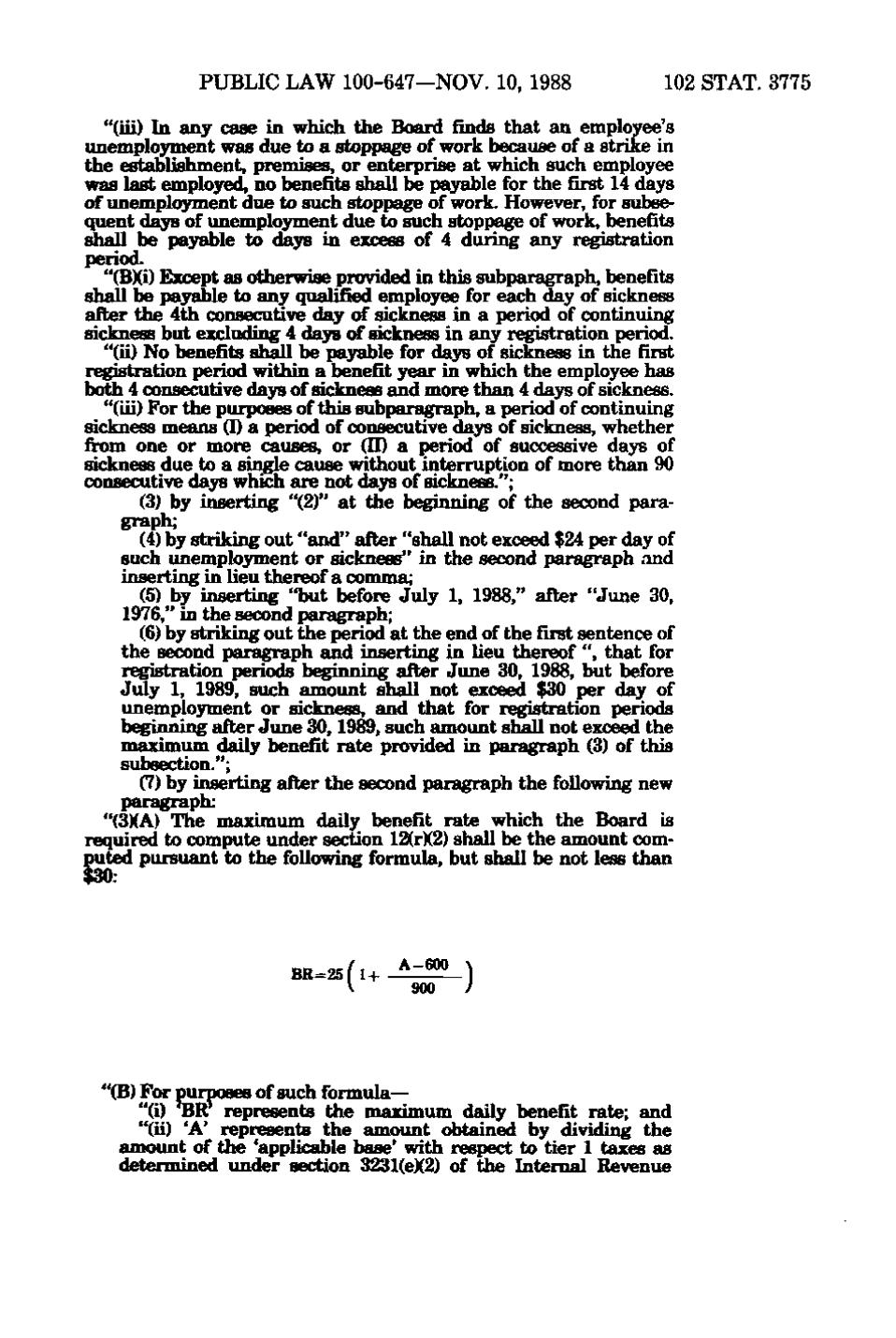

"(iii) In any case in which the Board finds that an employee's unemployment was due to a stoppage of work because of a strike in the establishment, premises, or enterprise at which such employee was last employed, no benefits shall be payable for the first 14 days of unemployment due to such stoppage of work. However, for subsequent days of unemployment due to such stoppage of work, benefits shall be payable to days in excess of 4 during any r^istration period. "(B)(i) E!xcept as otherwise provided in this subparagraph, benefits shall be payaMe to any qualified employee for each day of sickness after the 4th consecutive day of siclmess in a period of continuing sickness but excluding 4 days of sickness in any r^istration period. "(ii) No benefits shall be payable for days of sickness in the first r^istration period within a benefit year in which the employee has both 4 consecutive days of sickness and more than 4 days of sickness. "(iii) For the purposes of this subparagraph, a period of continuing sickness means (1) a period of consecutive days of sickness, whether from one or more causes, or (II) a period of successive days of sickness due to a single cause without interruption of more than 90 consecutive days which are not days of sickness."; (3) by inserting "(2)" at the beginning of the second paragraph; (4) by striking out "and" after "shall not exceed $24 per day of such unemployment or sickness" in the second paragraph and inserting in lieu thereof a comma; (5) by inserting "but before July 1, 1988," after "June 30, 1976," in the second paragraph; (6) by striking out the period at the end of the first sentence of the second paragraph and inserting in lieu thereof ", that for r^istration periods beginning after June 30, 1988, but before July 1, 1989, such amount shall not exceed $30 per day of unemployment or sickness, and that for r^^tration periods beginning after June 30, 1989, such amount shall not exceed the maximum daily benefit rate provided in paragraph (3) of this subsection."; (7) by inserting after the second paragraph the following new paragraph: "(3KA) The maximum daily benefit rate which the Board is required to compute under section 12(r)(2) shall be the amount computed pursuant to the following formula, but shall be not less than $30:

BR =25fl+ V

- -«•

900

- (B) For purposes of such formula—

"(i) 'BR' represents the maximum daily benefit rate; and "(ii) *A' represents the amount obtained by dividing the amount of the 'applicable base' with respect to tier 1 taxes as determined under section 3231(e)(2) of the Internal Revenue

�