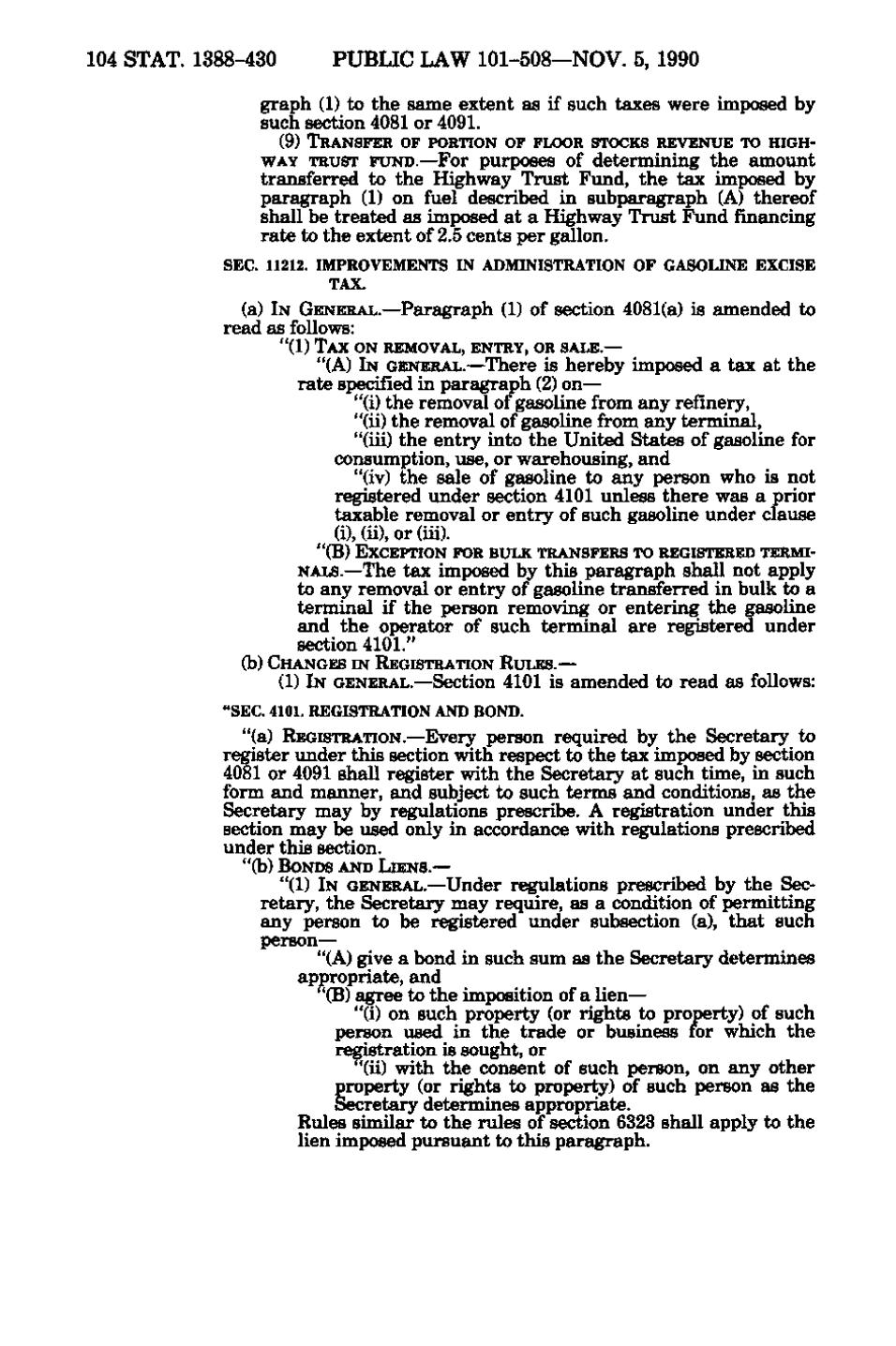

104 STAT. 1388-430 PUBLIC LAW 101-508—NOV. 5, 1990 graph (1) to the same extent as if such taxes were imposed by such section 4081 or 4091. (9) TRANSFER OF PORTION OF FLOOR STOCKS REVENUE TO HIGH- WAY TRUST FUND.— For purposes of determining the amount transferred to the Highway Trust Fund, the tax imposed by paragraph (1) on fuel described in subparagraph (A) thereof shall be treated as imposed at a Highway Trust Fund financing rate to the extent of 2.5 cents per gallon. SEC. 11212. IMPROVEMENTS IN ADMINISTRATION OF GASOLINE EXCISE TAX. (a) IN GENERAL. — Paragraph (1) of section 4081(a) is amended to read as follows: "(1) TAX ON REMOVAL, ENTRY, OR SALE.— "(A) IN GENERAL.— T here is hereby imposed a tax at the rate specified in paragraph (2) on— "(i) the removal of gasoline from any refinery, "(ii) the removal of gasoline from any terminal, "(iii) the entry into the United States of gasoline for consumption, use, or warehousing, and "(iv) the sale of gasoline to any person who is not registered under section 4101 unless there was a prior taxable removal or entry of such gasoline under clause (i), (ii), or (iii). "(B) EXCEPTION FOR BULK TRANSFERS TO REGISTERED TERMI- NALS.— The tax imposed by this paragraph shall not apply to any removal or entry of gasoline transferred in bulk to a terminal if the person removing or entering the gasoline and the operator of such terminal are registered under section 4101." (b) CHANGES IN REGISTRATION RULES.— (1) IN GENERAL.— Section 4101 is amended to read as follows: "SEC. 4101. REGISTRATION AND BOND. "(a) REGISTRATION. — Every person required by the Secretary to register under this section with respect to the tax imposed by section 4081 or 4091 shall register with the Secretary at such time, in such form and manner, and subject to such terms and conditions, as the Secretary may by regulations prescribe. A registration under this section may be used only in accordance with regulations prescribed under this section. "(b) BONDS AND LIENS.— "(1) IN GENERAL. —Under regulations prescribed by the Secretary, the Secretary may require, as a condition of permitting any person to be registered under subsection (a), that such person— "(A) give a bond in such sum as the Secretary determines appropriate, and '(B) agree to the imposition of a lien— "(i) on such property (or rights to property) of such person used in the trade or business for which the registration is sought, or (ii) with the consent of such person, on any other property (or rights to property) of such person as the Secretary determines appropriate. Rules similar to the rules of section 6323 shall apply to the lien imposed pursuant to this paragraph.

�