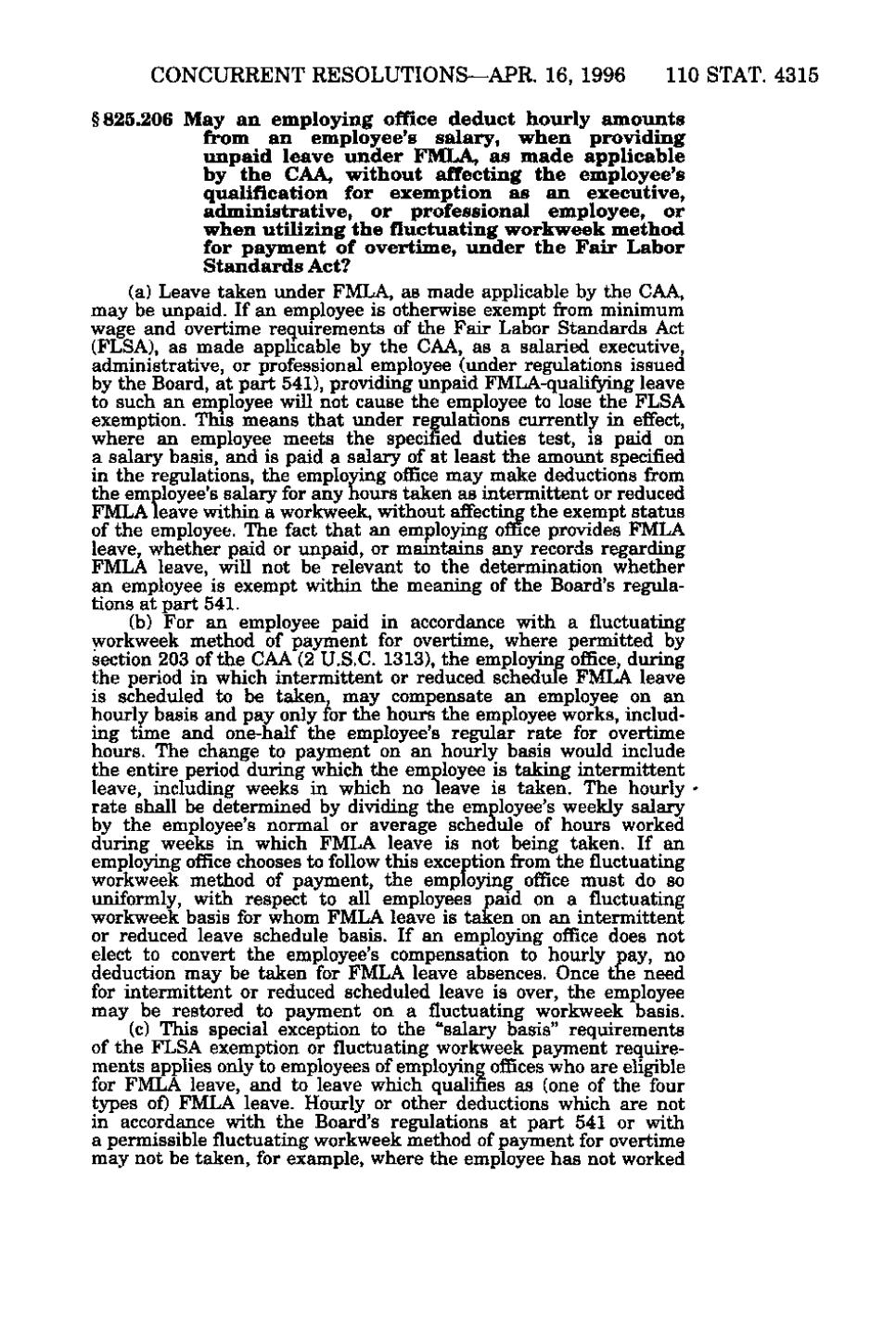

CONCURRENT RESOLUTIONS—APR. 16, 1996 110 STAT. 4315 §825.206 May an employing office deduct hourly amounts from an employee's salary, when providing unpaid leave under FMLA, as made applicable by the CAA, without affecting the employee's qualification for exemption as an executive, administrative, or professional employee, or when utilizing the fluctuating work^i^eek method for payment of overtime, under the Fair Labor Standards Act? (a) Leave taken under FMLA, as made applicable by the CAA, may be unpaid. If an employee is otherwise exempt from minimum wage and overtime requirements of the Fair Labor Standards Act (FLSA), as made applicable by the CAA, as a salaried executive, administrative, or professional employee (under regulations issued by the Board, at part 541), providing unpaid FMLA-qualifying leave to such an employee will not cause the employee to lose the FLSA exemption. This means that under regulations currently in effect, where an employee meets the specified duties test, is paid on a salary basis, and is paid a salary of at least the amount specified in the regulations, the employing office may make deductions from the employee's salary for any hours taken as intermittent or reduced FMLA leave within a workweek, without affecting the exempt status of the employee. The fact that an employing office provides FMLA leave, whether paid or unpaid, or maintains any records regarding FMLA leave, will not be relevant to the determination whether an employee is exempt within the meaning of the Board's regulations at part 541. (b) For an employee paid in accordance with a fluctuating workweek method of payment for overtime, where permitted by section 203 of the CAA (2 U.S.C. 1313), the employing office, during the period in which intermittent or reduced schedule FMLA leave is scheduled to be taken, may compensate an employee on an hourly basis and pay only for the hours the employee works, including time and one-half the employee's regular rate for overtime hours. The change to payment on an hourly basis would include the entire period during which the employee is taking intermittent leave, including weeks in which no leave is taken. The hourly - rate shall be determined by dividing the employee's weekly salary by the employee's normal or average schedule of hours worked during weeks in which FMLA leave is not being taken. If an employing office chooses to follow this exception from the fluctuating workweek method of payment, the employing office must do so uniformly, with respect to all employees paid on a fluctuating workweek basis for whom FMLA leave is taken on an intermittent or reduced leave schedule basis. If an employing office does not elect to convert the employee's compensation to hourly pay, no deduction may be taken for FMLA leave absences. Once the need for intermittent or reduced scheduled leave is over, the employee may be restored to payment on a fluctuating workweek basis. (c) This special exception to the "salary basis" requirements of the FLSA exemption or fluctuating workweek payment requirements applies only to employees of employing offices who are eligible for FMLA leave, and to leave which qualifies as (one of the four types of) FMLA leave. Hourly or other deductions which are not in accordance with the Board's regulations at part 541 or with a permissible fluctuating workweek method of pa3anent for overtime may not be taken, for example, where the employee has not worked

�