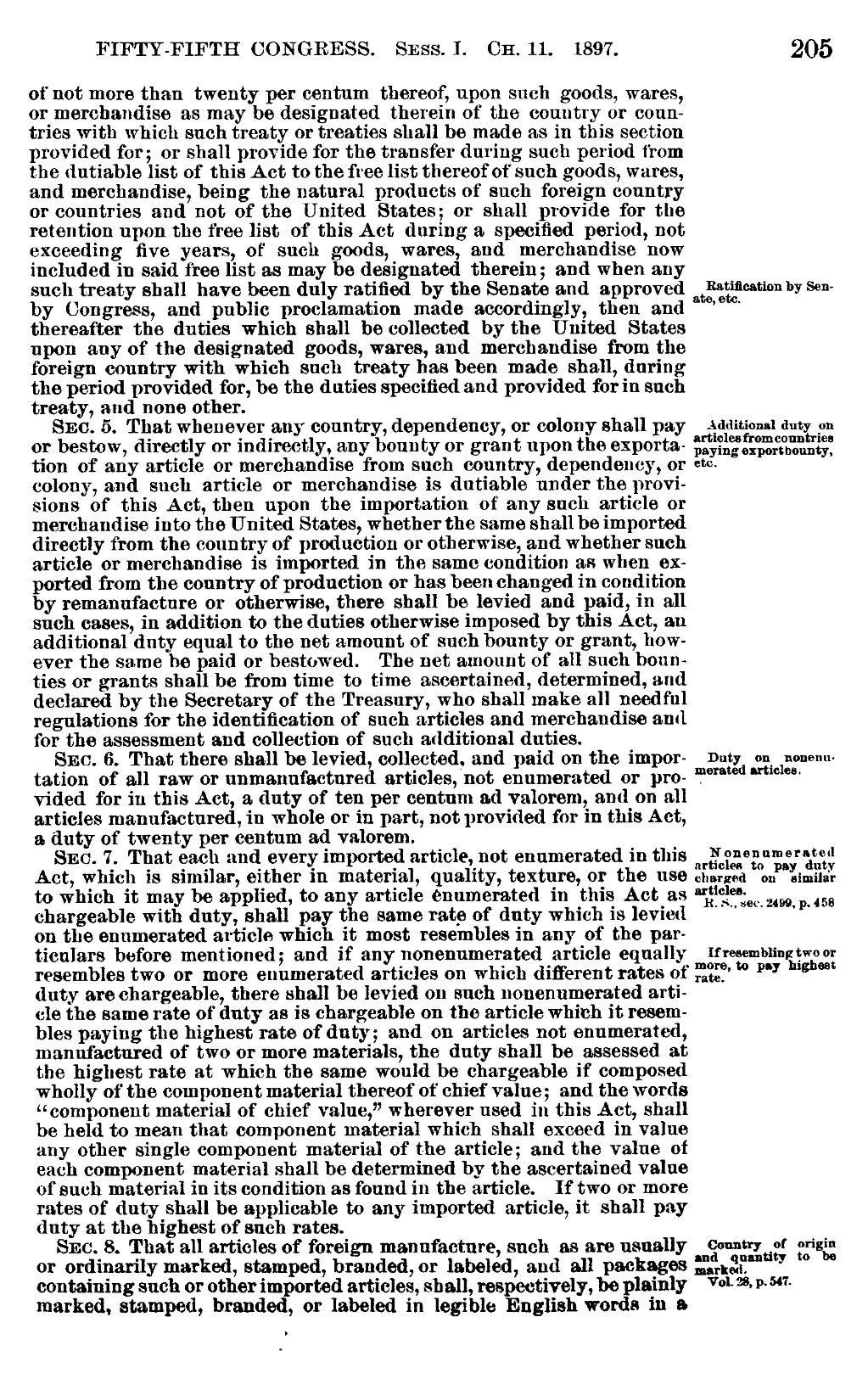

FIFTY-FIFTH CONGRESS. Sess. I. Ch. 11. 1897. 205 of not more than twenty per centum thereof, upon such goods, wares, or merchandise as may be designated therein of the country or countries with which such treaty or treaties shall be made as in this section provided for; or shall provide for the transfer during such period irom the dutiable list of this Act to the free list thereof of such goods, wares, and merchandise, being the natural products of such foreign country or countries and not of the United States; or shall provide for the retention upon the free list of this Act during a specified period, not exceeding five years, of such goods, wares, and merchandise now included in said free list as may be designated therein; and when any such treaty shall have been duly ratified by the Senate and approved tgeimcativn by Senby Congress, and public proclamation made accordingly, then and ° ’° °' thereafter the duties which shall be collected by the United States upon any of the designated goods, wares, and merchandise from the foreign country with which such treaty has been made shall, during the period provided for, be the duties specified and provided for in such treaty, and none other. Sec. 5. That whenever any country, dependency, or colony shall pay .-uiamtmi duty on or bestow, directly or indirectly, any bounty or grant upon the exporta- ;Q°;§:,?§§‘;},P§,°,}},'Q,*j{;? tion of any article or merchandise from such country, dependency, or cwcolony, and such article or merchandise is dutiable under the provisions of this Act, then upon the importation of any such article or merchandise into the United States, whether the same shall be imported directly from the country of production or otherwise, and whether such article or merchandise is imported in the same condition as when exported from the country of production or has been changed in condition by remanufacture or otherwise, there shall be levied and paid, in all such cases, in addition to the duties otherwise imposed by this Act, an additional duty equal to the net amount of such bounty or grant, however the same be paid or bestowed. The net amount of all such bounties or grants shall be from time to time ascertained, determined, and declared by the Secretary of the Treasury, who shall make all needful regulations for the identification of such articles and merchandise and for the assessment and collection of such additional duties. Sec. 6. That there shall be levied, collected, and paid on the impor- Duty ¤¤_ uomuu. tation of all raw or unmanufactured articles,`not enumerated or pro- '?‘°'"°° ‘"‘°’°°‘ vided for in this Act, a duty of ten per centum ad valorem, and on all articles manufactured, in whole or in part, not provided for in this Act, a duty of twenty per centum ad valorem. Sec. 7. That each and every imported article, not enumerated in this M&;>__¤;·>;·¤¤·¤=jl¢g·* Act, which is similar, either in material, quality, texture, or the use mama °¤¤P°iimii£i to which it may be applied, to any article enumerated in this Act as ”,§*2°°;m_ mg P ,58 chargeable with duty, shall pay the same rate of duty which is levied " ` on the enumerated article which it most resembles in any of the particulars before mentioned; and if any nonenumerated article equally Ifresembliuiztwwr resembles two or more enumerated articles on which diiferent rates of ff,?;?' W P" ’”gb°°° duty are chargeable, there shall be levied on such nonenumerated article the same rate of duty as is chargeable on the article which it resembles paying the highest rate of duty; and on articles not enumerated, manufactured of two or more materials, the duty shall be assessed at the highest rate at which the same would be chargeable if composed wholly of the component material thereof of chief value; and the words “component material of chief value," wherever used in this Act, shall be held to mean that component material which shall exceed in value any other single component material of the article; and the value of each component material shall be determined by the ascertained value of such material in its condition as found in the article. If two or more rates of duty shall be applicable to any imported article, it shall pay duty at the highest of such rates. Sec. S. That all articles of foreign manufacture, such as are usually Cvunirydef {Wis}: or ordinarily marked, stamped, branded, or labeled, and all packages Kt3R" W ° containing such or other imported articles, shall, respectively, be plainly WL 2** P· 5*7- marked, stamped, branded, or labeled in legible English words in a

Page:United States Statutes at Large Volume 30.djvu/244

This page needs to be proofread.