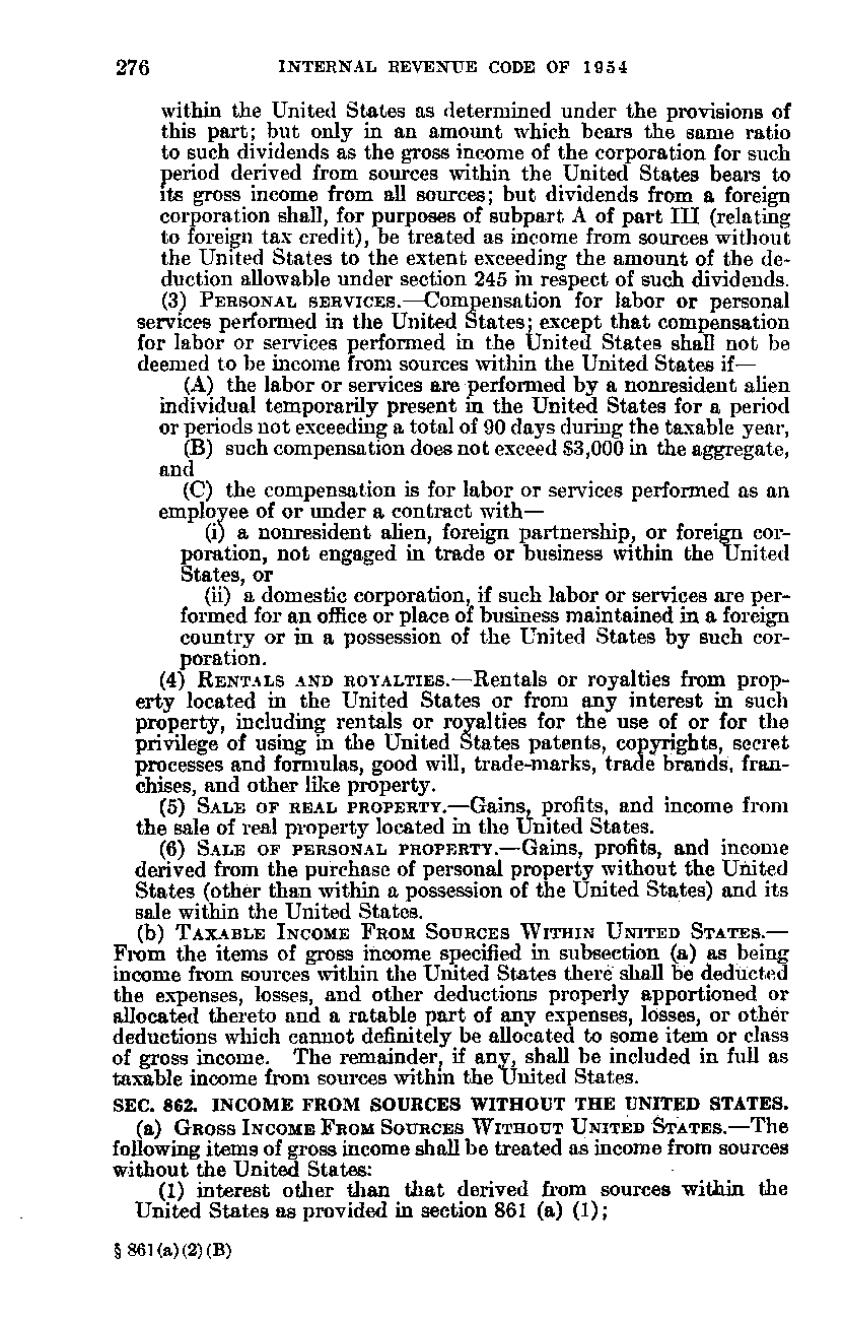

276

INTERNAL REVENUE CODE OF 1954

within the United States as determined under the provisions of this part; but only in an amount which bears the same ratio to such dividends as the gross income of the corporation for such period derived from sources within the United States bears to its gross income from all sources; but dividends from a foreign corporation shall, for purposes of subpart A of part III (relating to foreign tax credit), be treated as income from sources without the United States to the extent exceeding the amount of the deduction allowable under section 245 in respect of such dividends, (3) PERSONAL SERVICES,—Compensation for labor or personal services performed in the United States; except that compensation for labor or services performed in the United States shall not be deemed to be income from sources within the United States if— (A) the labor or services are performed by a nonresident alien individual temporarily present in the United States for a period or periods not exceeding a total of 90 days during the taxable year, (B) such compensation does not exceed $3,000 in the aggregate, and (C) the compensation is for labor or services performed as an employee of or under a contract with— (i) a nonresident alien, foreign partnership, or foreign corporation, not engaged in trade or business within the United States, or (ii) a domestic corporation, if such labor or services are performed for an office or place of business maintained in a foreign country or in a possession of the United States by such corporation. (4) RENTALS AND ROYALTIES.—Rentals or royalties from property located in the United States or from any interest in such property, including rentals or royalties for the use of or for the privilege of using in the United States patents, copyrights, secret processes and formulas, good will, trade-marks, trade brands, franchises, and other like property. (5) SALE OF REAL PROPERTY.—Gains, profits, and income from the sale of real property located in the United States. (6) SALE OF PERSONAL PROPERTY.—Gains, profits, and income derived from the purchase of personal property without the United States (other than within a possession of the United States) and its sale within the United States. (b) TAXABLE INCOME FROM SOURCES W I T H I N UNITED STATES.—

From the items of gross income specified in subsection (a) as being income from sources within the United States there shall be deducted the expenses, losses, and other deductions properly apportioned or allocated thereto and a ratable part of any expenses, losses, or other deductions which cannot definitely be allocated to some item or class of gross income. The remainder, if any, shall be included in full as taxable income from sources within the United States. SEC. 862. INCOME FROM SOURCES WITHOUT THE UNITED STATES. (a) GROSS INCOME FROM SOURCES WITHOUT UNITED STATES.—The

following items of gross income shall be treated as income from sources without the United States: (1) interest other than that derived from sources witifciin the United States as provided in section 861(a)(1); § 861(a)(2)(B)

�