CH. 1—NORMAL TAXES AND SURTAXES

299

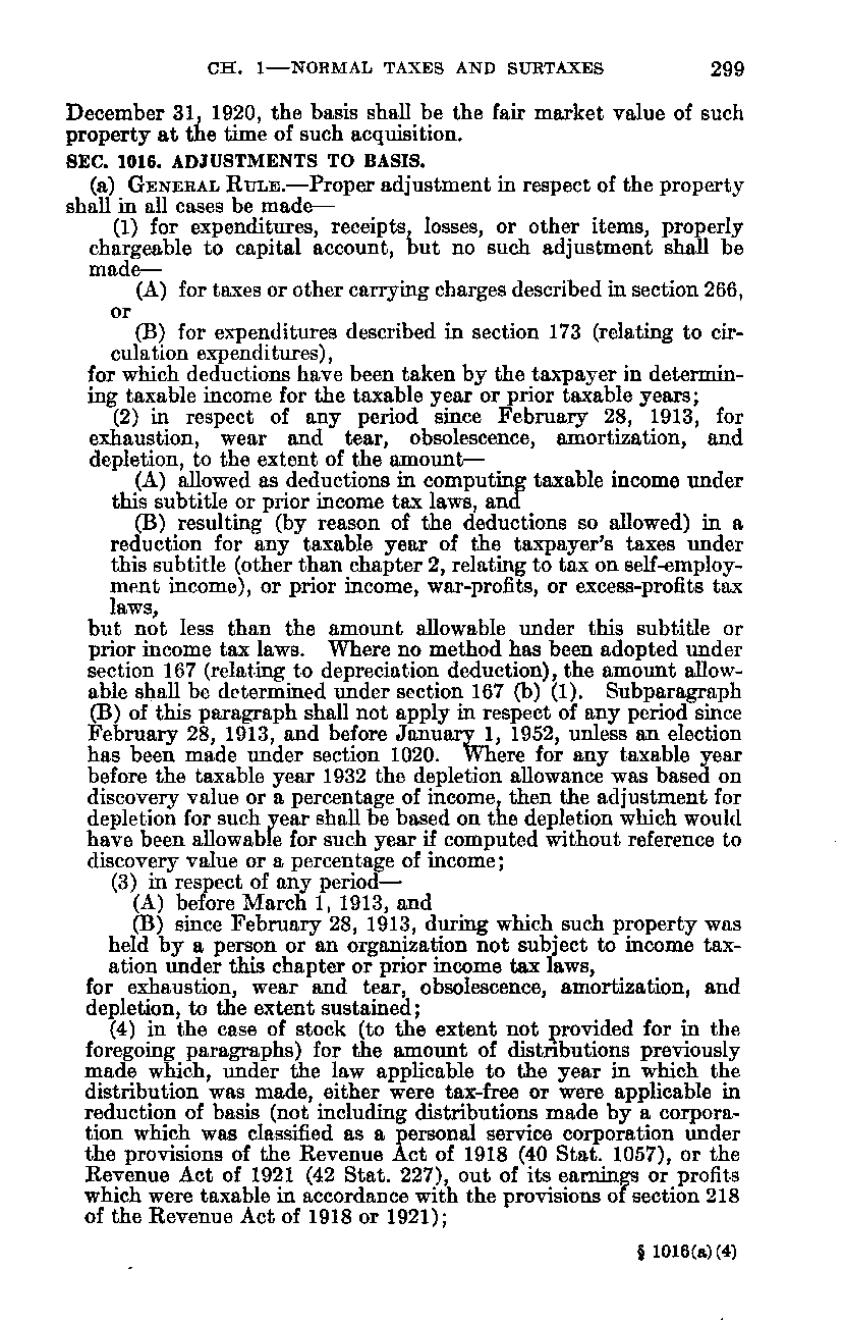

December 31, 1920, the basis shall be the fair market value of such property at the time of such acquisition. SEC. 1016. ADJUSTMENTS TO BASIS. (a) G E N E E A L RULE.—Proper adjustment in respect of the property

shall in all cases be made— (1) for expenditures, receipts, losses, or other items, properly ^ chargeable to capital account, but no such adjustment shall be made— ' (A) for taxes or other carrying charges described in section 266, ! or (B) for expenditures described in section 173 (relating to circulation expenditures), for which deductions have been taken by the taxpayer in determining taxable income for the taxable year or prior taxable years; (2) in respect of any period since February 28, 1913, for ' exhaustion, wear and tear, obsolescence, amortization, and ' depletion, to the extent of the amount— (A) allowed as deductions in computing taxable income under this subtitle or prior income tax laws, and " (B) resulting (by reason of the deductions so allowed) in a I reduction for any taxable year of the taxpayer's taxes under ' this subtitle (other than chapter 2, relating to tax on self-employment income), or prior income, war-profits, or excess-profits tax ^ laws, but not less than the amount allowable under this subtitle or prior income tax laws. Where no method has been adopted under ' section 167 (relating to depreciation deduction), the amount allow, able shall be determined under section 167(b)(1). Subparagraph (B) of this paragraph shall not apply in respect of any period since ' February 28, 1913, and before January 1, 1952, unless an election I has been made under section 1020. Where for any taxable year ' before the taxable year 1932 the depletion allowance was based on discovery value or a percentage of income, then the adjustment for depletion for such year shall be based on the depletion which would \ have been allowable for such year if computed without reference to • discovery value or a percentage of income; (3) in respect of any period— j = (A) before March 1, 1913, and (B) since February 28, 1913, during which such property was I held by a person or an organization not subject to income taxation under this chapter or prior income tax laws, , for exhaustion, wear and tear, obsolescence, amortization, and

- depletion, to the extent sustained;

' (4) in the case of stock (to the extent not provided for in the ,; foregoing paragraphs) for the amount of distributions previously made which, under the law applicable to the year in which the distribution was made, either were tax-free or were applicable in reduction of basis (not including distributions made by a corporation which was classified as a personal service corporation under the provisions of the Revenue Act of 1918 (40 Stat. 1057), or the Revenue Act of 1921 (42 Stat. 227), out of its earnings or profits which were taxable in accordance with the provisions of section 218 • of the Revenue Act of 1918 or 1921); § 1016(a)(4)

�