416

IM

INTERNAL REVENUE CODE OF 1954

- .HO

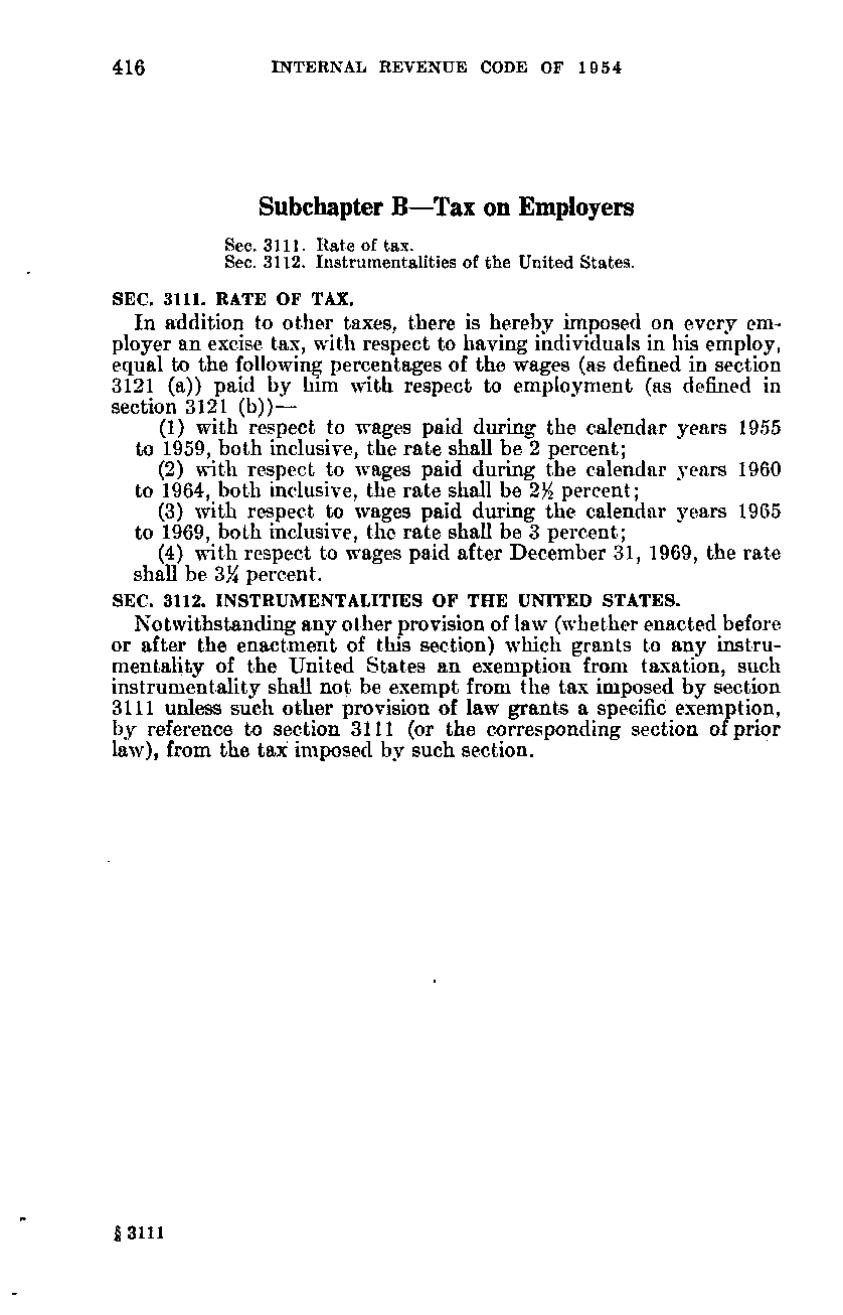

Subchapter B—Tax on Employers ! Sec. 3111. Rate of tax. Sec. 3112. Instrumentalities of the United States.

- \

SEC. 3111. RATE OF TAX.

In addition to other taxes, there is hereby imposed on every employer an excise tax, with respect to having individuals in his employ, equal to the following percentages of the wages (as defined in section 3121 (a)) paid by him with respect to employment (as defined in section 3121(b))— (1) with respect to wages paid during the calendar years 1955 to 1959, both inclusive, the rate shall be 2 percent; (2) with respect to wages paid during the calendar years 1960 to 1964, both inclusive, the rate shall be 2^ percent; (3) with respect to wages paid during the calendar years 1965 to 1969, both inclusive, the rate shall be 3 percent; (4) with respect to wages paid after December 31, 1969, the rate shall be 3K percent. SEC. 3112. INSTRUMENTALITIES OF THE UNITED STATES.

Notwithstanding any other provision of law (whether enacted before or after the enactment of this section) which grants to any instrumentality of the United States an exemption from taxation, such instrumentality shall not be exempt from the tax imposed by section 3111 unless such other provision of law grants a specific exemption, by reference to section 3111 (or the corresponding section of prior law), from the tax imposed by such section.

§3111

�