874

INTERNAL REVENUE CODE OF 1954

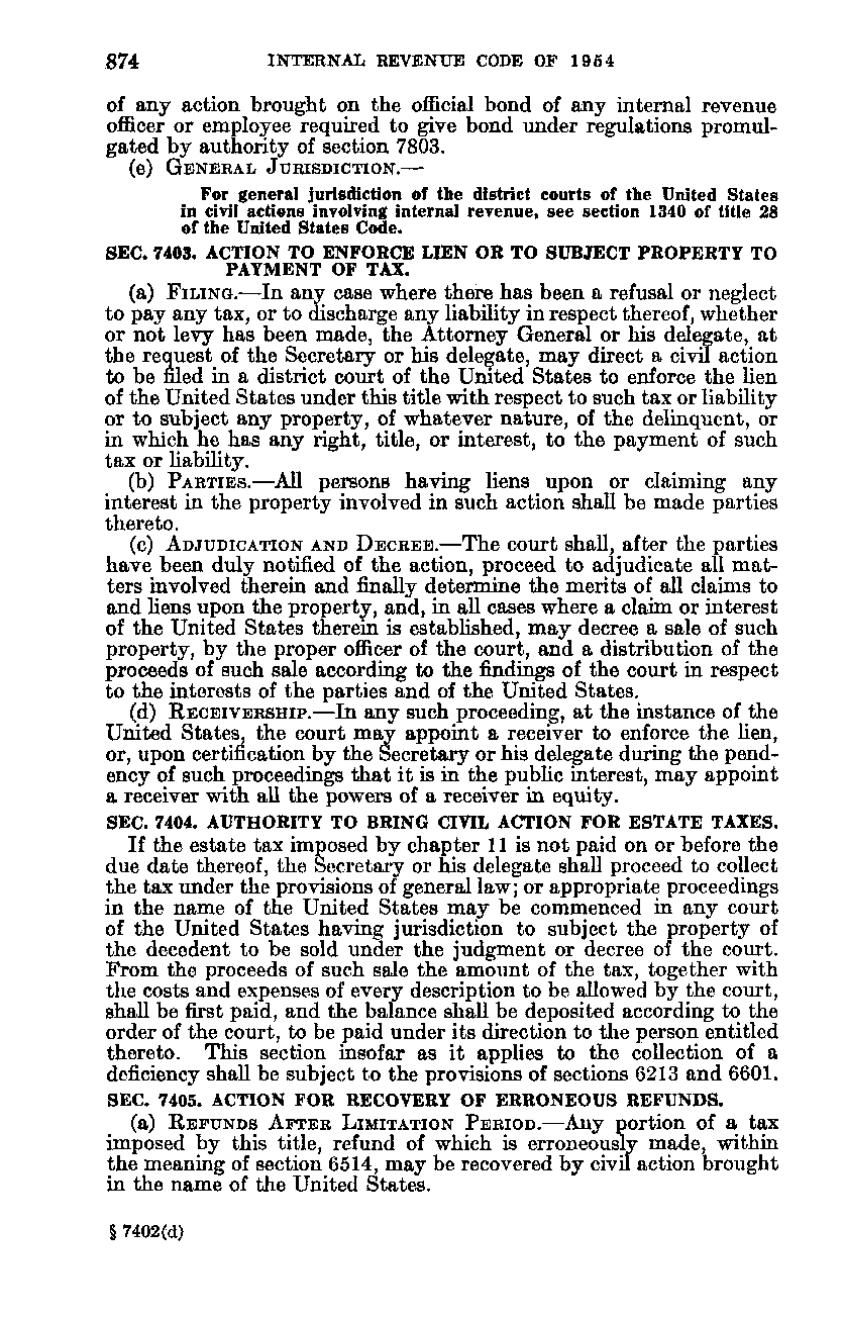

of any action brought on the official bond of any internal revenue officer or employee required to give bond under regulations promulgated by authority of section 7803. (e) GENERAL JURISDICTION.— For general jurisdiction of the district'cburlS of tKe tfnited States In civil actions involving internal revenue, see section 1340 of title 28 of the United States Code. SEC. 7403. ACTION TO ENFORCE LIEN OR TO SUBJECT PROPERTY TO PAYMENT OF TAX.

(a) FILING.—In any case where there has been a refusal or neglect to pay any tax, or to discharge any liability in respect thereof, whether or not levy has been made, the Attorney General or his delegate, at the request of the Secretary or his delegate, may direct a civil action to be filed in a district court of the United States to enforce the lien of the United States under this title with respect to such tax or liability or to subject any property, of whatever nature, of the delinquent, or in which he has any right, title, or interest, to the payment of such tax or liability. (b) PARTIES.—All persons having liens upon or claiming any interest in the property involved in such action shall be made parties thereto. (c) ADJUDICATION AND D E C R E E. — The court shall, after the parties have been duly notified of the action, proceed to adjudicate all matters involved therein and finally determine the merits of all claims to and liens upon the property, and, in all cases where a claim or interest of the United States therein is established, may decree a sale of such property, by the proper officer of the court, and a distribution of the proceeds of such sale according to the findings of the court in respect to the interests of the parties and of the United States. (d) RECEIVERSHIP.—In any such proceeding, at the instance of the United States, the court may appoint a receiver to enforce the lien, or, upon certification by the Secretary or his delegate during the pendency of such proceedings that it is in the public interest, may appoint a receiver with all the powers of a receiver in equity. SEC. 7404. AUTHORITY TO BRING CIVIL ACTION FOR ESTATE TAXES.

If the estate tax imposed by chapter 11 is not paid on or before the due date thereof, the Secretary or his delegate shall proceed to collect the tax under the provisions of general law; or appropriate proceedings in the name of the United States may be commenced in any court of the United States having jurisdiction to subject the property of the decedent to be sold under the judgment or decree of the court. From the proceeds of such sale the amount of the tax, together with the costs and expenses of every description to be allowed by the court, shall be first paid, and the balance shall be deposited according to the order of the court, to be paid under its direction to the person entitled thereto. This section insofar as it applies to the collection of a deficiency shall be subject to the provisions of sections 6213 and 6601. SEC. 7405. ACTION FOR RECOVERY OF ERRONEOUS

REFUNDS.

(a) R E F U N D S AFTER LIMITATION PERIOD.—Any portion of a

tax

imposed by this title, refund of which is erroneously made, within the meaning of section 6514, may be recovered by civil action brought in the name of the United States.,f ^QT yj evpo ^ ^un nuw /Hnrnu;) § 7402(d)

�