1000

PUBLIC LAW 8 6 - 7 7 9 - S E P T. 14, 1960

[74 ST A T.

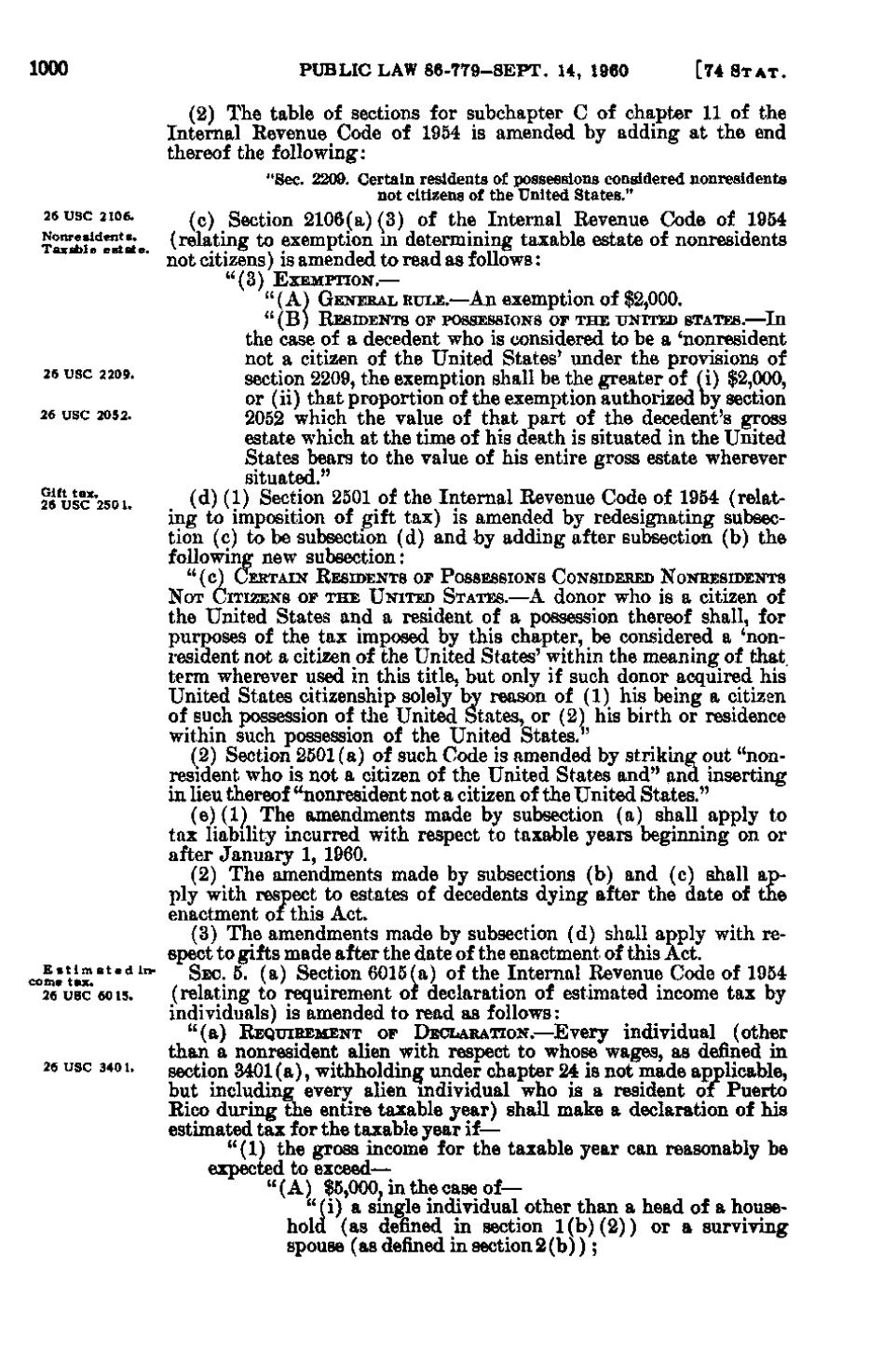

(2) The table of sections for subchapter C of chapter 11 of the Internal Revenue Code of 1954 is amended by adding at the end thereof the following: "Sec. 2209. Certain residents of possessions considered nonresidents not citizens of the United States." 26 USC 2106. Nonresidents. Taxable e s t a t e.

(c) Section 2106(a)(3) of the Internal Revenue Code of 1954 (relating to exemption m determining taxable estate of nonresidents not citizens) is amended to read as follows: " (3) EXEMPTION.— "(A^ GENERAL RULE.—An exemption of $2,000. " (B) RESIDENTS OF POSSESSIONS OF THE UNITED STATES.—In

26 USC 2209. 26 USC 2052.

Gift tax. 26 USC 250 1.

the case of a decedent who is considered to be a 'nonresident not a citizen of the United States' under the provisions of section 2209, the exemption shall be the greater of ^i) $2,000, or (ii) that proportion of the exemption authorized by section 2052 which the value of that part of the decedent's gross estate which at the time of his death is situated in the United States bears to the value of his entire gross estate wherever situated." (d)(1) Section 2501 of the Internal Revenue Code of 1954 (relating to imposition of gift tax) is amended by redesignating subsection (c) to be subsection (d) and by adding after subsection (b) the following new subsection: " (c) CERTAIN RESIDENTS OF POSSESSIONS CONSIDERED NONRESIDENTS NOT CITIZENS OF THE UNITED STATES.—A donor who is a citizen of

E s t i m a t e d income tax. 26 USC 50 15.

26 USC 340 1.

the United States and a resident of a possession thereof shall, for purposes of the tax imposed by this chapter, be considered a 'nonresident not a citizen of the United States' within the meaning of that term wherever used in this title, but only if such donor acquired his United States citizenship solely by reason of (1) his being a citizen of such possession of the United States, or (2) his birth or residence within such possession of the United States." (2) Section 2501(a) of such Code is amended by striking out "nonresident who is not a citizen of the United States and'* and inserting in lieu thereof "nonresident not a citizen of the United States." (e)(1) The amendments made by subsection (a) shall apply to tax liability incurred with respect to taxable years beginning on or after January 1, 1960. (2) The amendments made by subsections (b) and (c) shall apply with respect to estates of decedents dying after the date of the enactment or this Act. (3) The amendments made by subsection (d) shall apply with respect to gifts made after the date of the enactment of this Act. SEC. 5. (a) Section 6015(a) of the Internal Revenue Code of 1954 (relating to requirement of declaration of estimated income tax by individuals) is amended to read as follows: " (a) REQUIREMENT OF DECLARATION.—Every individual (other than a nonresident alien with respect to whose wages, as defined in section 3401(a), withholding under chapter 24 is not made applicable, but including everjr alien individual who is a resident of Puerto Rico during the entire taxable year) shall make a declaration of his estimated tax for the taxable year if— "(1) the gross income for the taxable year can reasonably be expected to exceed— " (A) $5,000^ in the case of— " (i) a single individual other than a head of a household (as defined in section 1(b)(2)) or a surviving spouse (as defined in section 2(b));

�