74

STAT.]

PUBLIC LAW 86-723-SEPT. 8, 1960 a DISCONTINUED

843

SERVICE RETIREMENT

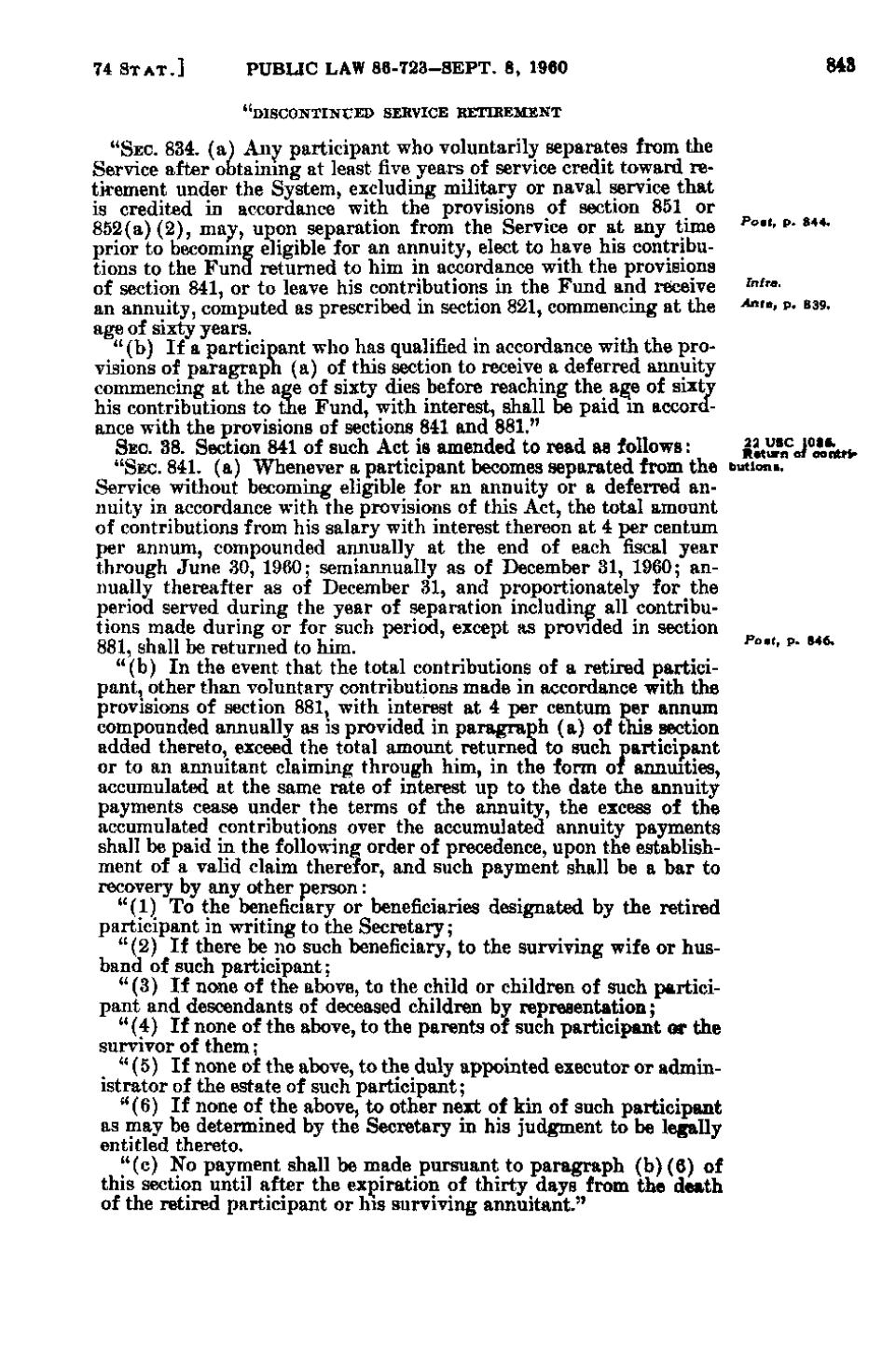

"SEC. 834. (a) Any participant who voluntarily separates from the Service after obtaining at least five years of service credit toward retirement under the System, excluding military or naval service that is credited in accordance with the provisions of section 851 or 852(a)(2), may, upon separation from the Service or at any time Po»t, p. 844. prior to becoming eligible for an annuity, elect to have his contributions to the Fund returned to him in accordance with the provisions Infra. of section 841, or to leave his contributions in the Fund and receive an annuity, computed as prescribed in section 821, commencing at the Ante, p. 839. age of sixty years. " (b) If a participant who has qualified in accordance with the provisions of paragraph (a) of this section to receive a deferred annuity commencing at the age of sixty dies before reaching the age of sixty his contributions to the Fund, with interest, shall be paid in accordance with the provisions of sections 841 and 881." 22 USC 1016. SEC. 38. Section 841 of such Act is amended to read as follows: Return of contrl* "SEC. 841. (a) Whenever a participant becomes separated from the buVion* Service without becoming eligible for an annuity or a deferred annuity in accordance with the provisions of this Act, the total amount of contributions from his salary with interest thereon at 4 per centum per annum, compounded annually at the end of each fiscal year through June 30, 1960; semiannually as of December 31, 1960; annually thereafter as of December 31, and proportionately for the period served during the year of separation including all contributions made during or for such period, except as provided in section Post, p. 846. 881, shall be returned to him. " (b) In the event that the total contributions of a retired participant, other than voluntary contributions made in accordance with the provisions of section 881, with interest at 4 per centum per annum compounded annually as is provided in paragraph (a) of this section added thereto, exceed the total amount returned to such participant or to an annuitant claiming through him, in the form of annuities, accumulated at the same rate of interest up to the date the annuity payments cease under the terms of the annuity, the excess of the accumulated contributions over the accumulated annuity payments shall be paid in the following order of precedence, upon the establishment of a valid claim therefor, and such payment shall be a bar to recovery by any other person: "(1) To the beneficiary or beneficiaries designated by the retired participant in writing to the Secretary; "(2) If there be no such beneficiary, to the surviving wife or husband of such participant; "(3) If none of the above, to the child or children of such participant and descendants of deceased children by representation; "(4) If none of the above, to the parents of such participant or the survivor of them; " (5) If none of the above, to the duly appointed executor or administrator of the estate of such participant; "(6) If none of the above, to other next of kin of such participant as may be determined by the Secretary in his judgment to be legally entitled thereto. "(c) No payment shall be made pursuant to paragraph (b)(6) of this section until after the expiration of thirty days from the death of the retired participant or his surviving annuitant."

�