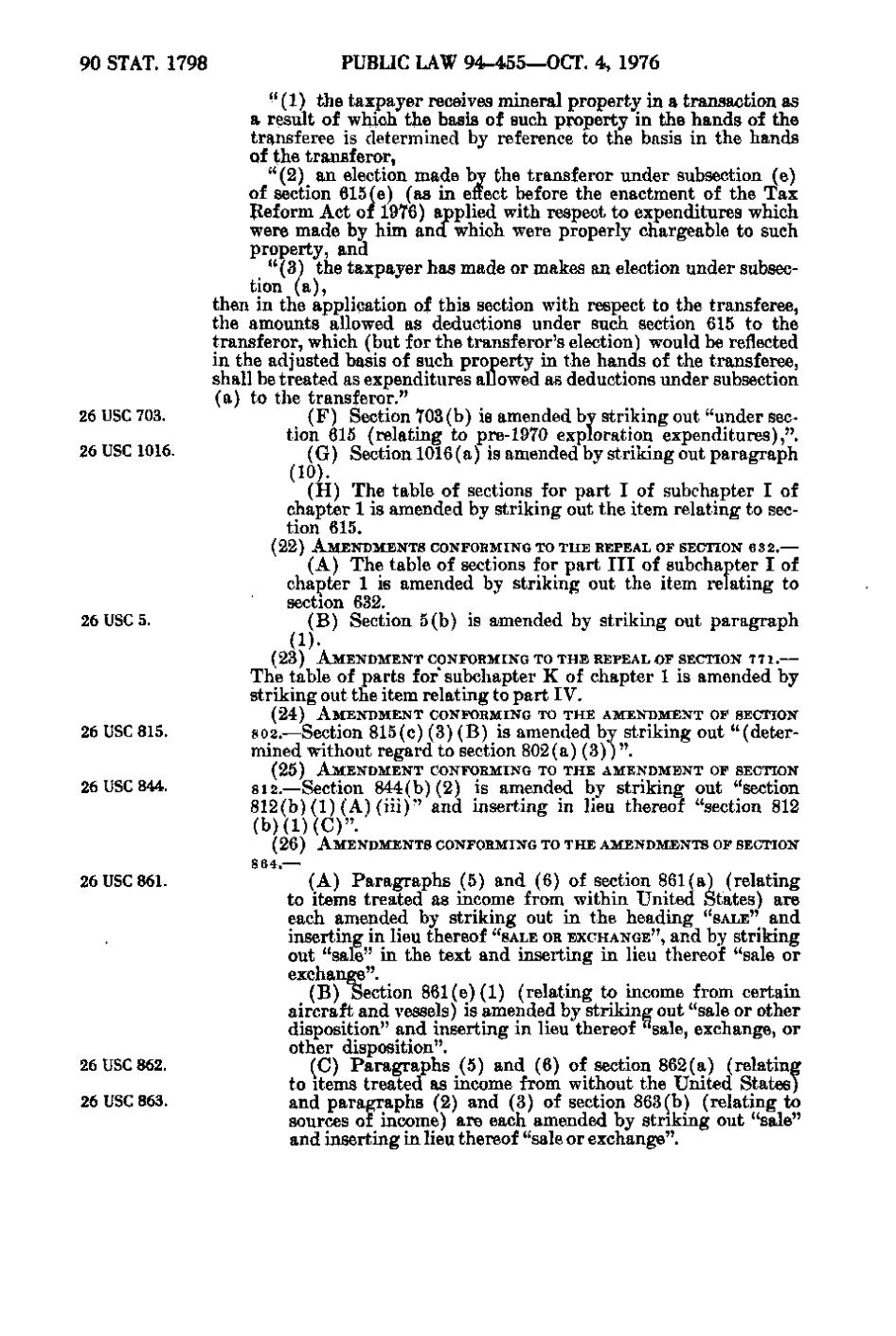

90 STAT. 1798

PUBLIC LAW 94-455—OCT. 4, 1976

"(1) the taxpayer receives mineral property in a transaction as .:•.i ^P: . g, result of which the basis of such property in the hands of the transferee is determined by reference to the basis in the hands ^' of the transferor, "(2) an election made by the transferor under subsection (e) of section 615(e) (as in effect before the enactment of the Tax Keform Act of 1976) applied with respect to expenditures which were made by him and which were properly chargeable to such property, and "(3) the taxpayer has made or makes an election under subsection (a), then in the application of this section with respect to the transferee, the amounts allowed as deductions under such section 615 to the transferor, which (but for the transferor's election) would be reflected .i-M r);-! J in the adjusted basis of such property in the hands of the transferee, shall be treated as expenditures allowed as deductions under subsection (a) to the transferor." 26 USC 703. (F) Section 703(b) is amended by striking out "under section 615 (relating to pre-1970 exploration expenditures),". 26 USC 1016. ((J) Section 1016(a) is amended by striking out paragraph (10). ..-•' i:••" 'r: (H) The table of sections for part I of subchapter I of chapter 1 is amended by striking out the item relating to section 615. (22) AMENDMENTS CONFORMING TO THE REPEAL OF SECTION 63 2.—

26 USC 5.

(A) The table of sections for part III of subchapter I of chapter 1 is amended by striking out the item relating to section 632. (B) Section 5(b) is amended by striking out paragraph (1). ( 2 3) AMENDMENT CONFORMING TO THE REPEAL OF SECTION 7 7 1. —

The table of parts for'subchapter K of chapter 1 is amended by striking out the item relating to part IV. (24)

26 USC 815.

802.—Section 815(c)(3)(B) is amended by striking out "(determined without regard to section 802(a)(3))". (25)

26 USC 844.

AMENDMENT CONFORMING TO THE AMENDMENT OF SECTION

AMENDMENT CONFORMING TO THE AMENDMENT OF SECTION

812.—Section 844(b)(2) is amended by striking out "section 812(b)(1)(A) (iii)" and inserting in lieu thereof "section 812 (b)(1)(C)". (26)

AMENDMENTS CONFORMING TO THE AMENDMENTS OF SECTION

864.—

26 USC 861. ,^

26 USC 862. 26 USC 863,

(A) Paragraphs (5) and (6) of section 861(a) (relating to items treated as income from within United States) are each amended by striking out in the heading "SALE" and inserting in lieu thereof "SALE OR EXCHANGE", and by striking out "sale" in the text and inserting in lieu thereof "sale or exchange". (B) Section 861(e)(1) (relating to income from certain aircraft and vessels) is amended by striking out "sale or other disposition" and inserting in lieu thereof "sale, exchange, or other disposition". (C) Paragraphs (5) and (6) of section 862(a) (relating to items treated as income from without the United States) and paragraphs (2) and (3) of section 863(b) (relating to sources of income) are each amended by striking out "sale" and inserting in lieu thereof "sale or exchange".

�