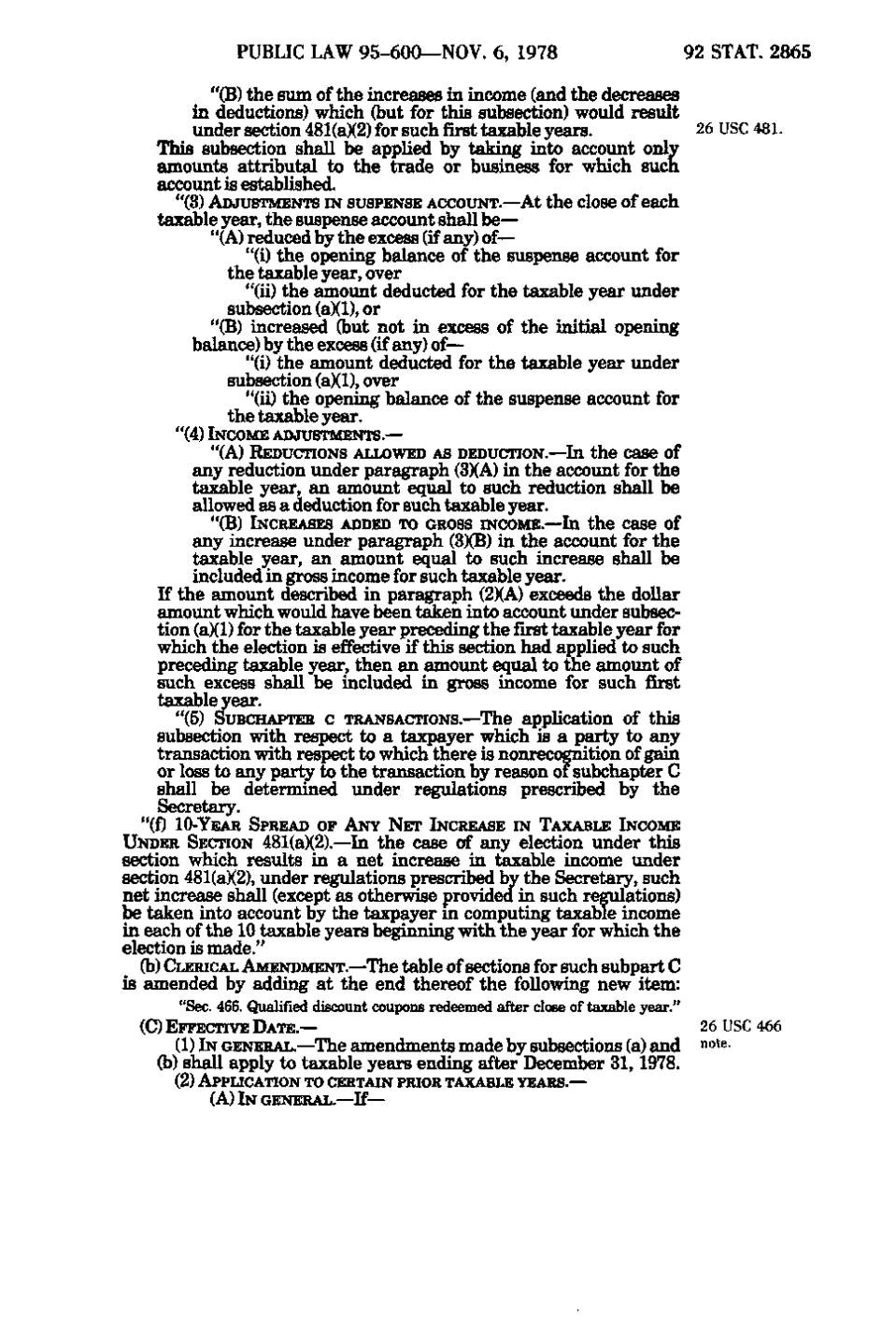

PUBLIC LAW 95-600—NOV. 6, 1978

92 STAT. 2865

"(B) the sum of the increases in income (and the decreases in deductions) which (but for this subsection) would result under section 481(a)(2) for such first taxable years. 26 USC 481. This subsection shall be applied by taking into account only amounts attributal to the trade or business for which such account is established. "(3) ADJUSTMENTS IN SUSPENSE ACCOUNT.—At the close of each taxable year, the suspense account shall be— "(A) reduced by the excess (if any) of— "(i) the opening balance of the suspense account for the taxable year, over "(ii) the amount deducted for the taxable year under subsection (a)(1), or "(B) increased (but not in excess of the initial opening bsdance) by the excess (if any) of— "(i) the amount deducted for the taxable year under subsection (a)(1), over "(ii) the opening balance of the suspense account for the taxable year. "(4) INCOME ADJUSTMENTS.— "(A) REDUCTIONS ALLOWED AS DEDUCTION.—In

the case of any reduction under paragraph (3)(A) in the account for the taxable year, an amount equal to such reduction shall be allowed as a deduction for such taxable year. "(B) INCREASES ADDED TO GROSS INCOME.—In the case of any increase under paragraph (3)(B) in the account for the taxable year, an amount equal to such increase shall be included in gross income for such taxable year. If the amount described in paragraph (2)(A) exceeds the dollar amount which would have been taken into account under subsection (a)(1) for the taxable year preceding the first taxable year for which the election is effective if this section had applied to such preceding taxable year, then an amount equal to the amount of such excess shall be included in gross income for such first taxable year. "(5) SUBCHAPTER C TRANSACTIONS.—The application of this subsection with respect to a taxpayer which is a party to any transaction with respect to which there is nonrecognition of gain or loss to any party to the transaction by reason of subchapter C shall be determined under regulations prescribed by the Secretary. "(f) 10-YEAR SPREAD OF ANY NET INCREASE IN TAXABLE INCOME UNDER SECTION 481(a)(2).—In the case of any election under this

section which results in a net increase in taxable income under section 481(a)(2), under regulations prescribed by the Secretary, such net increase shall (except as otherwise provided in such regulations) be taken into account by the tsixpayer in computing taxable income in each of the 10 taxable years beginning with the year for which the election is made." (b) CLERICAL AMENDMENT.—The table of sections for such subpart C is amended by adding at the end thereof the following new item: "Sec. 466. Qualified discount coupons redeemed after close of taxable year." (C) EFFECTIVE D A T E. —

26 USC 466

(1) IN GENERAL.—The amendments made by subsections (a) and "ote. (b) shall apply to taxable years ending after December 31, 1978. (2) APPLICATION TO CERTAIN PRIOR TAXABLE YEARS.— (A) IN GENERAL.—If—

�