PUBLIC LAW 95-615—NOV. 8, 1978 ,4;^ ij

9 2 STAT. 3 1 0 5

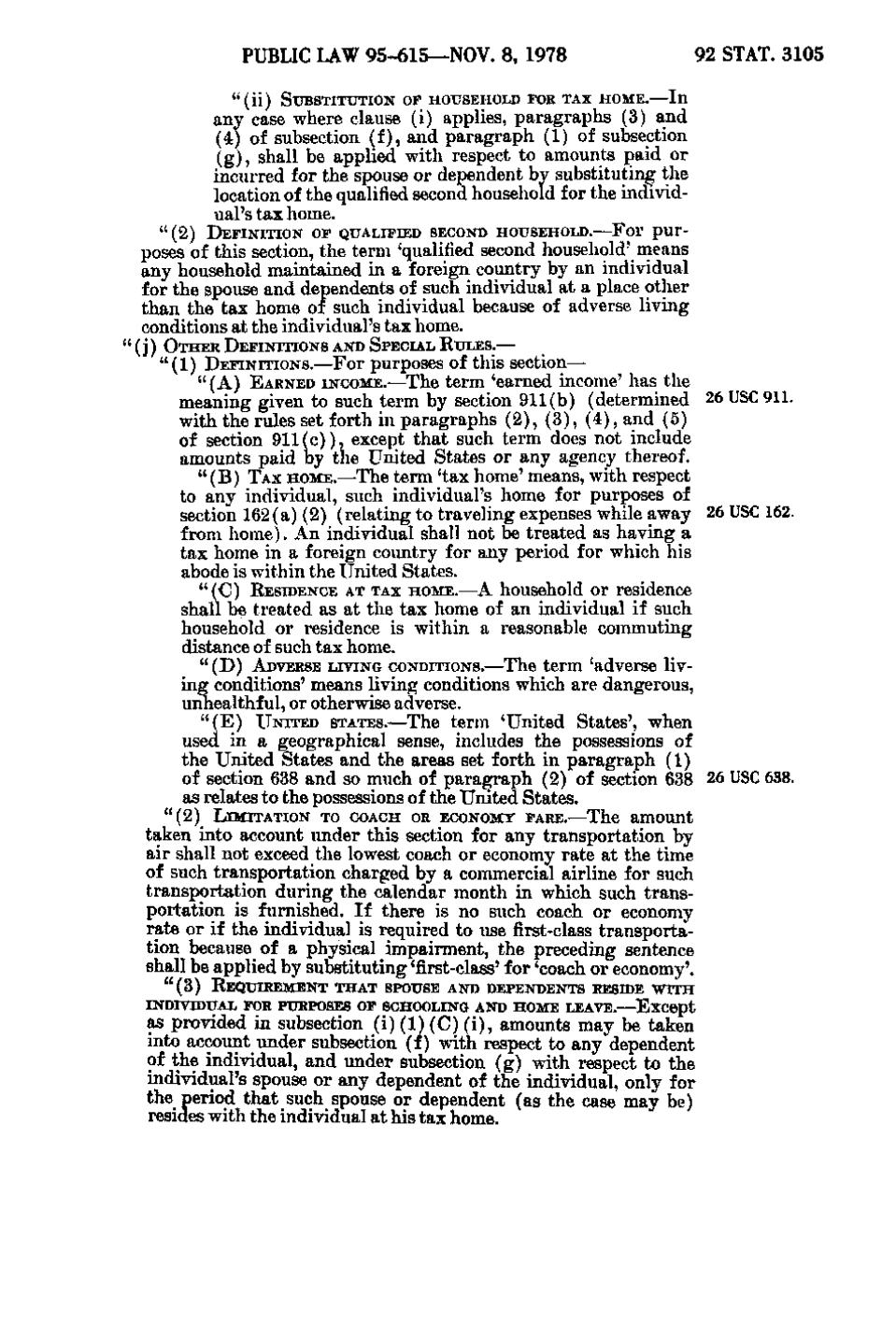

" ( i i) SUBSTITUTION OF HOUSEHOLD TOR TAX H O M E. — I n

any case where clause (i) applies, paragraph s (3) and (4) of subsection (f), and paragraph (1) of subsection (g), shall be applied with respect to amounts paid or incurred for the spouse or dependent by substituting the location of the qualified second household for the individual's tax home.

- 4f

- t

- -

" (2) DEFINITION OF QUALIFIED SECOND HOUSEHOLD.—For p u r -

poses of this section, the term 'qualified second household' means any household maintained in a foreign country by an individual for the spouse and dependents of such individual a t a place other than the tax home of such individual because of adverse living conditions a t the individual's tax home.

- i •

'

" (j) OTHER DEFINITIONS AND SPECIAL RULES. —

•

" (1) DEFINITIONS. — For purposes of this section— " (A) EARNED INCOME.—The term 'earned income' has the meaning given to such term by section 911(b) (determined 26 USC 911. with the rules set forth in paragraph s (2), (3), (4), and (5) of section 9 1 1 (c)), except that such term does not include amounts paid by the United States or any agency thereof. " (B) T A X HOME.—The term 'tax home' means, with respect to any individual, such individual's home for purposes of section 162(a)(2) (relating to traveling expenses while away 26 USC 162. from home). A n individual shall not be treated as h a v i n g a tax home in a foreign country for any period for which his abode is within the United States. " (C) RESIDENCE AT TAX HOME.—A household or residence shall be treated as at the tax home of an individual if such household or residence is within a reasonable commuting distance of such tax home.

" (D) ADVERSE LIVING CONDITIONS.—The term 'adverse liv-

ing conditions' means living conditions which are dangerous, unhealthful, or otherwise adverse. " (E) UNITED STATES.—The term 'United States', when used in a geographical sense, includes the possessions of the United States and the areas set forth in paragraph (1) of section 638 and so much of paragraph (2) of section 638 26 USC 638. as relates to the possessions of the United States. "(2)

L I M I T A T I O N TO COACH OR ECONOMY FARE.—The a m o u n t

taken into account under this section for any transportation by air shall not exceed the lowest coach or economy rate a t the time of such transportation charged by a commercial airline for such transportation during the calendar month in which such transportation is furnished. I f there is no such coach or economy rate or if the individual is required to use first-class transportation because of a physical impairment, the preceding sentence shall be applied by substituting 'first-class' for 'coach or economy'. " (3) REQUIREMENT THAT SPOUSE AND DEPENDENTS RESIDE W I T H INDIVIDUAL FOR PURPOSES OF SCHOOLING AND HOME LEAVE.—Except

as provided in subsection (i)(1)(C)(i), amounts may be taken into account under subsection (f) with respect to any dependent of the individual, and under subsection (g) with respect to the individual's spouse or any dependent of the individual, only for the period that such spouse or dependent (as the case may be) resides with the individual a t his tax home.

v ^

�