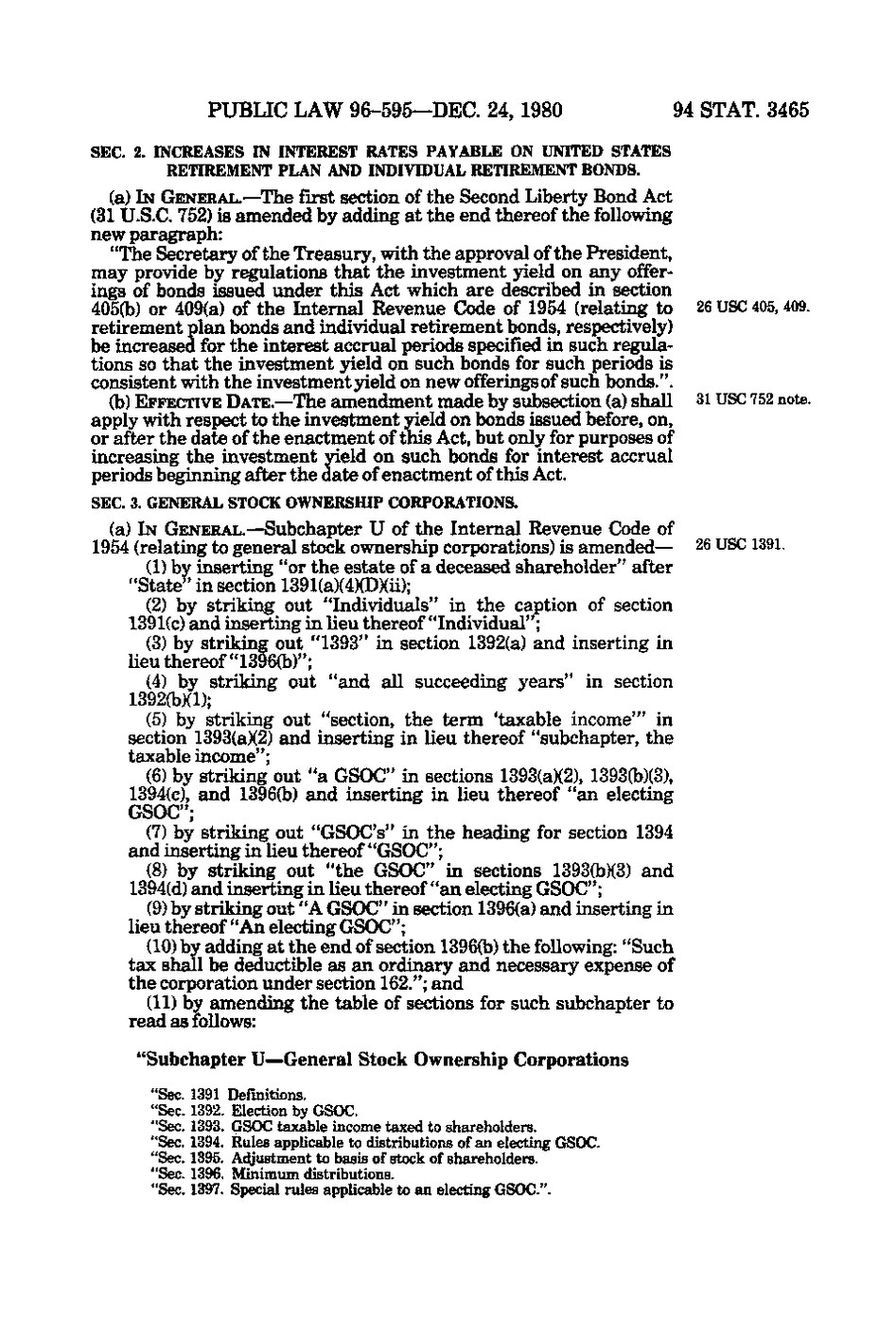

PUBLIC LAW 96-595—DEC. 24, 1980

94 STAT. 3465

SEC. 2. INCREASES IN INTEREST RATES PAYABLE ON UNITED STATES RETIREMENT PLAN AND INDIVIDUAL RETIREMENT BONDS.

(a) IN GENERAL.—The first section of the Second Liberty Bond Act (31 U.S.C. 752) is amended by adding at the end thereof the following new paragraph: "The Secretary of the Treasury, with the approval of the President, may provide by regulations that the investment yield on any offerings of bonds issued under this Act which are described in section 405(b) or 409(a) of the Internal Revenue Code of 1954 (relating to retirement plan bonds and individual retirement bonds, respectively) be increased for the interest accrual periods specified in such regulations so that the investment yield on such bonds for such periods is consistent with the investment yield on new offerings of such bonds.". (b) EFFECTIVE DATE.—The amendment made by subsection (a) shall apply with respect to the investment yield on bonds issued before, on, or after the date of the enactment of this Act, but only for purposes of increasing the investment yield on such bonds for interest accrual periods beginning after the date of enactment of this Act.

26 USC 405,409.

31 USC 752 note,

SEC. 3. GENERAL STOCK OWNERSHIP CORPORATIONS.

(a) IN GENERAL.—Subchapter U of the Internal Revenue Code of 1954 (relating to general stock ownership corporations) is amended— (1) by inserting "or the estate of a deceased shareholder" after "State" in section 1391(a)(4)(D)(ii); (2) by striking out "Individuals" in the caption of section 1391(c) and inserting in lieu thereof "Individual"; (3) by striking out "1393" in section 1392(a) and inserting in lieu thereof "1396(b)"; (4) by striking out "and all succeeding years" in section 1392(b)(1); (5) by striking out "section, the term 'taxable income"' in section 1393(a)(2) and inserting in lieu thereof "subchapter, the taxable income"; (6) by striking out "a GSOC" in sections 1393(a)(2), 1393(b)(3), 1394(c), and 1396(b) and inserting in lieu thereof "an electing GSOC"; (7) by striking out "GSOC's" in the heading for section 1394 and inserting in lieu thereof "GSOC"; (8) by striking out "the GSOC" in sections 1393(b)(3) and 1394(d) and inserting in lieu thereof "an electing GSOC"; (9) by striking out "A GSOC" in section 1396(a) and inserting in lieu thereof "An electing GSOC"; (10) by adding at the end of section 1396(b) the following: "Such tax shall be deductible as an ordinary and necessary expense of the corporation under section 162."; and (11) by amending the table of sections for such subchapter to read as follows: "Subchapter U—General Stock Ownership Corporations "Sec. "Sec. "Sec. "Sec. "Sec. "Sec. "Sec.

1391 Definitions. 1392. Election by GSOC. 1393. GSOC taxable income taxed to shareholders. 1394. Rules applicable to distributions of an electing GSOC. 1395. Adjustment to basis of stock of shareholders. 1396. Minimum distributions. 1397. Special rules applicable to an electing GSOC".

26 USC 1391.

�