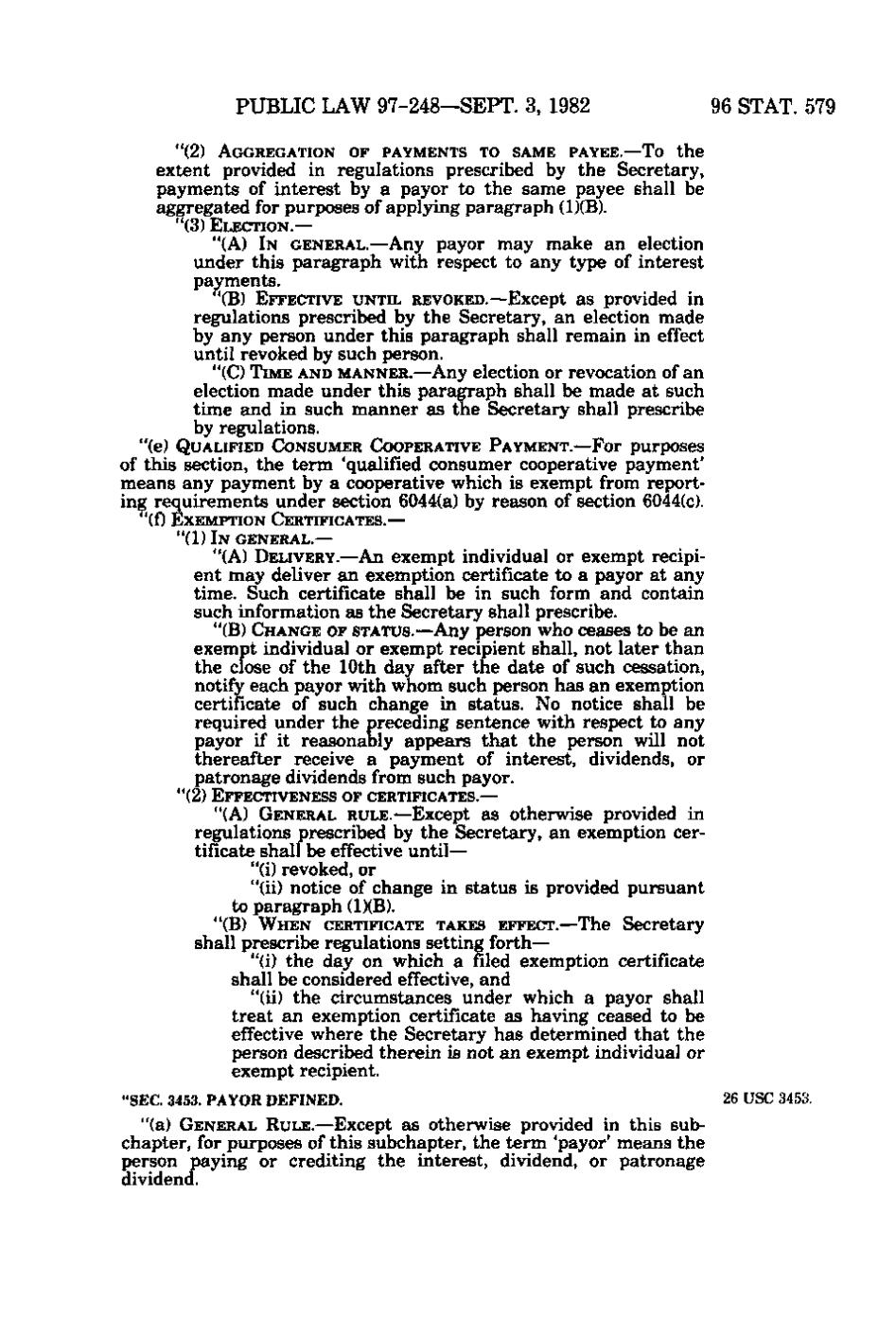

PUBLIC LAW 97-248—SEPT. 3, 1982 "(2) AGGREGATION

96 STAT. 579

O F PAYMENTS TO SAME PAYEE.—To

the

e x t e n t provided in regulations prescribed by the Secretary, payments of interest by a payor to the s a m e payee shall be aggregated for purposes of applying paragraph (1)(B). "(3) ELECTION. —

"(A) IN GENERAL.—Any payor may m a k e a n election under this paragraph with respect to any type of interest payments. '(B) EFFECTIVE U N T I L REVOKED.—Except a s provided

in

regulations prescribed by the Secretary, a n election m a d e by any person under this paragraph shall r e m a i n in effect until revoked by such person. "(C) T I M E AND M A N N E R. — Any election or revocation of a n election m a d e under this paragraph shall be m a d e a t such t i m e and in such m a n n e r a s the Secretary shall prescribe by regulations. "(e) Q U A L I F I E D C O N S U M E R COOPERATIVE P A Y M E N T. — For purposes

of this section, the term 'qualified consumer cooperative payment ' means any payment by a cooperative which is exempt from reporting requirements under section 6044(a) by reason of section 6044(c). "(f) E X E M P T I O N CERTIFICATES.— "(1) IN GENERAL. —

"(A) DELIVERY.—An exempt individual or exempt recipient may deliver a n exemption certificate to a payor a t any time. Such certificate shall be in such form and contain such information as the Secretary shall prescribe. "(B) C H A N G E OF STATUS.—Any person who ceases to b e a n exempt individual or exempt recipient shall, not later than the close of the 10th day after the date of such cessation, notify each payor with whom such person has a n exemption certificate of such change in status. No notice shall be required under the preceding sentence with respect to any payor if it reasonably a p p e a r s that the person will not thereafter receive a payment of interest, dividends, or p a t r o n a g e dividends from such payor. "(2) EFFECTIVENESS OF CERTIFICATES.—

"(A) GENERAL RULE.—Except a s otherwise provided in regulations prescribed by the Secretary, a n exemption certificate shall be effective until— "(i) revoked, or "(ii) notice of change in s t a t u s is provided pursuant to paragraph (1)(B). "(B) W H E N

CERTIFICATE TAKES EFFECT.—The

Secretary

shall prescribe regulations setting forth— "(i) the d a y on which a filed exemption certificate shall be considered effective, and "(ii) the circumstances under which a payor shall t r e a t a n exemption certificate as having ceased to be effective where the Secretary has determined that the person described therein is not a n exempt individual or exempt recipient. "SEC. 3453. PAYOR DEFINED.

"(a) GENERAL RULE.—Except as otherwise provided in this subchapter, for purposes of this subchapter, the term 'payor' means the person paying or crediting the interest, dividend, or patronage dividend.

26 USC 3453.

�