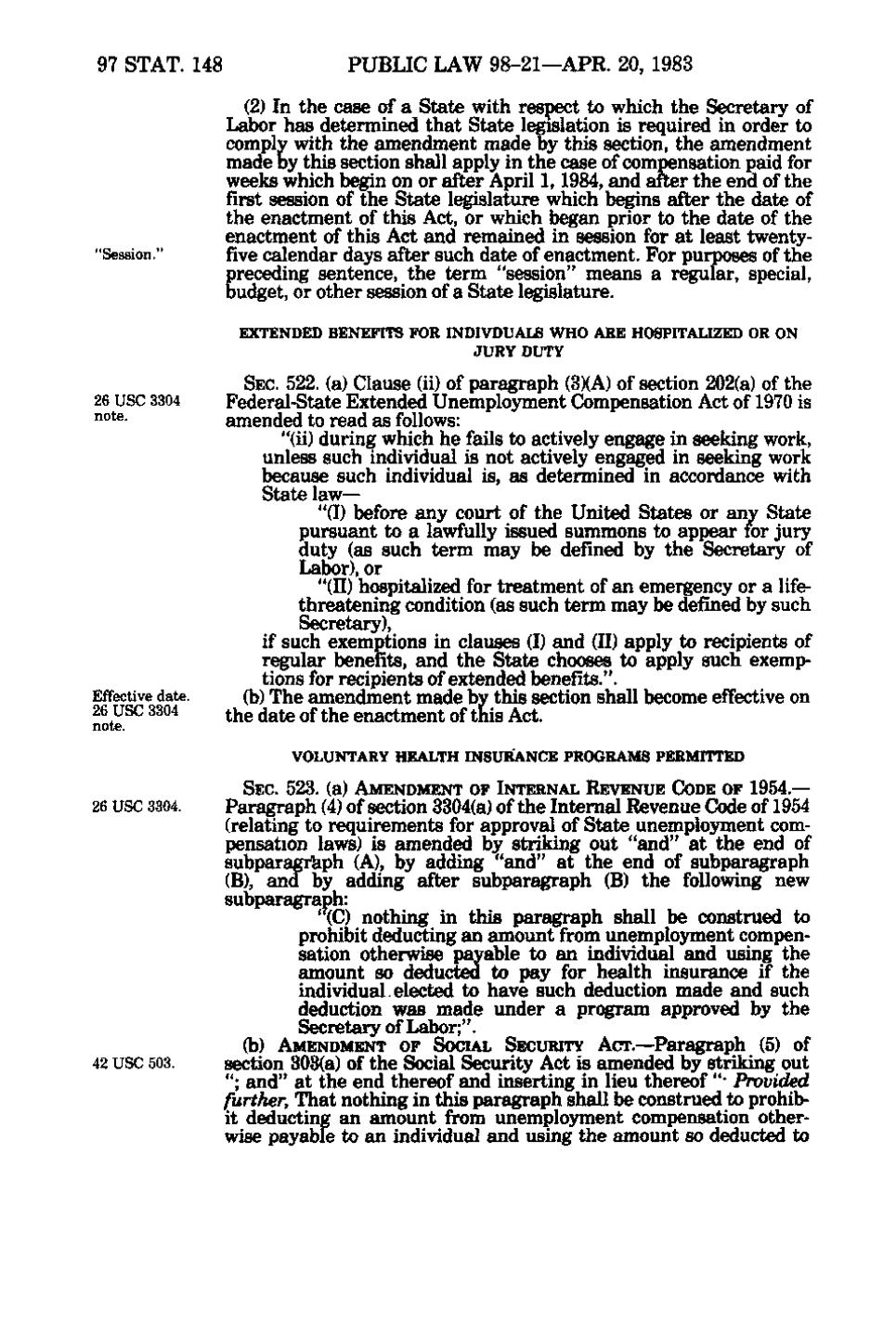

97 STAT. 148 PUBLIC LAW 98-21 —APR. 20, 1983 'Session." (2) In the case of a State with respect to which the Secretary of Labor has determined that State legislation is required in order to comply with the amendment made by this section, the amendment made by this section shall apply in the case of compensation paid for weeks which begin on or after April 1, 1984, and after the end of the first session of the State legislature which begins after the date of the enactment of this Act, or which began prior to the date of the enactment of this Act and remained in session for at least twenty- five calendar days after such date of enactment. For purposes of the preceding sentence, the term "session" means a regular, special, budget, or other session of a State legislature. 26 USC 3304 note. Effective date. 26 USC 3304 note. 26 USC 3304. 42 USC 503. EXTENDED BENEFITS FOR INDIVDUALS WHO ARE HOSPITALIZED OR ON JURY DUTY SEC. 522. (a) Clause (ii) of paragraph (3)(A) of section 202(a) of the Federal-State Extended Unemployment Compensation Act of 1970 is amended to read as follows: "(ii) during which he fails to actively engeige in seeking work, unless such individual is not actively engaged in seeking work because such individual is, as determined in accordance with State law— "(I) before any court of the United States or any State pursuant to a lawfully issued summons to appear for jury duty {as such term may be defined by the Secretary of Labor), or "(II) hospitalized for treatment of an emergency or a life- threatening condition (as such term may be defined by such Secretary), if such exemptions in clauses (I) and (II) apply to recipients of regular benefits, and the State chooses to apply such exemp- tions for recipients of extended benefits.", (b) The amendment made by this section shall become effective on the date of the enactment of this Act. VOLUNTARY HEALTH INSURANCE PROGRAMS PERMITTED SEC. 523. (a) AMENDMENT OF INTERNAL REVENUE CODE OF 1954.— Paragraph (4) of section 3304(a) of the Internal Revenue Code of 1954 (relating to requirements for approval of State unemployment com- pensation laws) is amended by striking out "and" at the end of subparagraph (A), by adding "and" at the end of subparagraph (B), and by adding after subparagraph (B) the following new subparagraph: (C) nothing in this paragraph shall be construed to prohibit deducting an amount from unemplo5ment compen- sation otherwise payable to an individual and using the amount so deducted to pay for health insurance if the individual.elected to have such deduction made and such deduction was made under a program approved by the Secretary of Labor;". (b) AMENDMENT OF SOCIAL SECURITY ACT. —Paragraph (5) of section 303(a) of the Social Security Act is amended by striking out "; and" at the end thereof and inserting in lieu thereof "• Provided further, That nothing in this paragraph shall be construed to prohib- it deducting an amount from unemployment compensation other- wise payable to an individual and using the amount so deducted to

�