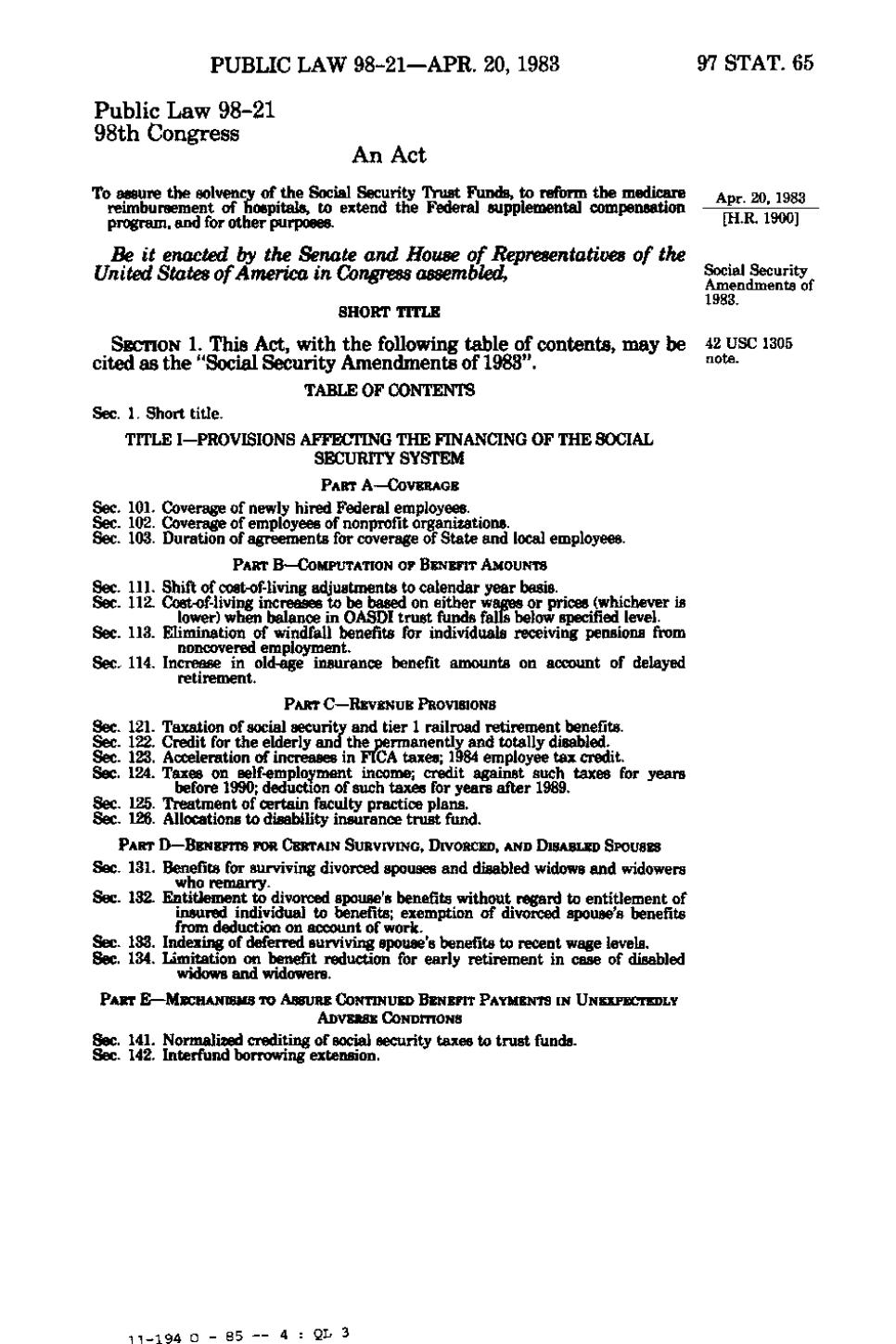

PUBLIC LAW 98-21 —APR. 20, 1983 97 STAT. 65 Public Law 98-21 98th Congress An Act To assure the solvency of the Social Security Trust Funds, to reform the medicare ^pj. 20 1983 reimbursement of hospitals, to extend the Federal supplemental compensation program, and for other purposes. [H.R. 1900] Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled. Social Security Amendments of 1983. SHORT TITLE SECTION 1. This Act, with the following table of contents, may be 42 USC 1305 cited as the "Social Security Amendments of 1983". "o^- TABLE OF CONTENTS Sec. 1. Short title. TITLE I-PROVISIONS AFFECTING THE FINANCING OF THE SOCIAL SECURITY SYSTEM PART A—COVERAGE Sec. 101. Coverage of newly hired Federal employees. Sec. 102. Coverage of employees of nonprofit organizations. Sec. 103. Duration of agreements for coverage of State and local employees. PART B—COMPUTATION OF BENEFIT AMOUNTS Sec. 111. Shift of cost-of-living adjustments to calendar year basis. Sec. 112. Cost-of-living increases to be based on either wages or prices (whichever is lower) when balance in OASDI trust funds falls below specified level. Sec. 113. Elimination of windfall benefits for individuals receiving pensions from noncovered employment. Sec. 114. Increase in old-age insurance benefit amounts on account of delayed retirement. PART C—REVENUE PROVISIONS Sec. 121. Taxation of social security and tier 1 railroad retirement benefits. Sec. 122. Credit for the elderly and the permanently and totally disabled. Sec. 123. Acceleration of increases in FICA taxes; 1984 employee tax credit. Sec. 124. Taxes on self-employment income; credit against such taxes for years before 1990; deduction of such taxes for years after 1989. Sec. 125. Treatment of certain faculty practice plans. Sec. 126. Allocations to disability insurance trust fund. PART D—BENEFITS FOR CERTAIN SURVIVING, DIVORCED, AND DISABLED SPOUSES Sec. 131. Benefits for surviving divorced spouses and disabled widows and widowers who remarry. Sec. 132. Entitlement to divorced spouse's benefits without regard to entitlement of insured individual to benefits; exemption of divorced spouse's benefits from deduction on account of work. Sec. 133. Indexing of deferred surviving spouse's benefits to recent wage levels. Sec. 134. Limitation on benefit reduction for early retirement in case of disabled widows and widowers. PART E—MECHANISMS TO ASSURE CONTINUED BENEFIT PAYMENTS IN UNEXPECTEDLY ADVERSE CONDITIONS Sec. 141. Normalized crediting of social security taxes to trust funds. Sec. 142. Interfund borrowing extension. 11-194O 85—4:QL3

�