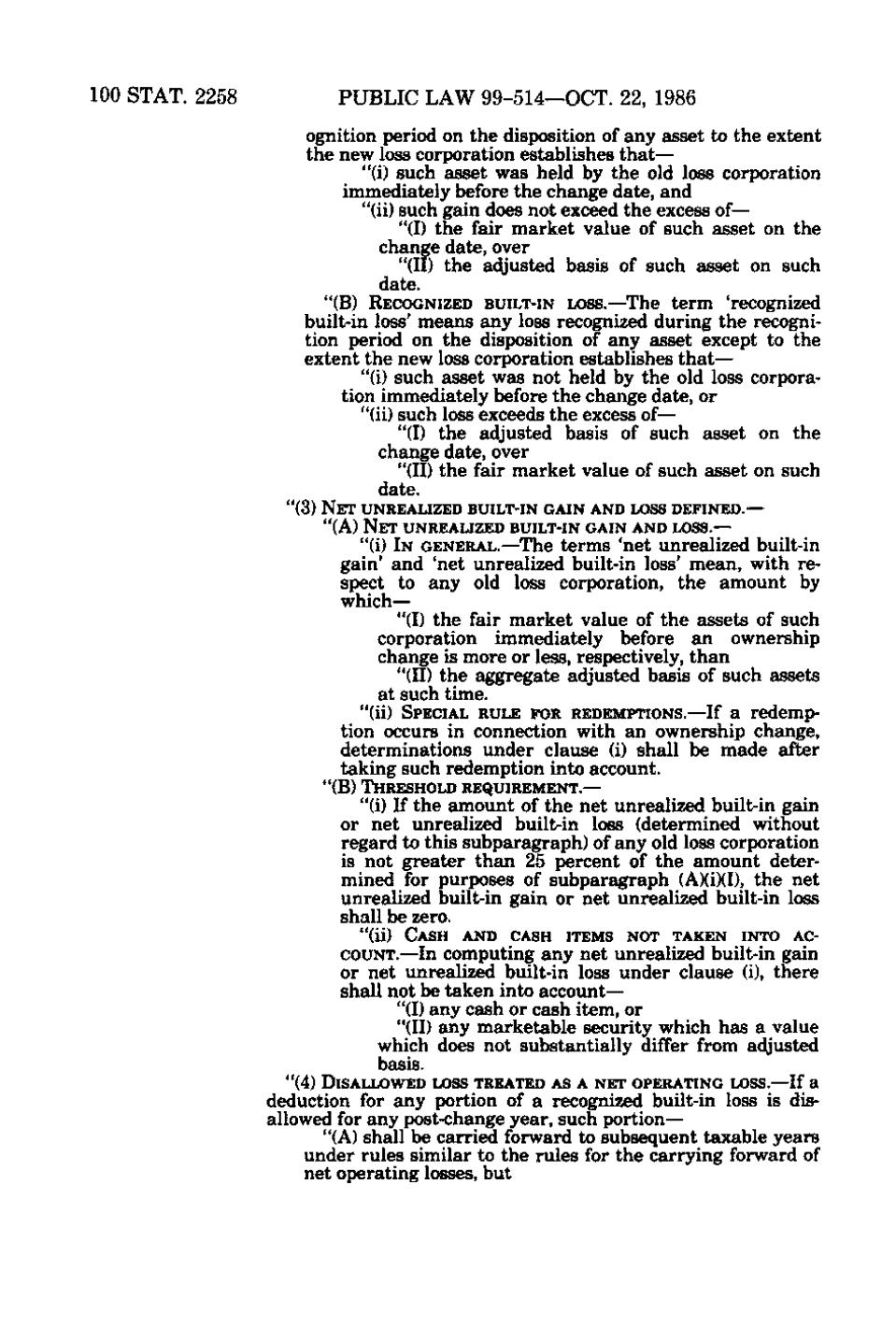

100 STAT. 2258

PUBLIC LAW 99-514—OCT. 22, 1986

-j^'if._

ognition period on the disposition of any asset to the extent JWIIH: the new loss corporation establishes that— "(i) such asset was held by the old loss corporation « immediately before the change date, and "(ii) such gain does not exceed the excess of— "(I) the fair market value of such asset on the change date, over "(II) the adjusted basis of such asset on such date.

- .<o"(B) RECOGNIZED BUILT-IN LOSS.—The term 'recognized

built-in loss' means any loss recognized during the recognition period on the disposition of any asset except to the .,,, extent the new loss corporation establishes that— "(i) such asset was not held by the old loss corporation immediately before the change date, or "(ii) such loss exceeds the excess of— ...;,. "(I) the adjusted basis of such asset on the „ \',, ^ change date, over -. , "(II) the fair market value of such asset on such date. "(3) NET UNREALIZED BUILT-IN GAIN AND LOSS DEFINED.— "(A) NET UNREALIZED BUILT-IN GAIN AND LOSS.—

7

"(i) IN GENERAL.—The terms 'net unrealized built-in gain' and 'net unrealized built-in loss' mean, with respect to any old loss corporation, the amount by which— "(I) the fair market value of the assets of such corporation immediately before an ownership change is more or less, respectively, than "(II) the aggregate adjusted basis of such assets at such time.

5

"(ii^ SPECIAL RULE FOR REDEMPTIONS.—If a redemp-

(<i« p

'^•'•'"•I •• fe

tion occurs in connection with an ownership change, determinations under clause (i) shall be made after taking such redemption into account. "(B) THRESHOLD REQUIREMENT.—

"

bs>ix:^o:; lis? > ,

"(i) If the amount of the net unrealized built-in gain or net unrealized built-in loss (determined without regard to this subparagraph) of any old loss corporation is not greater than 25 percent of the amount determined for purposes of subparagraph (A)(i)(I), the net unrealized built-in gain or net unrealized built-in loss shall be zero. "(ii)

'

ni

•'•

CASH AND CASH ITEMS NOT TAKEN INTO AC-

COUNT.—In computing any net unrealized built-in gain or net unrealized built-in loss under clause (i), there shall not be taken into account— "(I) any cash or cash item, or "(II) any marketable security which has a value which does not substantially differ from adjusted basis.

"(4) DISALLOWED LOSS TREATED AS A NET OPERATING LOSS.—If a

<l-] deduction for any portion of a recognized built-in loss is disallowed for any post-change year, such portion— "(A) shall be carried forward to subsequent taxable years basiii under rules similar to the rules for the carrying forward of

- >3i n'li net operating losses, but,. _

„

- ,:

.

�