PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2497

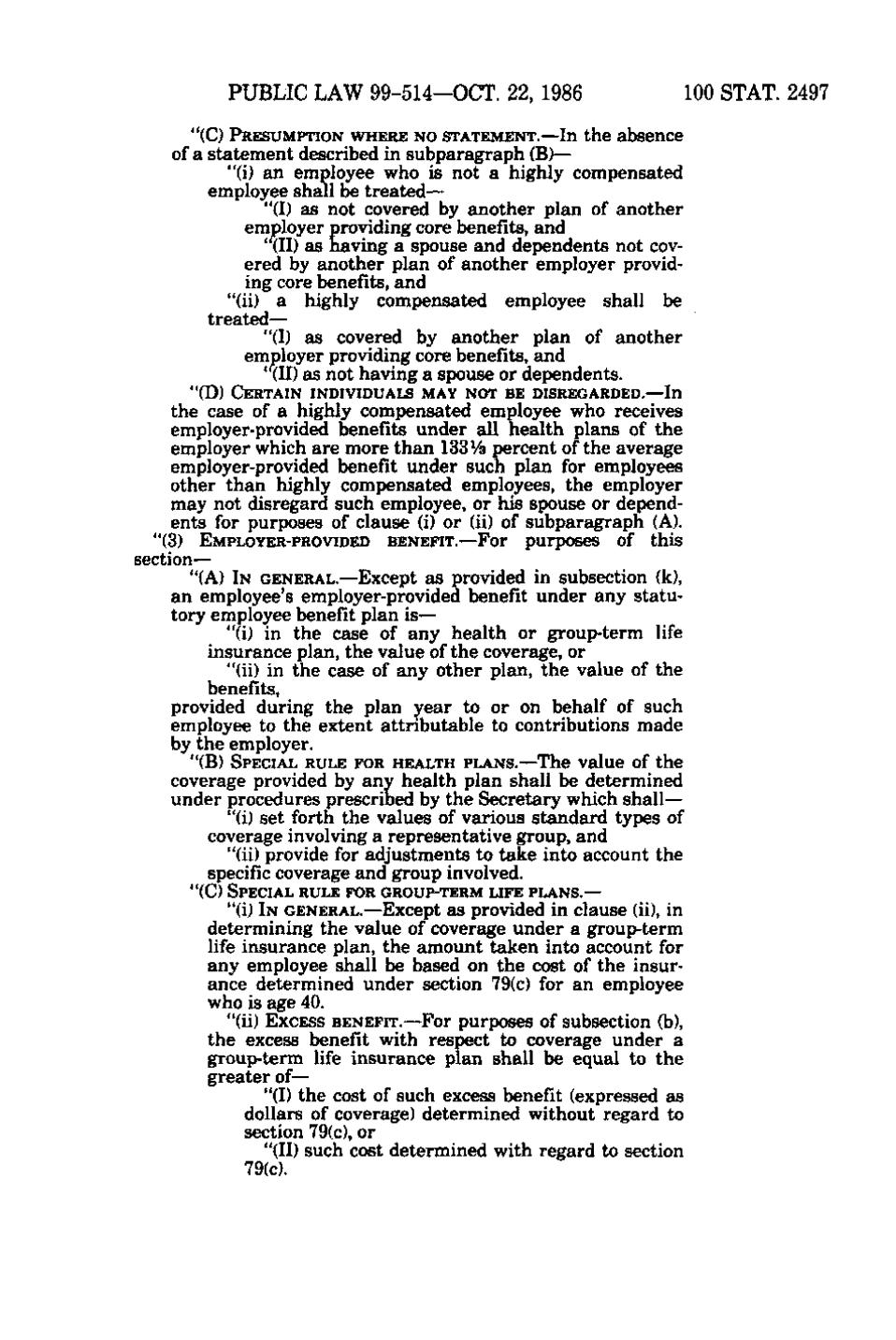

"(C) PRESUMPTION WHERE NO STATEMENT.—In the absence

of a statement described in subparagraph (B)— "(i) an employee who is not a highly compensated employee shall be treated— "(I) as not covered by another plan of another employer providing core benefits, and "(II) as having a spouse and dependents not covered by another plan of another employer providing core benefits, and "(ii) a highly compensated employee shall be treated— "(I) as covered by another plan of another employer providing core benefits, and "(II) as not having a spouse or dependents. "(D) CERTAIN INDIVIDUALS MAY NOT BE DISREGARDED.—In

£

cj >, ff.

the case of a highly compensated employee who receives employer-provided benefits under all health plans of the employer which are more than 133 V percent of the average b employer-provided benefit under such plan for employees other than highly compensated employees, the employer may not disregard such employee, or his spouse or dependents for purposes of clause (i) or (ii) of subparagraph (A). "(3) EMPLOYER-PROVIDED BENEFIT.—For purposes of this section— "(A) IN GENERAL.—Except as provided in subsection (k), an employee's employer-provided benefit under any statutory employee benefit plan is— "(i) in the case of any health or group-term life insurance plan, the value of the coverage, or "(ii) in the case of any other plan, the value of the benefits, provided during the plan year to or on behalf of such employee to the extent attributable to contributions made by the employer. "(B) SPECIAL RULE FOR HEALTH PLANS.—The value of the coverage provided by any health plan shall be determined under procedures prescribed by the Secretary which shall— "(i) set forth the values of various standard types of coverage involving a representative group, and "(ii) provide for adjustments to take into account the specific coverage and group involved. "(C) SPECIAL RULE FOR GROUP-TERM LIFE PLANS.—

"(i) IN GENERAL.—Except as provided in clause (ii), in determining the value of coverage under a group-term life insurance plan, the amount taken into account for any employee shall be based on the cost of the insurance determined under section 79(c) for an employee who is age 40. "(ii) EXCESS BENEFIT.—For purposes of subsection (b), the excess benefit with respect to coverage under a group-term life insurance plan shall be equal to the greater of— "(I) the cost of such excess benefit (expressed as dollars of coverage) determined without regard to section 79(c), or "(II) such cost determined with regard to section 79(c).

�