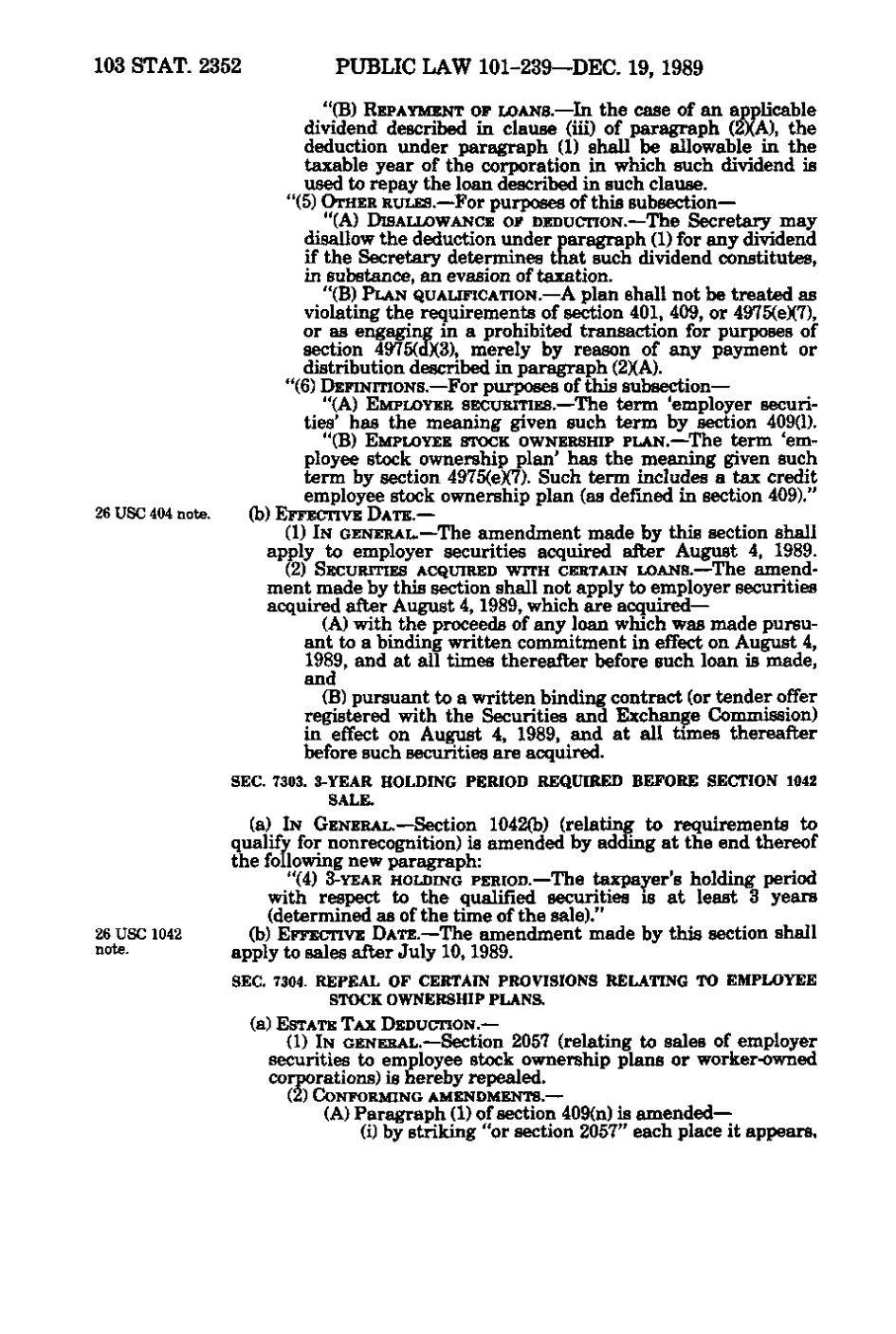

103 STAT. 2352 PUBLIC LAW 101-239—DEC. 19, 1989 "(B) REPAYMENT OF LOANS. —In the case of an applicable dividend described in clause (iii) of paragraph (2)(A), the - deduction under paragraph (1) shall be allowable in the taxable year of the corporation in which such dividend is used to repay the loan described in such clause. "(5) OTHER RULES. —For purposes of this subsection— " (A) DISALLOWANCE OF DEDUCTION. — The Secretary may disallow the deduction under paragraph (1) for any dividend 5. if the Secretary determines that such dividend constitutes, in substance, an evasion of taxation. "(B) PLAN QUALIFICATION. —A plan shall not be treated as violating the requirements of section 401, 409, or 4975(e)(7),

- or as engaging in a prohibited transaction for purposes of

section 4975(d)(3), merely by reason of any payment or distribution described in paragraph (2)(A). "(6) DEFINITIONS.— For purposes of this subsection— "(A) EMPLOYER SECURITIES. —The term 'employer securi- ties' has the meaning given such term by section 409(1). "(B) EMPLOYEE STOCK OWNERSHIP PLAN.—The term 'em- ployee stock ownership plan' has the meaning given such term by section 4975(e)(7). Such term includes a tax credit employee stock ownership plan (as defined in section 409)." 26 USC 404 note. (b) EFFECTIVE DATE.— (1) IN GENERAL.— The amendment made by this section shall apply to employer securities acquired after August 4, 1989. (2) SECURITIES ACQUIRED WITH CERTAIN LOANS.—The amend- ment made by this section shall not apply to employer securities acquired after August 4, 1989, which are acquired— (A) with the proceeds of any loan which was made pursu- ant to a binding written commitment in effect on August 4, 1989, and at all times thereafter before such loan is made, and (B) pursuant to a written binding contract (or tender offer registered with the Securities and Exchange Commission) ' in effect on August 4, 1989, and at all times thereafter before such securities are acquired. SEC. 7303. 3-YEAR HOLDING PERIOD REQUIRED BEFORE SECTION 1042 SALE. (a) IN GENERAL. — Section 1042(b) (relating to requirements to qualify for nonrecognition) is amended by adding at the end thereof the following new paragraph: "(4) 3-YEAR HOLDING PERIOD.—The taxpayer's holding period with respect to the qualified securities is at least 3 years (determined as of the time of the sale)." 26 USC 1042 (b) EFFECTIVE DATE. —The amendment made by this section shall note. apply to sales after July 10, 1989. SEC. 7304. REPEAL OF CERTAIN PROVISIONS RELATING TO EMPLOYEE STOCK OWNERSHIP PLANS. (a) ESTATE TAX DEDUCTION. — (1) IN GENERAL.—Section 2057 (relating to sales of employer securities to employee stock ownership plans or worker-owned corporations) is hereby repealed. (2) CONFORMING AMENDMENTS. — (A) Paragraph (1) of section 409(n) is amended— (i) by striking "or section 2057" each place it appears.

�