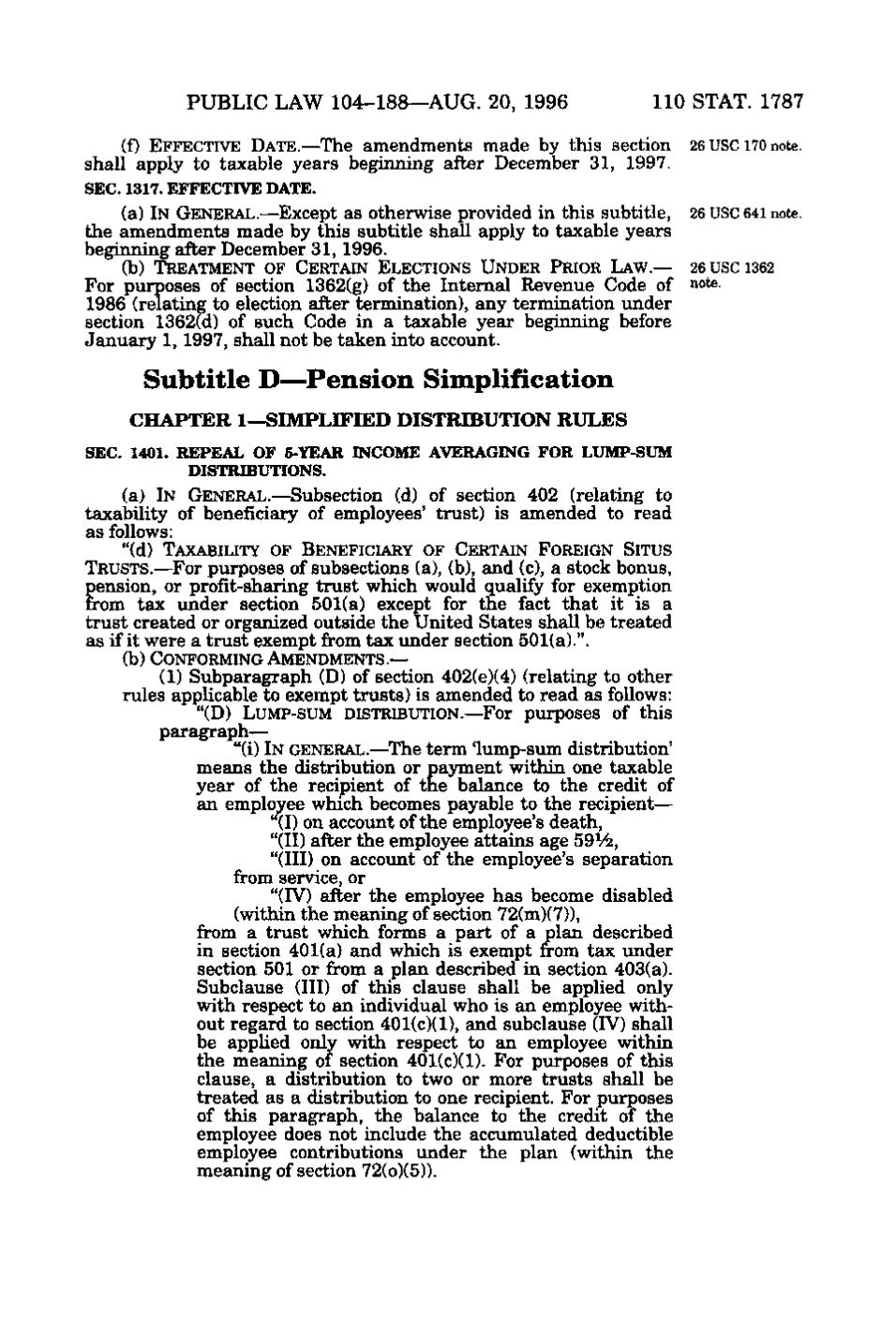

PUBLIC LAW 104-188—AUG. 20, 1996 110 STAT. 1787 (f) EFFECTIVE DATE.— The amendments made by this section 26 USC 170 note. shall apply to taxable years beginning after December 31, 1997. SEC. 1317. EFFECTIVE DATE. (a) IN GENERAL.—Except as otherwise provided in this subtitle, 26 USC 641 note. the amendments made by this subtitle shall apply to taxable years beginning after December 31, 1996. (b) TREATMENT OF CERTAIN ELECTIONS UNDER PRIOR LAW.— 26 USC i362 For purposes of section 1362(g) of the Internal Revenue Code of note. 1986 (relating to election after termination), any termination under section 1362(d) of such Code in a taxable year beginning before January 1, 1997, shall not be taken into account. Subtitle D—Pension Simplification CHAPTER 1—SIMPLIFIED DISTRIBUTION RULES SEC. 1401. REPEAL OF 5-YEAR INCOME AVERAGING FOR LUMP-SUM DISTRIBUTIONS. (a) IN GENERAL.— Subsection (d) of section 402 (relating to taxability of beneficiary of employees' trust) is amended to read as follows: "(d) TAXABILITY OF BENEFICIARY OF CERTAIN FOREIGN SITUS TRUSTS. — For purposes of subsections (a), (b), and (c), a stock bonus, pension, or profit-sharing trust which would qualify for exemption from tax under section 501(a) except for the fact that it is a trust created or organized outside the United States shall be treated as if it were a trust exempt from tax under section 501(a).". (b) CONFORMING AMENDMENTS. — (1) Subparagraph (D) of section 402(e)(4) (relating to other rules applicable to exempt trusts) is amended to read as follows: "(D) LUMP-SUM DISTRIBUTION.—For purposes of this paragraph— "(i) IN GENERAL.— The term lump-sum distribution' means the distribution or payment within one taxable year of the recipient of the balance to the credit of an employee which becomes payable to the recipient— "(I) on account of the employee's death, "(II) after the employee attains age 59V2, "(III) on account of the employee's separation from service, or "(IV) after the employee has become disabled (within the meaning of section 72(m)(7)), from a trust which forms a part of a plan described in section 401(a) and which is exempt from tax under section 501 or from a plan described in section 403(a). Subclause (III) of this clause shall be applied only with respect to an individual who is an employee without regard to section 401(c)(1), and subclause (IV) shall be applied only with respect to an employee within the meaning of section 401(c)(1). For purposes of this clause, a distribution to two or more trusts shall be treated as a distribution to one recipient. For purposes of this paragraph, the balance to the credit of the employee does not include the accumulated deductible employee contributions under the plan (within the meaning of section 72(o)(5)).

�