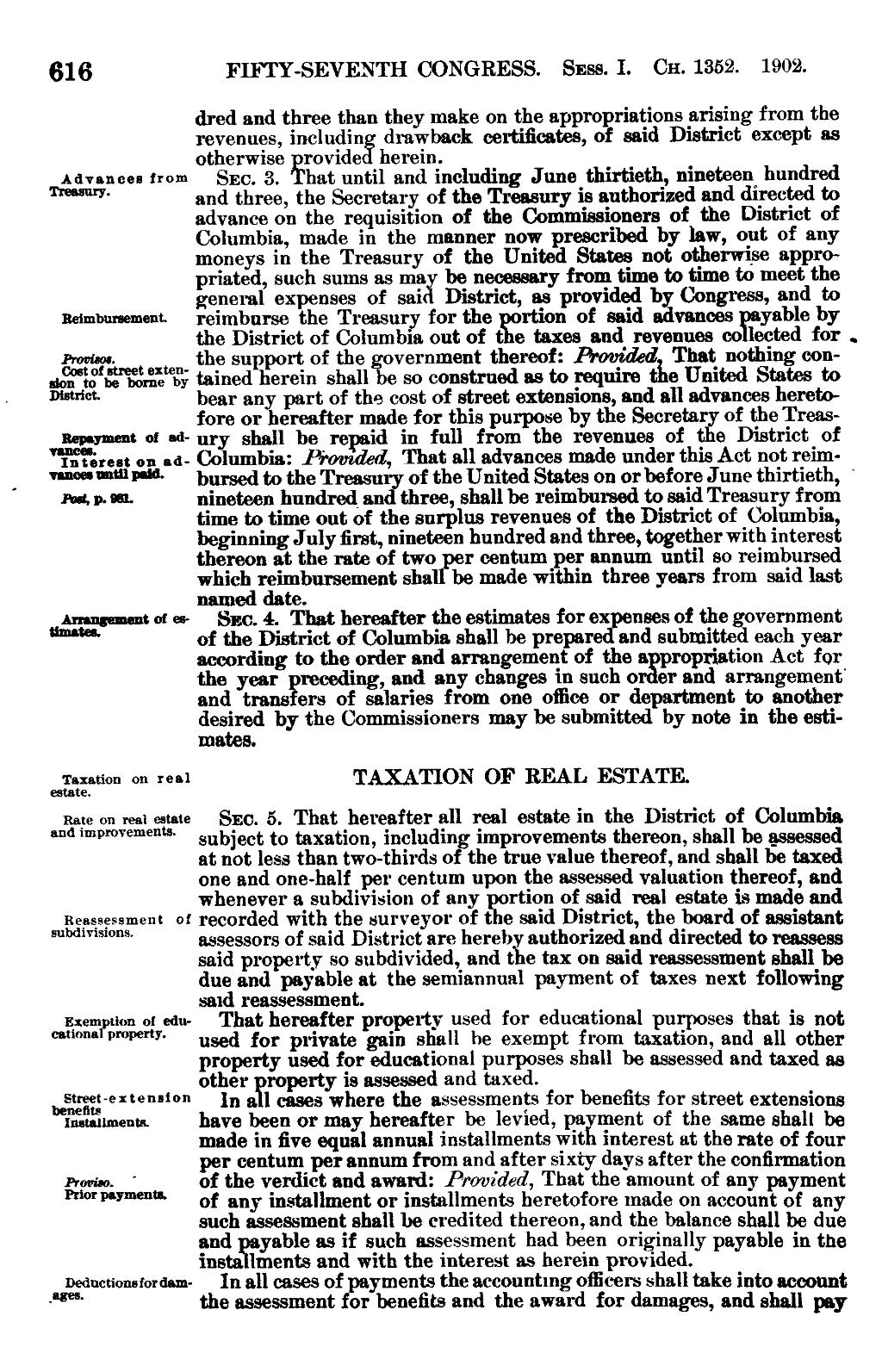

616 FIFTY-SEVENTH CONGRESS. Sess. I. Ch. 1352. 1902. dred and three than they make on the appropriations arising from the revenues, including drawback certificates, of said District except as otherwise provide herein. Advsucen from Sec. 3. hat until and including June thirtieth, nineteen hundred mm"' and three, the Secretary of the Treasury is authorized and directed to advance on the requisition of the Commissioners of the District of Columbia, made in the manner now prescribed by law, out of any moneys in the Treasury of the United States not otherwise appropriated, such sums as may be necessary from time to time to meet the general expenses of said District, as provided by Congress, and to Reimbunemem reimburse the Treasury for the r·tion of said advances payable by the District of Columbia out of gh: taxes and revenues co lected for , P~v¢•}»•· t w the support of the government thereof: Provided That nothing connoilixiri r;'é’°§.,.‘i.’f. 5*,7 tained herein shall be so construed as to require the United States to » D*’”"°‘· bear any part of the cost of street extensions, and all advances heretofore or hereafter made for this purpose by the Secretary of the Treas- R¢i¤•y¤•=¤¢ M Mi- ury shall be repaid in full from the revenues of the District of winriiiéresr on an- Columbia: Piomded, That all advances made under this Act not reim- _ ""°°'“““"‘”· bursed to the Treasury of the United States on or before June thirtieth, ° rw. v- vm- nineteen hundred and three, shall be reimbursed to said Treasury from time to time out of the surplus revenues of the District of Columbia, beginning July first, nineteen hundred and three, together with interest thereon at the rate of two lper centum per annum until so reimbursed which reimbursement shal be made within three years from said last named date. uglnmzmnr of es- Sec. 4. That hereafter the estimates for expenses of the government i"' of the District of Columbia shall be prepared and submitted each year according to the order and arrangement of the {appropriation Act for the year preceding, and any changes in such o er and arrangement and transfers of salaries from one office or department to another desired by the Commissioners may be submitted by note in the estimates. esgiericu vu rv! TAXATION OF REAL ESTATE. Rate on real eswe Sec. 5. That hereafter all real estate in the District of Columbia ‘“° "“"'°"°m°"°°’ subject to taxation, including improvements thereon, shall be assessed at not less than two-thirds of the true value thereof, and shall be taxed one and one-half per centum upon the assessed valuation thereof, and whenever a subdivision: of any pprtion of said real estate is made and Reassessment of recorded with the surveyor of the said District, the board of assistant ”“b°l"m°"”‘ assessors of said District are hereby authorized and directed to reassess said property so subdivided, and the tax on said reassessment shall be due and payable at the semiannual payment of taxes next following said reassessment. sxemipeion or edu- That hereafter property used for educational purposes that is not °"""““ *""*’°""‘ used for private gain shall be exempt from taxation, and all other property used for educational purposes shall be assessed and taxed as other property is assessed and taxed. m§§;·¤¤*¤¤¤*°¤ In a l cases where the assessments for benefits for street extensions xmnrmems have been or may hereafter be levied, payment of the same shall be made in five equal annual installments wit interest at the rate of four per centum per annum from and after sixty days after the confirmation hmm.of the verdict and award: Provided, That the amount of any payment P"°' ""“°”“‘ of any installment or installments heretofore made on account of any such assessment shall be credited thereon, and the balance shall be due and payable as if such assessment had been originally payable in the instalments and with the interest as herein provided. Deductions for um- In all cases of payments the accounting officers shall take into account —"°°‘ the assessment for benefits and the award for damages, and shall pay

Page:United States Statutes at Large Volume 32 Part 1.djvu/682

This page needs to be proofread.