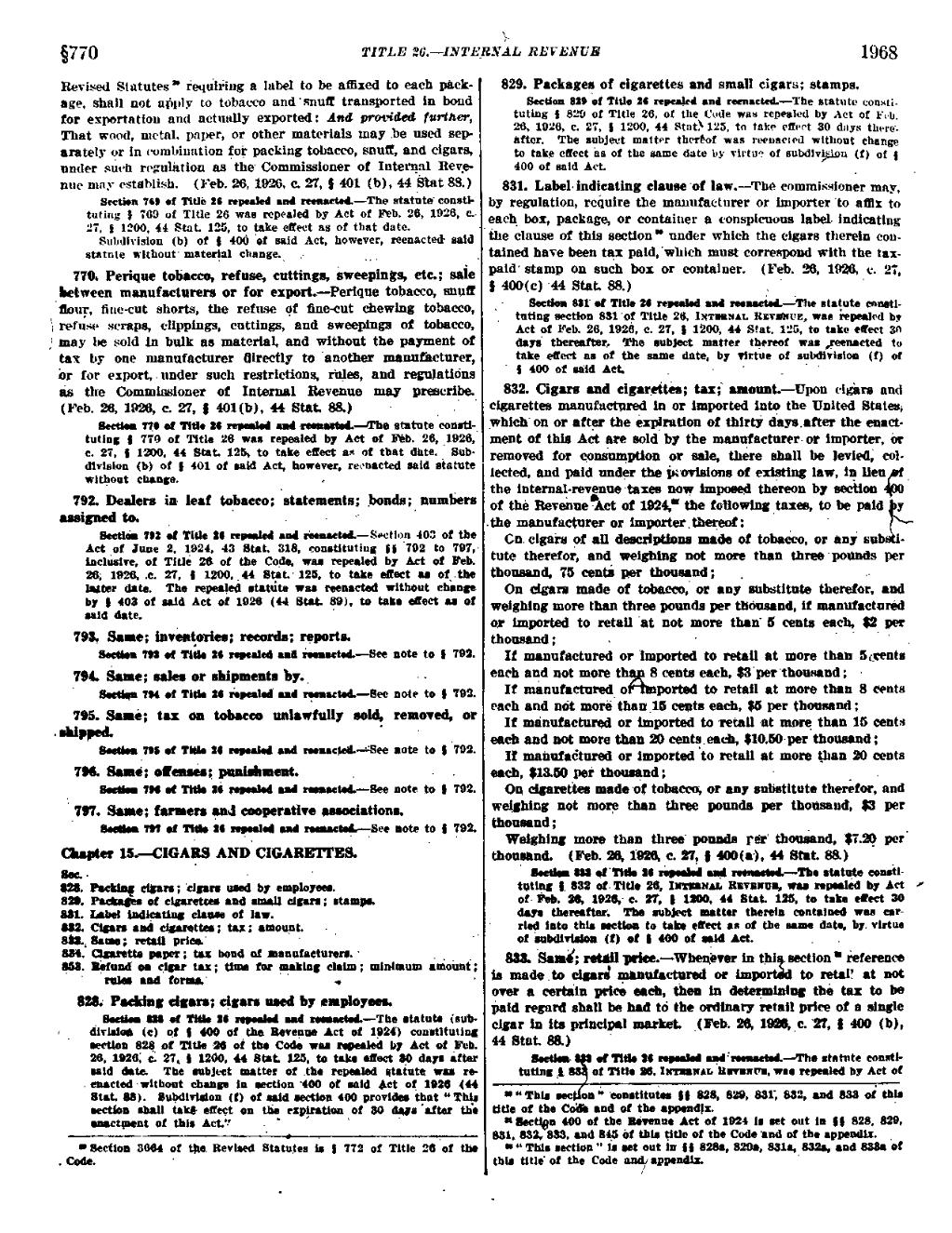

.§770 TITLE .°36.————INTl Revised Stututes" éeqtiiéiug a label to be afiixcd to each packago, shall not apply to tobacco and ‘snuiI.t1*ausp0rted in bond for exportation and actually exported: And provided further, That wood, metal. paper, or otbof materials may be used separately or in vomlpiuatiou tot packing tobacco, s1ii1E, and cigars, under such rogulatiooas the Commissioner of Intcrq;11 Rev_e- ·rmc~ nm}: establish. (Feb. 26, 1926, c. N, 5 401 (b), 44 Stat 88.) Section 769 •f Title 26 regbealed and r¢·c¤•ct¢d.——The statute` constiturmgt 769 of Title 26 was repealed by Act or Feb. 26, 1926, c.- 27, § 1200, 44 Stat. 125, to take effect as of that date. . Subdivision (b) of Q 400 of said Act, however, reenacted said V statute without material change, _- ‘ · 770. Périque tobacco, refuse, cuttings, Swecpiugs, ·ctc.; sale ·_bctwecn manufacturers or_fo17 export.--Perique tobacco, auutt doug-, tiuo—cut shorts, the refuse of finc-cot chewing tobacco, Erefatxse scraps, c1ippit1gs,_; cuttings, and sweepiugs of tobacco, } may be sold-, in bulk as motorialg and without tho payment of tax by, one manufacturer fiirectly to another manufacturer, br fmt export, Qunder such restrictions, tixles, and regulations is the Commissioner of Internal Revenue may ·prescribe. (Feb. 26, 1926, c. 27; { 4010)),,44 Stat. 88.) · -_ _ I · Saw Tia of Title 26 "repasled and-nonacud.-Jfhé statute constitutiog { 779 ot Title 26 was repealed by Act ot- Feb. 26,1926, c. 27, { IEO, 44 Smt. 125, to tnkebctoct as of that dhte.; Subdivisioo (by of Q 401 ot said Act, however, reenacted said statute without chaogo. · -, ‘ 792. Dealers in- leaf tobacco ; statements; bonds; numbers 8c1:§<i¤ 792 •f·'1°it1o 26 nvaled and roonn¢t•<§.——S••cti0_n 403 of the Act or Juno 2; 1924, 43 —_8tat. 318, ooustitutiug H 792 to 797, inclusive, of Title 26 of the Coda, was repealed by Act of `_Feb. 26; 1926; .c. 27. S 1200, _44 Btgt.‘125, to take eltoct as ot_.tho latmr date. The repealed statute was reenacted without changeby { 403 ot said Act ot 1926 (44 Stat. 89), to tan otoct as ot com date., _ v I ' I 793, Same: invontories; records; reports. Section *»'t8`•e!Y'1‘it}•oz8 Nvuind soil n*e•¤•et•d.-»-See note to { 792. 794. Same; sales or shipmeiats `by._ ‘ l · - · I TN •f fith 28 iapcald nd romnctod.-·-Soc note to { 792. 795. Santo; tu on tobacco unlswfulli Bold, removed, or sauna 795 •! Title ZG nvenlol and r••n•¤te&l.—-¥Soo noto to 792. 7%. Suse; gdmsés; punimmont. ‘ _ .` . l 1*8 of 'Nth Si npedod wd r••n•ctod.·—-Seo note to l 792.

797Q Same; farmers god cooperative associations. __

Sacha 797 o! ’l1d• Zttngoslod and` maenaotg.-7See nom to I 192. Wwe ns.-crows Ama c1GAm·:·1*r Es. a 8%. ciknn; xzigum used by employees. t SM. ot cigarettes md small cigars; stamp; 831. Label imliontlog clause of law. 882. Cigars nad cignrottea: tu: amount. - _ — 838.;3n1m; price! ` _ SM. Qguotto paper; tax bond ox mauu£acturors.‘·· _ _ _ _ $$3. Eoiuud u ein: tax; time for poking claim; minimum gmount; ' mm and forma; . ” to _· ’ 8%.- *P•&¤g dgari; cigars aged by employees. _ · _ SM of Tith 26 ivpedd n¤d1•na:t•d.——Tho statute (sub-

diwistoia io) oi { 409 of the Rovoom Act ot 1924`Y constituting

section $23Mot Two —26 ot the Codo was rwcnled by Act ct _F¤b. 28, 1926, 4:. 27,_ i 1200, 44 mt. 125, to tum oaoct 89 dan sito: said data. The gubjoct matte: ot tho repealed otntuto www ro enacted without change in section *400 of maid Act ol! 1926 (44 Stat. H). Butpoivision (t) of sud section 400 providoa that “Tots section shalt tok! moot on the expgratton of 30 dns gotta: the ooactmeot ot this Act.? . F _- ‘ ••Soot1o¤ 3664 ot tho. Revised. Statutes is S 772 or Title 26 ot tm . _Code._ * ‘ ’ _ .

QRNAL REVENUE 1968 ` 829. Packages of cigarettes and small cigars; stamps. Section 829 of Title 26 repealed and reenacted.-·—'1‘he statute consti; tuting § 829 of Title 26, of the Code was repealed by Act of Feb, 26, 1926, c. 27, { 1209, 44 Smt}125, tg take. cfiwt 30 days there- ‘ after. The stxbjcct matter theréof was recn-acted without change F to take eicct as oi the same date by virtue ot subdivgieu (I) of § . 400 of said Act. · _ ° . L » 831. Labelindiceting clause of law.¢—Tbe commissioner may, by regulation,"rc€;uire the mamnfacmrcr or importer to um: to t each box, package, or container a conspicuous label-jndimting ‘ the clause of this section" uhdcr which the cigars therein een- _ tained havebeen tv.: paid,'which must correspond with the taxpaid stamp on such box or container. L (Feb. 26,19%. 4;. 27,

- § 400(c) :44 Stat. 88.) `. e '

_ — Secticu 88{ of Title'26 repealed statute muti- __ · tqtingeectieu 831`pf Title 26, Iwrnaxn. Rzvmwe, was repealed by _ Act of Feb. 26, .1926, e. —27, { 1200, 44 Stat. 1::5, tp take eseet an days thereafter. The subject matter thereof was ,reeuacted to take effect us of the seme date, by virtue of sntbdieieton (f) ot ‘§400¤:\»¤idAct. _ __ . ~. 832. Cigars and cigarettes; tax { amcwt.-eUpon cighrs; and ` cigarettes manufactured in or imported inte the United States, p which` on or utter the expiration of thirty daysgfter the enact- ° ment of this Act are sold by the mam;fecturcr· or importer, br removed for consixmption or sale, there shall be levied,} coll lected, and paid under the °p:*0visions of existing law, hg lieu _ the internat—rev;2bt1ue·taxes new imposed thereon by section ’ `ot the Revenue Act qt 1924,* the tetlowing taxes, to be. paid d y the manufacturer or impqrtergthexject : d _ bb tc Ch. cigars pt all descriptions made ot tobacco, or ani stx i- ` tute therefor, and weighing ~n0f.mcre_ than threepotmds per . thousand, 75 centi per thousand; _ ‘ _ p .. ~ Oh cigars made of tobacco, dr any substitute therefor, and weighting mere than three pounds per thousand, it manufactured or `imported to retail 'at not m0re‘tha¤‘ 5 cents each.? PPT thousand; · · · It manufactured or imported to retail at more than 5;3:€·nts each and not more th 8 cents each, $3`per‘tb0umud ;‘ · If manufactured ogmported to retail at more than S cents _ each and mit more th¤¤_15‘ cents each, $5 per thousand; It manufactured, or imported to retail at more than 15 cents _ each and not more than 20 ceutgeaw, $10.50-per thousand; It matmtaétured or imported to retail et more than 20 cents each. $1&¤0·-per ttmusgzidt. e ~ _ . _ O!1 dsarettes made ·0¢‘t0bacc0, or any substitute therefor, and weighing not more than - three tpcuhds per thetm nd. $ wr

thousand; · p _ ‘

L ‘ Weighing more than three pounds ret thoumud, $229 per` thousand. (Feb. 26, 1926, c. 27, { ,400(n·), 44 Stat. 88.) _ •!`Tttl• it repaid reen•et•d.———-—’1‘he statute constituttpg {S32 otilfitle 26, Inrnxn. Revnmm, srerrepuled by Act ··* ot- Feb. M, 1926,1. 27, { 1290, 44 Stat. 125, te take esect 30 due thereafter; The subject matter therein contained wes cnr- ‘ rted into this section to take effect as et the same date. by. virtue ° p otanubdivmcn (t) at I 400‘¤t Act. ‘ _ . . _ 888. Snug; retiil price.-——#Whe¤@ver in thi section " reference ' is made .t0_cigars° gnnufsctuxed or —imp0rt& tb retai? at not over a certem price each, then in determining the tax to be paid regard shall be had to the ordinary retail price ot a single L cigar in its principal market. _(Feb. 26, 1w8,_c. 27, Q 400_ (b), _ 44 Stat. 88.) ’ · J F Seetkn- •f‘l'it1•‘8¢ reputed •ed‘°r•en•¢t•d.-—-The statute consti- - tutingei. ct Title 26, Iwrnnxn Rnpnvn, vu repealed by Act ef

- ¤• *• Thii cen muatltutes §| 828, 8%, 831} 882, 833 of thts

» title ot the.C¤i1% and et the nppendgx. , ¤ Sectign 406 et theixevemie Aet et 1924 An set out in || 828, 829. ·— $31. 832, 833, and 8·t5.e! thu title of the Cedennd of the appendix. _ » ¤ “This section " in net out in M 828a, 82%, 831a, 832a, And HSA of this title ot the Code N14)! appendix. `