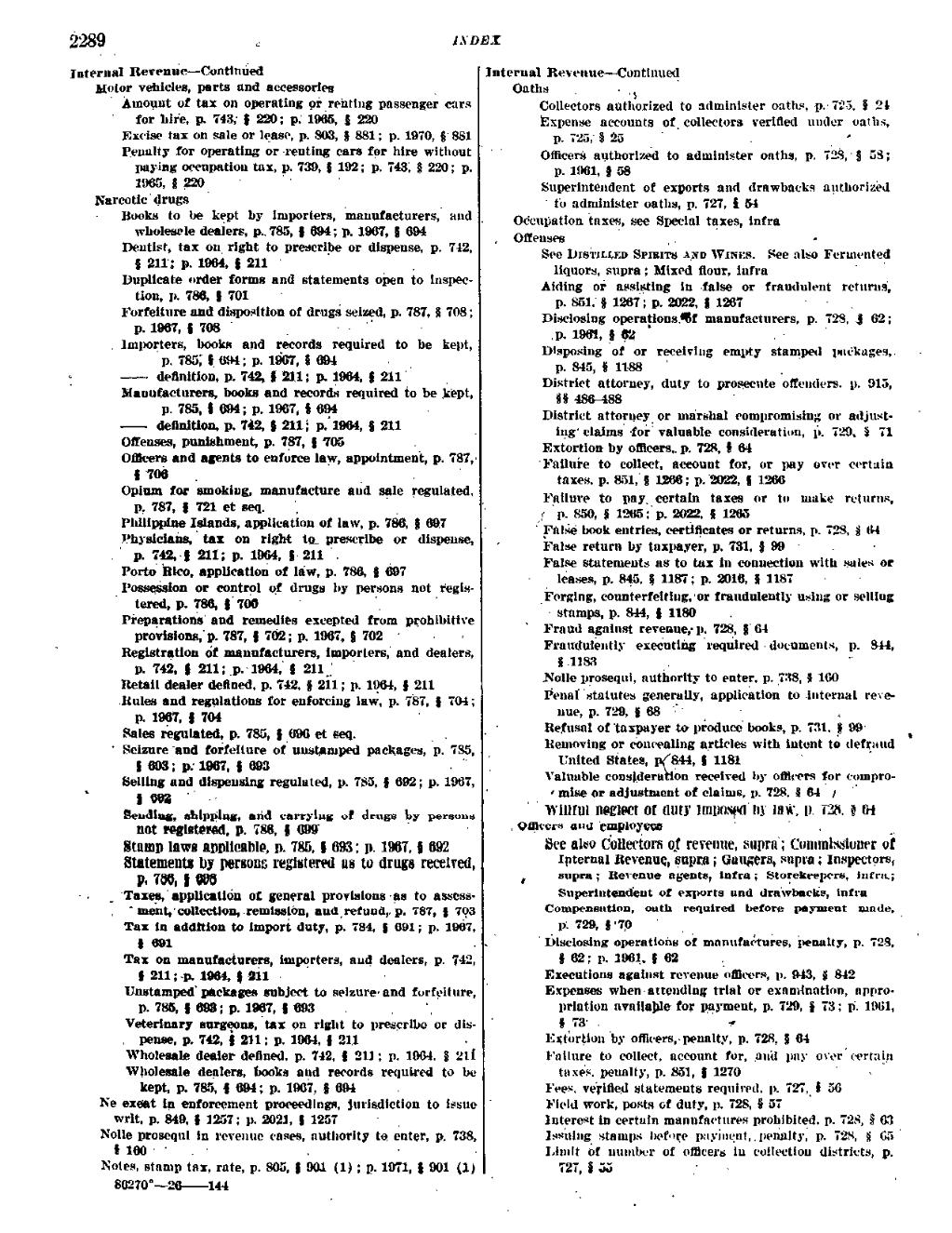

2289 e lx; Interim] Revemie——-Continued . _ Q ' Vmotor s?el1ieles,,parts and accessories · \ ’ ` hxnonnt of tax on operating ,»i·,»·enm,g passenger carsf ‘ Q for hire, p. 743; § 220; p.‘ 1965,-§ 220 _ Excise tax on sale or lease, ‘p. 803,·—§ 881 ;_ p. 1970, §‘ 881 Penalty for operating or renting cars for hire without ` pay-ing oecapationl tax, p. 739, § 192; p. 743, § 220 ·; p. 1965,§.229 ‘ I ` Nareotie'd rngs. I d l _ - ·— Books to be kept by importers, manufacturers,. and , wholesale dealers, p..785, § @4; p. 1967, §` 694 . _ — Dentist, tax on, right to prescribe or dispense, p. `7-12, ` §211`.;”B· 1%4»`§ 211 Z _ . Duplicate order forms and statements open to inspection, p. 786, § 701 - ‘ · - _ Forfeiture and disposition of drugs seized, pd. 787, § 708; p.`1967,§708' `. ·· - " ·, _ i . la1porters,‘books and records required to be ‘ kept, ` p.785I§_6$l4;p.1967,§@4- - ·_ ( —~; -—-— definition, p, 742,7 211; p. 1964, § 211`_ _ _ ` Manufacturers, books and records required to be kept, ‘ p. 785, 5 694; p. 1967, § 664 ·~ -4--- definition, p.·742, § 211i ip. 1964, § 211 _ Offeases, punishment, p. 787, § 705 · ,d ~ _ ( O@cers and agents to enforce layv, appointment, p. 787, -§‘706 _ - ‘ ‘_ y _“ Opium for smoking., manufacture and sale regulated, ~ p, 787, §” 721 etseq. Q · ,_ _ _ Philippine Islands, application of law, p. 786, _§ 697 Physlclaas,` tax on right io, prescribe S or dispense,

742,·§ 211; p. 1964, §·`211 i. _

Porto, Rico, application of law, p. 786, § 697 ` _I’ossession. or control of drugs by persons not regis-, ` tered,°9·'788, 5.709 `~ 7 ra at 3 Preparations and remedies {excepted from prohibitive provisions,`p. 787, § 702; p. 1967, § 702 ,· —_ " ·

Registration of mannfacttu·ers,`i;1aporlers,' and dealers,

p.: 742,} 211; p.··1964,·§ 211; . ° Retailddealer dedned. p._74 2, § 211;,p. 1961, § 211 __ .Rt1l%and regulations `forenforciizg law, p. 787; § 704; —p.1967,·§704`- ·. . e ° v Sales regulated, p. 785, ,§ 696 et seq. . _ . ‘ Seizure and forfeiture of uustamped packages, p. 785, t ·§.693§P•'1967»"§ 693 " ’ 9 - Sellingd_aad.di_spensLng regulated, p. 785, § 692; p..1967, A and C¥§.1'1‘}’1l»1.$ of <11.'\\g$ 1Jy -p€lL‘S01.1=s A not registered, p. 786, 5 we 1 · Stamplawa analleable, p. 785, Q 093; p. 1967, § 692 ' Statements by persona registered us to drugs rcccivetl, p,_766,§W8_ ,· *_ ( ; 5 · __ Taxes, application ot general — provisions as to assess- . "Qtaent,·oo1lectioa, remisaiim, audgrefund,. p. 787, 3 793 Tax in addition to import duty, p. 784, § 691;=p. 1967, 5 @1. _ s _ ‘ . Tai on xaannfaetarers, i·mporters,!and dealers, p. 742, d §211;’~p;1964,§211 -‘ 1- v »· U¤stamped`,paekages subject to seizure- and forfeiture, p.78§,§6%; p,1®7,§693 . , ~ _— Veterinary surgeons, ’ tax on rights to prescribe or disl- . Daum, p. 742,.9 211; 1%-1, § 21,1 . . . · _ Wholesale dealer deaaed, ‘p. 742, § 211; p. _§.211 Wlsolemle , dealers, books and records retpxired to be ~ kept, p. 785, ·§ 694:ip. 1967, ·§ 694 _. _ _ Ne exeatln enforcement proceedings, jurisdiction to issue writ, @849, § 1257 ; p.- 2621, $1267 ‘ · , N?le prosequl in revenue eases, authority to enter, p. 738, `Noles, stamp lax, rate,`p. 805, .§ (1) ; p. 1971, § 901 (1) 86270°—~·26e——-#-144 : » ‘

LEX Internal R€V€ll\l€r··CODtlIlll€(l Oaths _ , ,5. - , , i “Collectors rautho.rized·to stlmlalster oaths, p.- 725, $124 Expense accounts of, collectors verided under oaths, r "p.725;§25` . , .4 · _ ’ . ' I Officers authorized to administer oaths, p. "72§,·§ 5S;. {1.,1961, §58_ _ ‘ A _ Stlperinteudent of exports and drawbacks authorized ‘ to administer oaths, p. 727, S 54; - Occupation taxes, see Special taxes, infra _, Oifeuses ·‘_ v_ Q 1 " ·¤ A ·See DlS;l‘ILLED. Srmrrs Asn Wtrtrrs: See also Fermeated _ liquors, supra; Mixed flour, infra ° V _ ` i Aiding· or assisting ia false or frat1dsleot returns, “ p. S51,`§_1267; p.'2922,§1267,, r ·· _ ’ .) _Disclosing opera§ioas.$f manufacturers, p. CIQS, ,§ 62; t ,p.1961,§,§2 · _. · ‘ . Disposillg of or receiving empty starrlped packages, g lp. S45, 51188 J Q _ , _ ‘ District attorney, duty to prosecute offeaders, pl. 915, . V§§"5t86=488 ° A ·` ·‘ , , ~ · District attorney or IIlH1'SIl&l_€0II}}lli(}I}11:iiIl§W;l org adjust- ` il}g'(!l£l,iI11S- ·for` valuable consi<let·atit>n,` fl. TN,} .'i’1’ -Extortlou· by omcersj. p.`7%, § 64 , * .; ‘~ t ‘Failui·e to collect, account for, or pay over certain ‘ · taxesyp. 851,’§ 1,266; 9.]%.22, § 1266 I ‘_ _ ” Failure to pay__certall1 taxes or to make returns, ` ,5 ll-850.§1265;p.2022;§1265 ` » ~ ‘ . i False book eat-ries, certificates orreturns, p, 728, § til r' False return, by taxpayer, p. 731, § 99 · . · , False statements as to tax in comrectioa. vvitlr wles or

‘ leases, p. salts, § 1187; p. %16;·§ 1187 _· ‘~

`_l:`org*ing, comiterfelti1lg,‘or. fraudulently using or selling , · stamps, p., 8·l4,`§ 1180 N i N ' ` Fraud agaittsfreveaae,·p. 72$, {64 , . x , Q Fratttl‘alently, execatiag 't·eqaired »documetlts, p. 344, ,r §.1183 Z `. _ · " i Nolle prosequi, authority to enter, p. _'2°:lS, § 160, Penal' statutes geaet·ally,`applieation to ~iIl(€¥l’Ilil[ reve· · ,11UQ, p. 729, § 6S" » ‘ , , _ g· Refusal of taxpayer tolprodueel books, pi. 731, ‘ r Removing or coaeeallag articles *\\’ith latent te defraud ’_ United States, `piiSs14, ·§— 1181 i 1 " Yaluable considers oa received by edlcers for cotaprog ‘ r mise or adjustment of claims, p. 723, § 64 i { { , i V Wlllflll neglect ot tllltll lH111{}$l'igU}`i I3\$`, ll. 735; t ctrl _ .Q®cers and 'cypleyjeee ‘ _ ‘- ' , _, ‘ SQE slew G£lH€{’iQl`§ (lf l’€Y€llll€, §lllll*tl`; {.§t!IlllIliaisltlHit‘l‘ QI Internal Bevemltz, §ll[3lZR ;` Gl1ll§€1’§, Silpfa i IHS9@€?l'$l ~ I ‘ supra; ltevemxei agents, letra; eltoreaeepers, terra; s · . S•.tperi11`te*ndeat of experts and drexrixaclés, infra bompensation, oath required before; payment mode, _ , p;"l’29,§"2’§“ ‘q ` Q

Q X Dlselosiag operatioixs ot, mantxfacitoeres, inenalty, p. 723, sl

· §62;,1>. 1961.§62 ,_- , { Exeeutions against revenue o@cers—, p. 943, § 842 » ` Expenses when—atteadlag trial 0l'»€XtlHl~lIl€liii€&¥}, appro·

, prlatioa available for Q§}’111QI1lI,$ p. *729, §g`E’3; ofllldl, 5:7% - z ‘ ~ _ ,

l·.`Ix;tortloa by ofllteers,·peaaltFl ll. 728, § 64 , lfailure to collect, account f•Jl*,._3lltl pay ovet·Icerta_ia taxes, penalty, p. S5], § 1270 , ’ R Fees.»ve}·ltied statements required, lr. 71?i',_§ 56 ’ . Field work, posts otltitxty, p. 728, § 57 _‘ Interest in certaiamal1l1fat·ttxres prohibited, ,p. $23, § 63 , 'I$Fllll1g` stamps hiéfilllff? ,p$t_viuetxt,,,,fleti.tllty, p. 728, .§ G5 Q · Limit of number of efdcelfs in collection districts, p. 727, $ 535 —' V r `