1362

PUBLIC LAW 85-859-SEPT. 2, 1958

[72 S T A T.

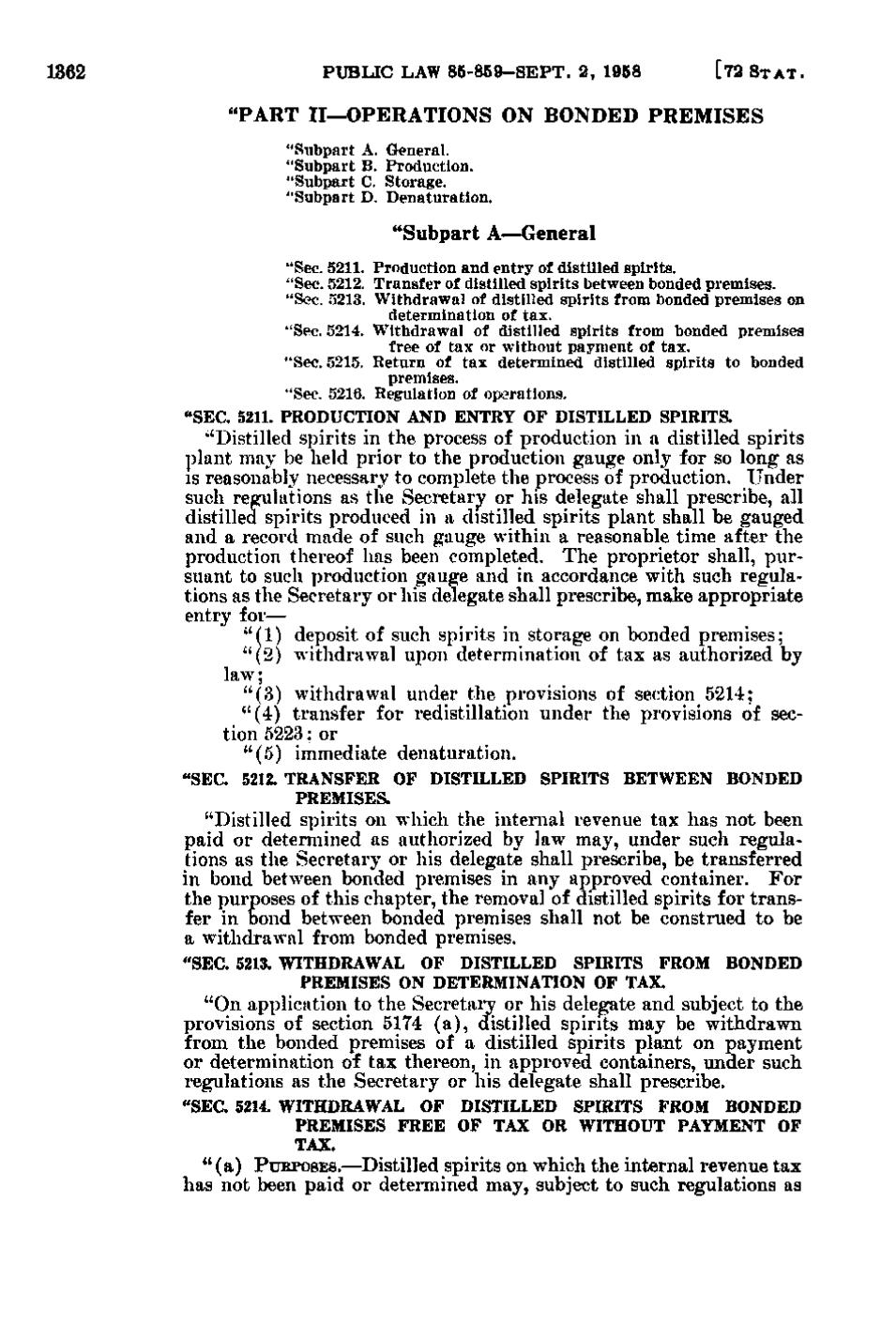

"PART II—OPERATIONS ON BONDED PREMISES "Subpart "Subpart "Subpart "Subpart

A. B. C. D.

General. Production. Storage. Denaturation.

"Subpart A—General "Sec. 5211. Production and entry of distilled spirits. "Sec. 5212. Transfer of distilled spirits between bonded premises. "S-ac. 5213. Withdrawal of distilled spirits from bonded premises on determination of tax. "Sec. 5214. Withdrawal of distilled spirits from bonded premises free of tax or without payment of tax. "Sec. 5215. Return of tax determined distilled spirits to bonded premises. "Sec. 5216. Regulation of op>3rations. "SEC. 5211. PRODUCTION AND ENTRY OF DISTILLED SPIRITS.

"Distilled spirits in the process of production in a distilled spirits plant may be held prior to the production gauge only for so long as IS reasonably necessary to complete the process of production. Under such regulations as the Secretary or his delegate shall prescribe, all distilled spirits produced in a distilled spirits plant shall be gauged and a record made of such gauge within a reasonable time after the production thereof has been completed. The proprietor shall, pursuant to such production gauge and in accordance with such regulations as the Secretary or his delegate shall prescribe, make appropriate entry for— " (1) deposit of such spirits in storage on bonded premises; "(2) withdrawal upon determination of tax as authorized by law; "(3) withdrawal under the provisions of section 5214; "(4) transfer for redistillation under the provisions of section 5223; or "(5) immediate denaturation. "SEC. 5212. TRANSFER OF DISTILLED SPIRITS BETWEEN BONDED PREMISES. "Distilled spirits on which the internal revenue tax has not been paid or determined as authorized by law may, under such regulations as the Secretary or his delegate shall prescribe, be transferred in bond between bonded premises in any approved container. For the purposes of this chapter, the removal of distilled spirits for transfer in bond between bonded premises shall not be construed to be a withdrawal from bonded premises. "SEC. 5213. WITHDRAWAL OF DISTILLED SPIRITS FROM BONDED PREMISES ON DETERMINATION OF TAX. "On application to the Secretary or his delegate and subject to the provisions of section 5174(a), distilled spirits may be withdrawn from the bonded premises of a distilled spirits plant on payment or determination of tax thereon, in approved containers, under such regulations as the Secretary or his delegate shall prescribe. "SEC. 5214. WITHDRAWAL OF DISTILLED SPIRITS FROM BONDED PREMISES FREE OF TAX OR WITHOUT PAYMENT OF TAX. " (a) PURPOSES.—Distilled spirits on which the internal revenue tax has not been paid or determined may, subject to such regulations as

�