742

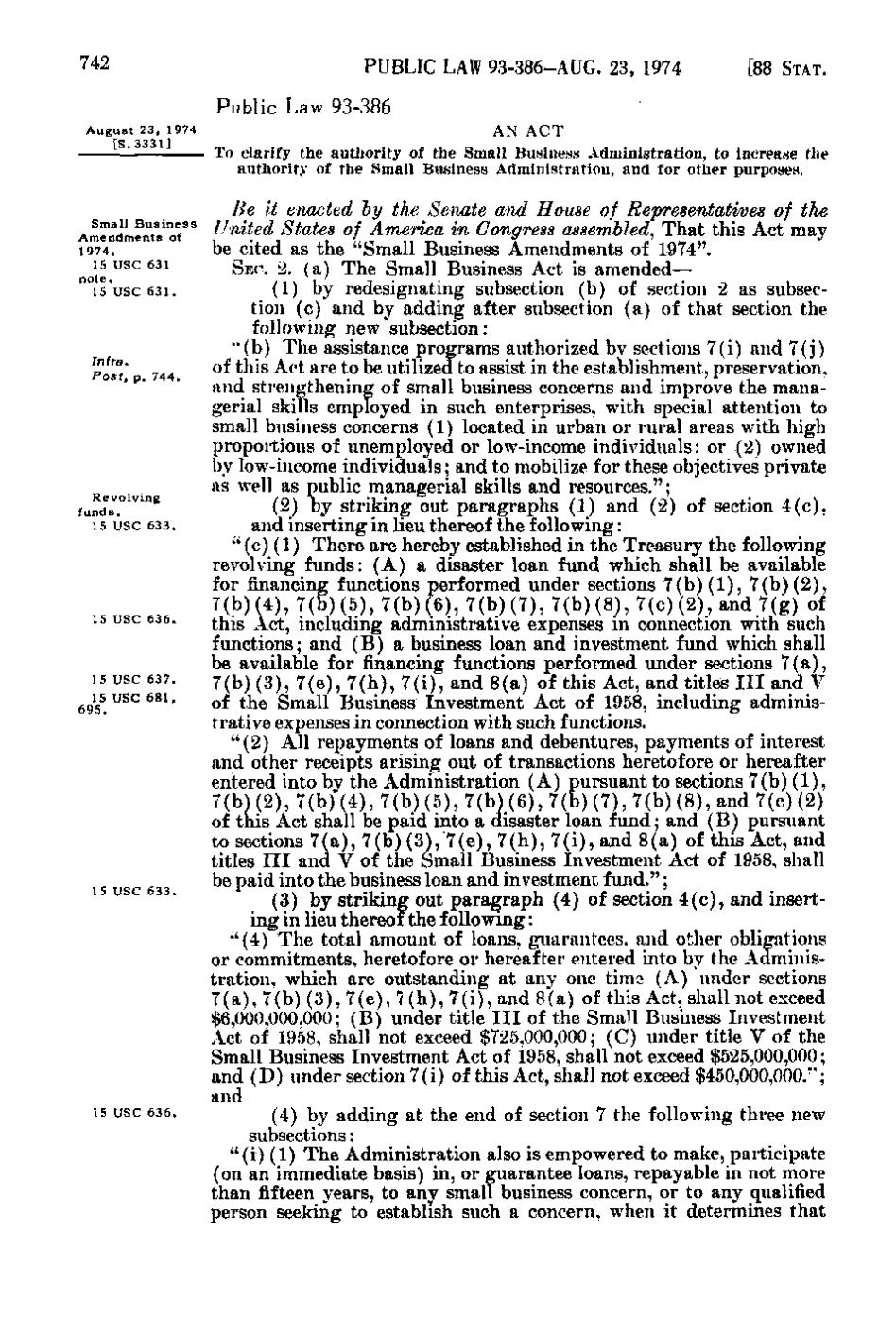

PUBLIC LAW 93-386-AUG. 23, 1974

[88 STAT.

Public Law 93-386 August 23, 1974 [S.3331]

Small B u s i n e s s Amendments of 1974. 15 USC 631 note. 15 USC 6 3 1.

Infra. Post, p. 744.

Revolving funds. 15 USC 6 3 3.

15 USC 636.

15 USC 637. 15 USC 6 8 1, 695.

15 USC 6 3 3.

15 USC 6 3 6.

AN ACT To clarify the authority of the Small Business Administration, to increase the authority of the Small Business Administration, and for other purposes. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That this Act may be cited as the "Small Business Amendments of 1974". SEC. 2. (a) The Small Business Act is amended— (1) by redesignating subsection (b) of section 2 as subsection (c) and by adding after subsection (a) of that section the following new subsection: "(b) The assistance programs authorized by sections 7(i) and 7(j) of this Act are to be utilized to assist in the establishment, preservation, and strengthening of small business concerns and improve the managerial skills employed in such enterprises, with special attention to small business concerns (1) located in urban or rural areas with high proportions of unemployed or low-income individuals: or (2) owned by low-income individuals; and to mobilize for these objectives private as well as public managerial skills and resources."; (2) by striking out paragraphs (1) and (2) of section 4(c), and inserting in lieu thereof the following: (c)(1) There are hereby established in the Treasury the following revolving funds: (A) a disaster loan fund which shall be available for financing functions performed under sections 7(b)(1), 7 (b)(2), 7(b)(4), 7(b)(5), 7(b)(6), 7(b)(7), 7(b)(8), 7(c)(2), and 7(g) of this Act, including administrative expenses in connection with such functions; and (B) a business loan and investment fund which shall be available for financing functions performed under sections 7(a), 7(b)(3), 7(e), 7 (h), 7 (i), and 8(a) of this Act, and titles III and V of the Small Business Investment Act of 1958, including administrative expenses in connection with such functions. "(2) All repayments of loans and debentures, payments of interest and other receipts arising out of transactions heretofore or hereafter entered into by the Administration (A) pursuant to sections 7(b)(1), 7(b)(2), 7(b)(4), 7(b)(5), 7(b)(6), 7(b)(7), 7(b)(8), and 7(c)(2) of this Act shall be paid into a disaster loan fund; and (B) pursuant to sections 7(a), 7(b)(3), 7(e), 7 (h), 7 (i), and 8(a) of this Act, and titles III and V of the Small Business Investment Act of 1958, shall be paid into the business loan and investment fund."; (3) by striking out paragraph (4) of section 4(c), and inserting in lieu thereof the following: •'(4) The total amount of loans, guarantees, and other obligations or commitments, heretofore or hereafter entered into by the Administration, which are outstanding at any one timo (A) under sections 7 (a), 7(b)(3), 7(e), 7 (h), 7 (i), and 8(a) of this Act, shall not exceed $6,000,000,000; (B) under title III of the Small Business Investment Act of 1958, shall not exceed $725,000,000; (C) under title V of the Small Business Investment Act of 1958, shall not exceed $525,000,000; and (D) under section 7(i) of this Act, shall not exceed $450,000,000."; and (4) by adding at the end of section 7 the following three new subsections: "(i)(1) The Administration also is empowered to make, participate (on an immediate basis) in, or guarantee loans, repayable in not more than fifteen years, to any small business concern, or to any qualified person seeking to establish such a concern, when it determines that

�