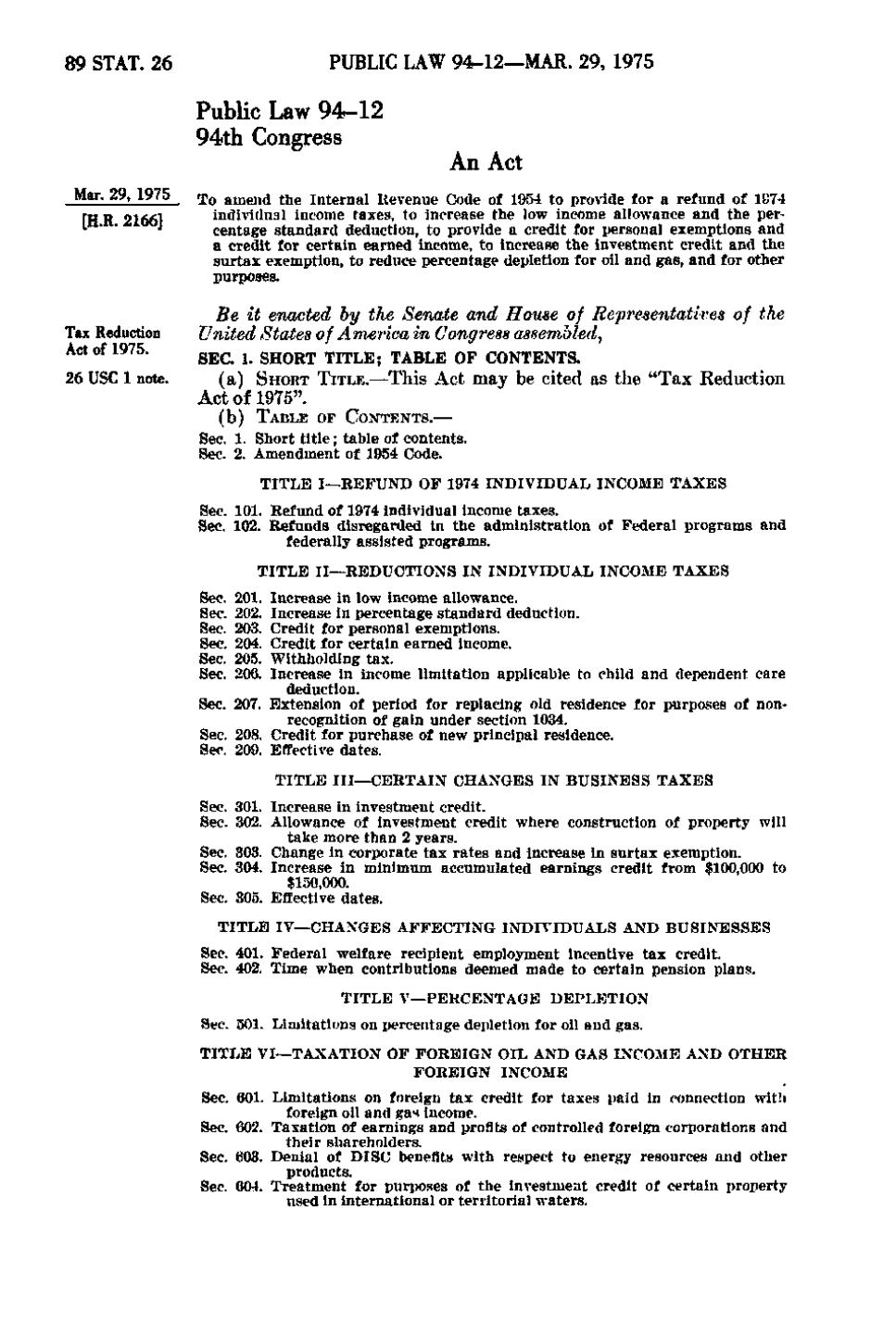

PUBLIC LAW 94-12—MAR. 29, 1975

89 STAT. 26

Public Law 94-12 94th Congress An Act Mar. 29, 1975 [H.R. 2166]

Tax Reduction Act of 1975. 26 USC 1 note.

To amend the Internal Revenue Code of 1954 to provide for a refund of 1874 individual income taxes, to increase the low income allowance and the percentage standard deduction, to provide a credit for personal exemptions and a credit for certain earned income, to increase the investment credit and the surtax exemption, to reduce percentage depletion for oil and gas, and for other purposes.

Be it enacted by the Senate and House of Representatives United States of America in Congress assembled,

of the

SEC. 1. SHORT TITLE; TABLE OF CONTENTS.

(a) SHORT TITLE.—This Act may be cited as the "Tax Reduction

Act of 1975". (b) TABLE OF CONTENTS.— Sec. 1. Short title; table of contents. Sec. 2. Amendment of 1954 Code. TITLE I—REFUND OF 1974 INDIVIDUAL INCOME TAXES Sec. 101. Refund of 1974 individual income taxes. Sec. 102. Refunds disregarded in the administration of Federal programs and federally assisted programs. TITLE II—REDUCTIONS IN INDIVIDUAL INCOME TAXES Sec. Sec. Sec. Sec. Sec. Sec.

201. Increase in low income allowance. 202. Increase in percentage standard deduction. 203. Credit for personal exemptions. 204. Credit for certain earned Income. 205. Withholding tax. 206. Increase in income limitation applicable to child and dependent care deduction. Sec. 207. Extension of period for replacing old residence for purposes of nonrecognition of gain under section 1034. Sec. 208. Credit for purchase of new principal residence. Sec. 209. Effective dates. TITLE III—CERTAIN CHANGES IN BUSINESS TAXES Sec. 301. Increase in investment credit. Sec. 302. Allowance of investment credit where construction of property will take more than 2 years. Sec. 303. Change in corporate tax rates and increase in surtax exemption. Sec. 304. Increase in minimum accumulated earnings credit from $100,000 to $150,000. Sec. 305. Effective dates. TITLE IV—CHANGES AFFECTING INDIVIDUALS AND BUSINESSES Sec. 401. Federal welfare recipient employment incentive tax credit. Sec. 402. Time when contributions deemed made to certain pension plans. TITLE V—PERCENTAGE DEPLETION Sec. 501. Limitations on percentage depletion for oil and gas. TITLE VI—TAXATION OF FOREIGN OIL AND GAS INCOME AND OTHER FOREIGN INCOME Sec. 601. Limitations on foreign tax credit for taxes paid in connection with foreign oil and gas income. Sec. 602. Taxation of earnings and profits of controlled foreign corporations and their shareholders. Sec. 603. Denial of DISC benefits with respect to energy resources and other products. Sec. 604. Treatment for purposes of the investment credit of certain property used in international or territorial waters.

�