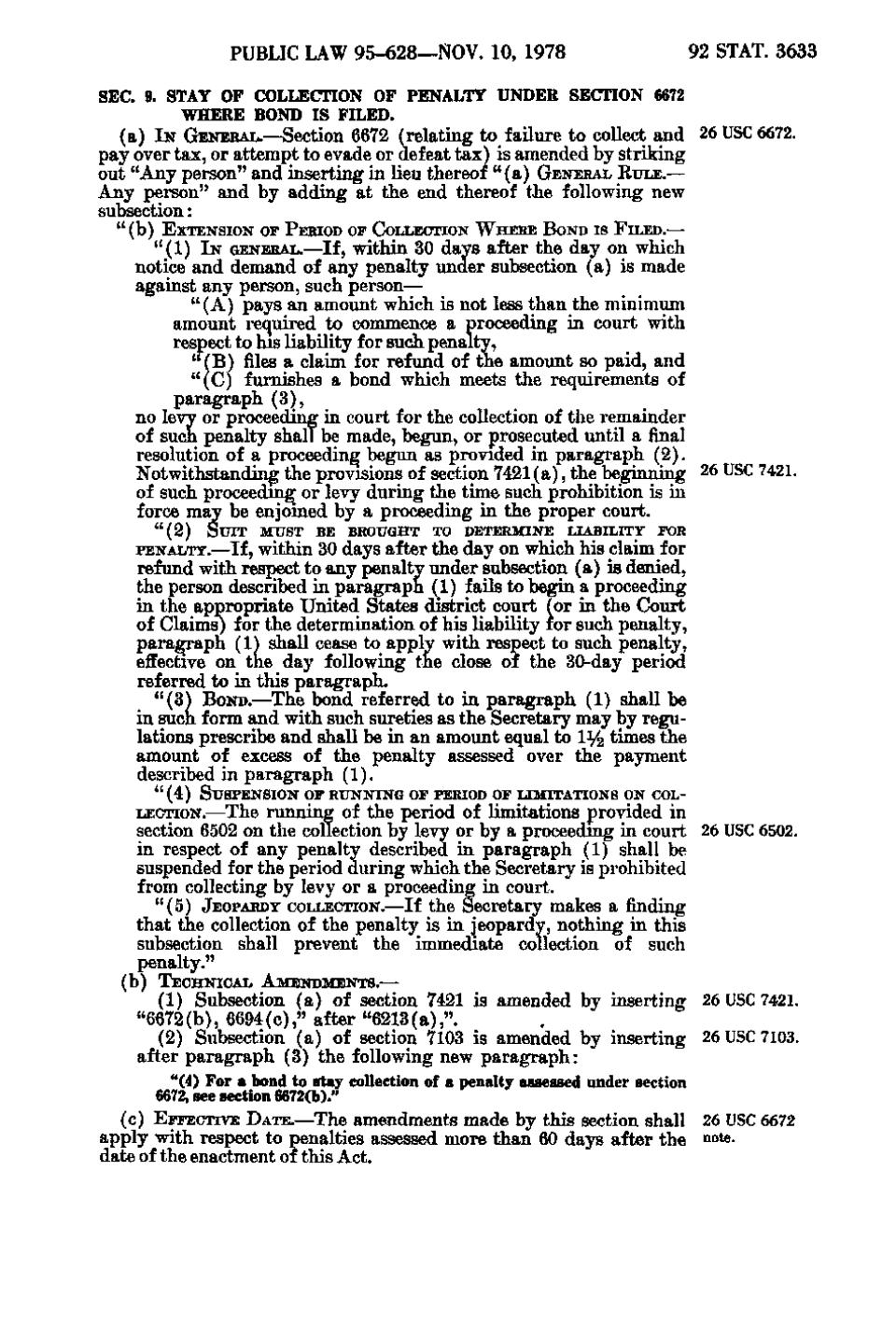

PUBLIC LAW 95-628—NOV. 10, 1978

92 STAT. 3633

SEC. 9. STAY OF COLLECTION OF PENALTY UNDER SECTION 6672 WHERE BOND IS FILED. (a) IN GENERAL.—Section 6672 (relating to failure to collect and 26 USC 6672, pay over tax, or attempt to evade or defeat tax) is amended by striking out " Any person" and inserting in lieu thereof " (a) GENERAL RULE. — Any person" and by a d d i n g a t the end thereof the following new subsection: " (b) E X T E N S I O N o r PERIOD OF COLLECTION W H E R E BOND I S F I L E D. —

" (1) IN GENERAL.—If, within 30 days after the d a y on which notice and demand of any penalty under subsection (a) is made against any person, such person— " (A) pays a n amount which is not less than the minimum amount required to commence a proceeding in court with respect to his liability for such penalty, " (B) files a claim for refund of the amount so paid, and " (C) furnishes a bond which meets the requirements of paragraph (3), no levy or proceeding in court for the collection of the remainder of such penalty shall be made, begun, or prosecuted until a final resolution of a proceeding begun as provided in paragraph (2). Notwithstanding the provisions of section 7421(a), the beginning 26 USC 7421. of such proceeding or levy during the time such prohibition is in force may be enjoined by a proceeding in the proper court. "(2)

SUIT

MUST BE BROUGHT TO DETERMINE LIABILITY FOR

PENALTY.—If, within 30 days after the day on which his claim for refund with respect to any penalty under subsection (a) is denied, the person described in paragraph (1) fails to begin a proceeding in the appropriate United States district court (or in the Court of Claims) for the determination of his liability for such penalty, paragraph (1) shall cease to apply with respect to such penalty, effective on t n e d a y following the close of the 30-day period referred to in this paragraph. " (3) BOND.—The bond referred to i n paragraph (1) shall be in such form and with such sureties as the Secretary may by regulations prescribe and shall be in a n amount equal to li/^ times the amount of excess of the penalty assessed over the payment described in paragraph (1). " (4) SUSPENSION OF RUNNING OF PERIOD OF LIMITATIONS ON COL-

LECTION.—The r u n n i n g of the period of limitations provided in section 6502 on the collection by levy or by a proceeding in court 26 USC 6502. in respect of any penalty described in paragraph (1) shall be suspended for the period during which the Secretary is prohibited from collecting by levy or a proceeding i n court. " (5) JEOPARDY COLLECTION.—If the Secretary makes a

finding

that the collection of the penalty is in jeopardy, nothing in this subsection shall prevent the immediate collection of such penalty." (b) TECHNICAL AMENDMENTS.—

(1) Subsection (a) of section 7421 is amended by inserting "6672(b), 6694(c)," after "6213(a),". (2) Subsection (a) of section 7103 is amended by inserting after paragraph (3) the following new paragraph: "(4) For a bond to stay collection of a penalty assessed under section 6672, see section 6672(b)." (c) EFFECTIVE D A T E. — The amendments made by this section shall apply with respect to penalties assessed more than 60 days after the date of the enactment of this Act.

26 USC 7421. 26 USC 7103.

26 USC 6672 note.

�