PUBLIC LAW 95-600—NOV. 6, 1978

92 STAT. 2767

TITLE VIII—AMENDMENTS RELATING TO SOCIAL SECURITY ACT Sec. 801. Grants to States for social services. Sec. 802. Change in public assistance matching formula, and increase in amount of public assistance dollar limitations, for Puerto Rico, the Virgin Islands, and Guam in fiscal year 1979. SEC. 2. AMENDMENT OF 1954 CODE.

Except as otherwise expressly provided, whenever in this Act an amendment or repeal is expressed in terms of an amendment to, or repeal of, a section or other provision, the reference shall be considered to be made to a section or other provision of the Internal Revenue Code of 1954. 26 USC l et seq. SEC. 3. POLICY WITH RESPECT TO ADDITIONAL TAX REDUCTIONS.

As a matter of national policy the rate of growth in Federal outlays, 26 USC l note. adjusted for inflation, should not exceed 1 percent per year between fiscal year 1979 and fiscal year 1983; Federal outlays as a percentage of gross national product should decline to below 21 percent in fiscal year 1980, 20.5 percent in fiscal year 1981, 20 percent in fiscal year 1982 and 19.5 percent in fiscal year 1983; and the Federal budget should be balanced in fiscal years 1982 and 1983. If these conditions are met, it is the intention that the tax-writing committees of Congress will report legislation providing significant tax reductions for individuals to the extent that these tax reductions are justified in the light of prevailing and expected economic conditions.

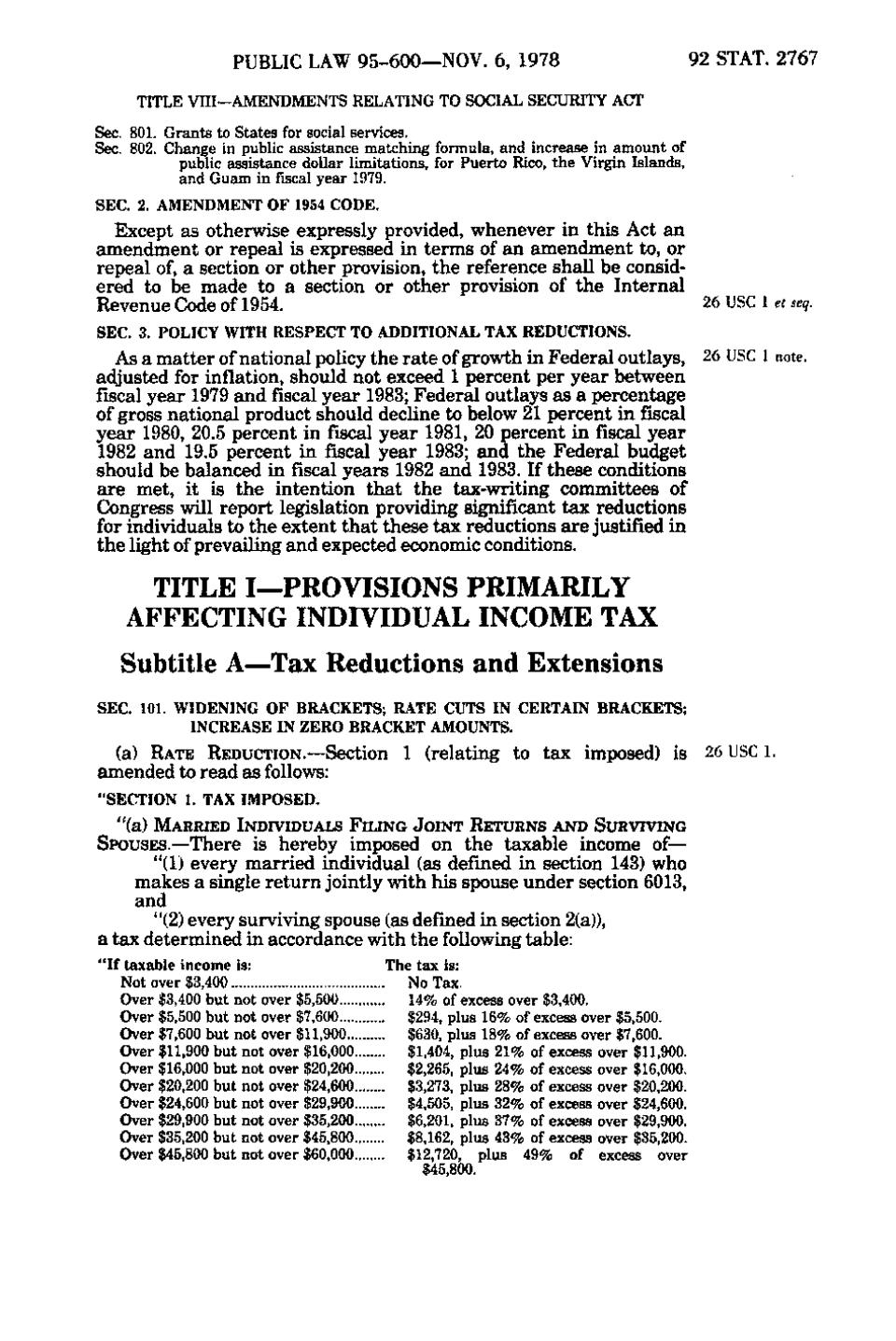

TITLE I—PROVISIONS PRIMARILY AFFECTING INDIVIDUAL INCOME TAX Subtitle A—Tax Reductions and Extensions SEC. 101. WIDENING OF BRACKETS; RATE CUTS IN CERTAIN BRACKETS; INCREASE IN ZERO BRACKET AMOUNTS. (a) RATE REDUCTION.—Section 1 (relating to tax imposed) is

amended to read as follows: "SECTION 1. TAX IMPOSED. "(a) MARRIED INDIVIDUALS FILING JOINT RETURNS AND SURVIVING

SPOUSES.—There is hereby imposed on the taxable income of— "(1) every married individual (as defined in section 143) who makes a single return jointly with his spouse under section 6013, and "(2) every surviving spouse (as defined in section 2(a)), a tax determined in accordance with the following table: "If taxable income is: Not over $3,400 Over $3,400 but not over $5,500 Over $5,500 but not over $7,600 Over $7,600 but not over $11,900 Over $11,900 but not over $16,000 Over $16,000 but not over $20,200 Over $20,200 but not over $24,600 Over $24,600 but not over $29,900 Over $29,900 but not over $35,200 Over $35,200 but not over $45,800 Over $45,800 but not over $60,000

The tax is: No Tax. 14% of excess over $3,400. $294, plus 16% of excess over $5,500. $630, plus 18% of excess over $7,600. $1,404, plus 21% of excess over $11,900. $2,265, plus 24% of excess over $16,000. $3,273, plus 28% of excess over $20,200. $4,505, plus 32% of excess over $24,600. $6,201, plus 37% of excess over $29,900. $8,162, plus 43% of excess over $35,200. $12,720, plus 49% of excess over $45,800.

26 USC l.

�