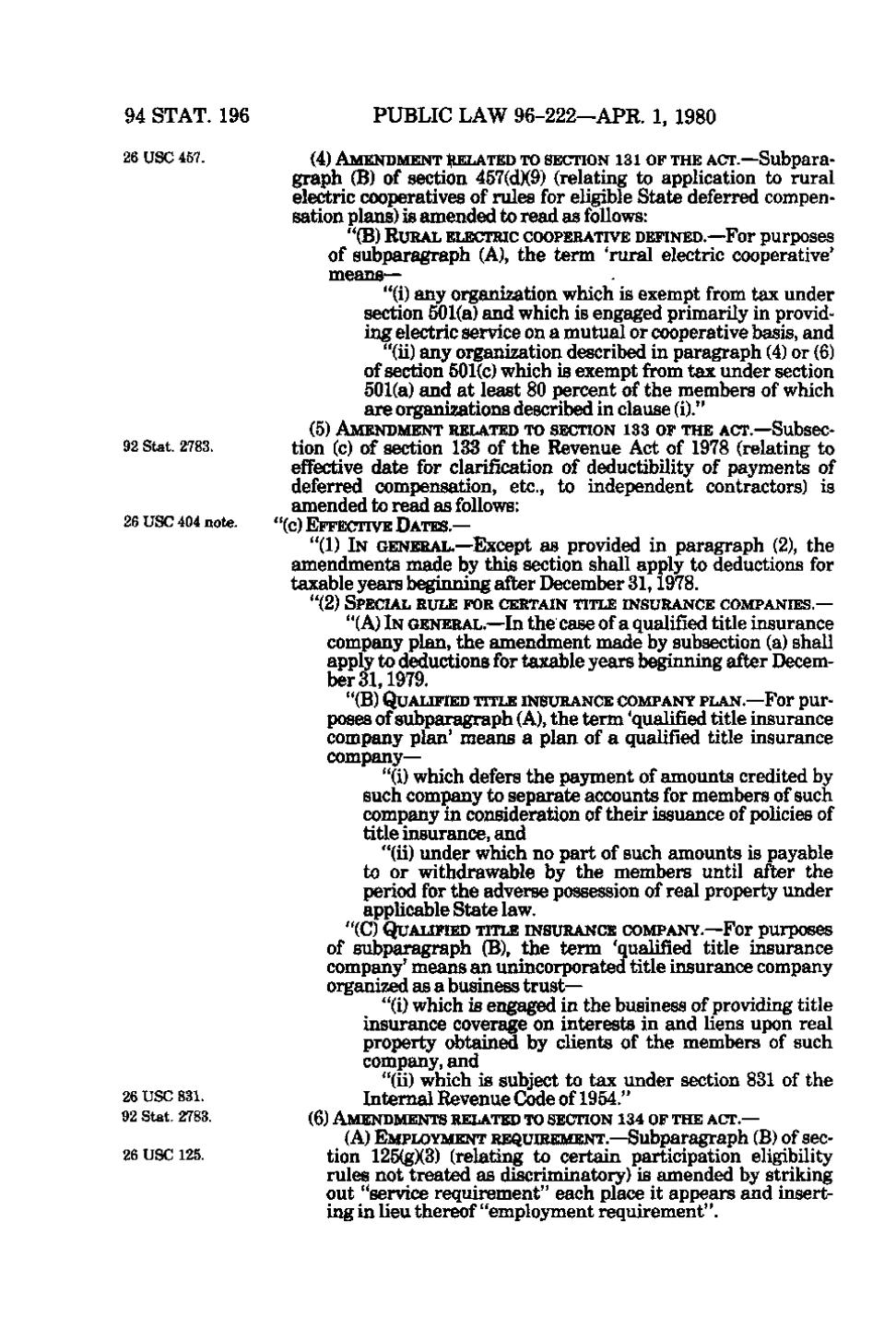

94 STAT. 196 26 USC 457.

PUBLIC LAW 96-222—APR. 1, 1980 (4) AMENDMENT ^IELATED TO SECTION I 3 1 OF THE ACT.—Subpara-

graph (B) of section 457(d)(9) (relating to application to rural electric cooperatives of rules for eligible State deferred compensation pleins) is amended to read as follows: "(B) RURAL ELECTRIC COOPERATIVE DEFINED.—For purposes of subparagraph (A), the term 'rural electric cooperative' means— "(i) any organization which is exempt from tax under section 501(a) and which is engaged primarily in providing electric service on a mutual or cooperative basis, and "(ii) any organization described in paragraph (4) or (6) of section 501(c) which is exempt from tax under section 501(a) and at least 80 percent of the members of which are organizations described in clause (i)." (5) AMENDMENT RELATED TO SECTION 133 OF THE ACT.—Subsec-

92 Stat. 2783.

26 USC 404 note.

tion (c) of section 133 of the Revenue Act of 1978 (relating to effective date for clarification of deductibility of payments of deferred compensation, etc., to independent contractors) is amended to read as follows: "(c) EFFECTIVE D A T E S. —

"(1) IN GENERAL.—Except as provided in paragraph (2), the amendments made by this section shall apply to deductions for taxable years beginning after December 31, 1978. "(2) SPECIAL RULE FOR CERTAIN TITLE INSURANCE COMPANIES.—

26 USC 831. 92 Stat. 2783.

26 USC 125.

"(A) IN GENERAL.—In the case of a qualified title insurance company plan, the amendment made by subsection (a) shall apply to deductions for taxable years beginning after December 31, 1979. "(B) QUALIFIED TITLE INSURANCE COMPANY PLAN.—For purposes of subparagraph (A), the term 'qualified title insurance company plan* means a plan of a qualified title insurance company— "(i) which defers the payment of amounts credited by such company to separate accounts for members of such company in consideration of their issuance of policies of title insurance, and "(ii) under which no part of such amounts is payable to or withdrawable by the members until after the period for the adverse possession of real property under applicable State law. "(C) QUALIFIED TITLE INSURANCE COMPANY.—For purposes of subparagraph (B), the term 'qualified title insurance company' means an unincorporated title insurance company organized as a business trust— "(i) which is engaged in the business of providing title insurance coverage on interests in and liens upon real property obtained by clients of the members of such company, and "(ii) which is subject to tax under section 831 of the Internal Revenue Code of 1954." (6) AMENDMENTS RELATED TO SECTION 134 OF THE ACT.— (A) EMPLOYMENT REQUIREMENT.—Subparagraph (B) of sec-

tion 125(g)(3) (relating to certain participation eligibility rules not treated as discriminatory) is amended by striking out "service requirement" each place it appears and inserting in lieu thereof "employment requirement".

�