PUBLIC LAW 96-223—APR. 2, 1980

94 STAT. 303

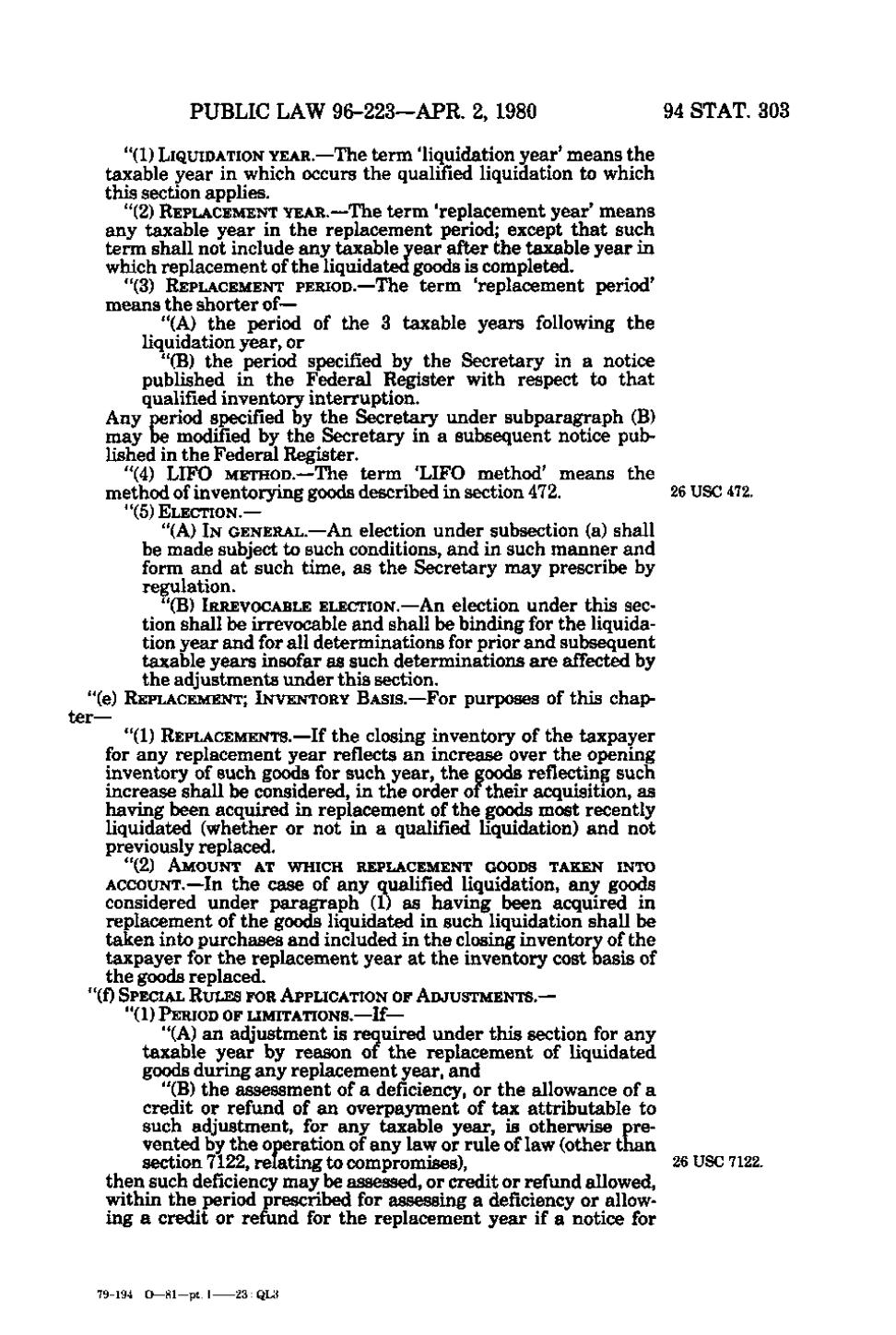

"(1) LIQUIDATION YEAR.—The term 'liquidation year* means the taxable year in which occurs the qualified liquidation to which this section applies. "(2) REPLACEMENT YEAR.—The term 'replacement year' means any taxable year in the replacement period; except that such term shall not include any taxable year after the taxable year in which replacement of the liquidated goods is completed. "(3) REPLACEMENT PERIOD.—The term 'replacement period' means the shorter of— "(A) the period of the 3 taxable years following the liquidation year, or "(B) the period specified by the Secretary in a notice published in the Federal Register with respect to that qualified inventory interruption. Any period specified by the Secretary under subparagraph (B) may be modified by the Secretary in a subsequent notice published in the Federal Register. "(4) LIFO METHOD.—The term 'LIFO method' means the method of inventorying goods described in section 472. 26 USC 472. "(5) ELECTION.—

"(A) IN GENERAL.—An election under subsection (a) shall be made subject to such conditions, and in such manner and form and at such time, as the Secretary may prescribe by regulation. "(B) IRREVOCABLE ELECTION.—An election under this section shall be irrevocable and shall be binding for the liquidation year and for all determinations for prior and subsequent taxable years insofar as such determinations are affected by the adjustments under this section. "(e) REPLACEMENT; INVENTORY BASIS.—For purposes of this chapter— "(1) REPLACEMENTS.—If the closing inventory of the taxpayer for any replacement year reflects an increase over the opening inventory of such goods for such year, the goods reflecting such increase shall be considered, in the order of their acquisition, as having been acquired in replacement of the goods most recently liquidated (whether or not in a qualified liquidation) and not previously replaced. "(2)

AMOUNT AT WHICH REPLACEMENT GOODS TAKEN INTO

ACCOUNT.—In the case of any qualified liquidation, any goods considered under paragraph (1) as having been acquired in replacement of the goods liquidated in such liquidation shall be taken into purchases and included in the closing inventory of the taxpayer for the replacement year at the inventory cost basis of the goods replaced. "(f) SPECIAL RULES FOR APPLICATION OF ADJUSTMENTS.— "(1) PERIOD OF LIMITATIONS.—If—

"(A) an adjustment is required under this section for any taxable year by reason of the replacement of liquidated goods during any replacement year, and "(B) the assessment of a deficiency, or the allowance of a credit or refund of an overpayment of tax attributable to such adjustment, for any taxable year, is otherwise prevented by the operation of any law or rule of law (other than section 7122, relating to compromises), 26 USC 7122. then such deficiency may be assessed, or credit or refund allowed, within the period prescribed for assessing a deficiency or allowing a credit or refund for the replacement year if a notice for

79-194

O—81—pt. 1

23: QL3

�