PUBLIC LAW 98-369—JULY 18, 1984

98 STAT. 869

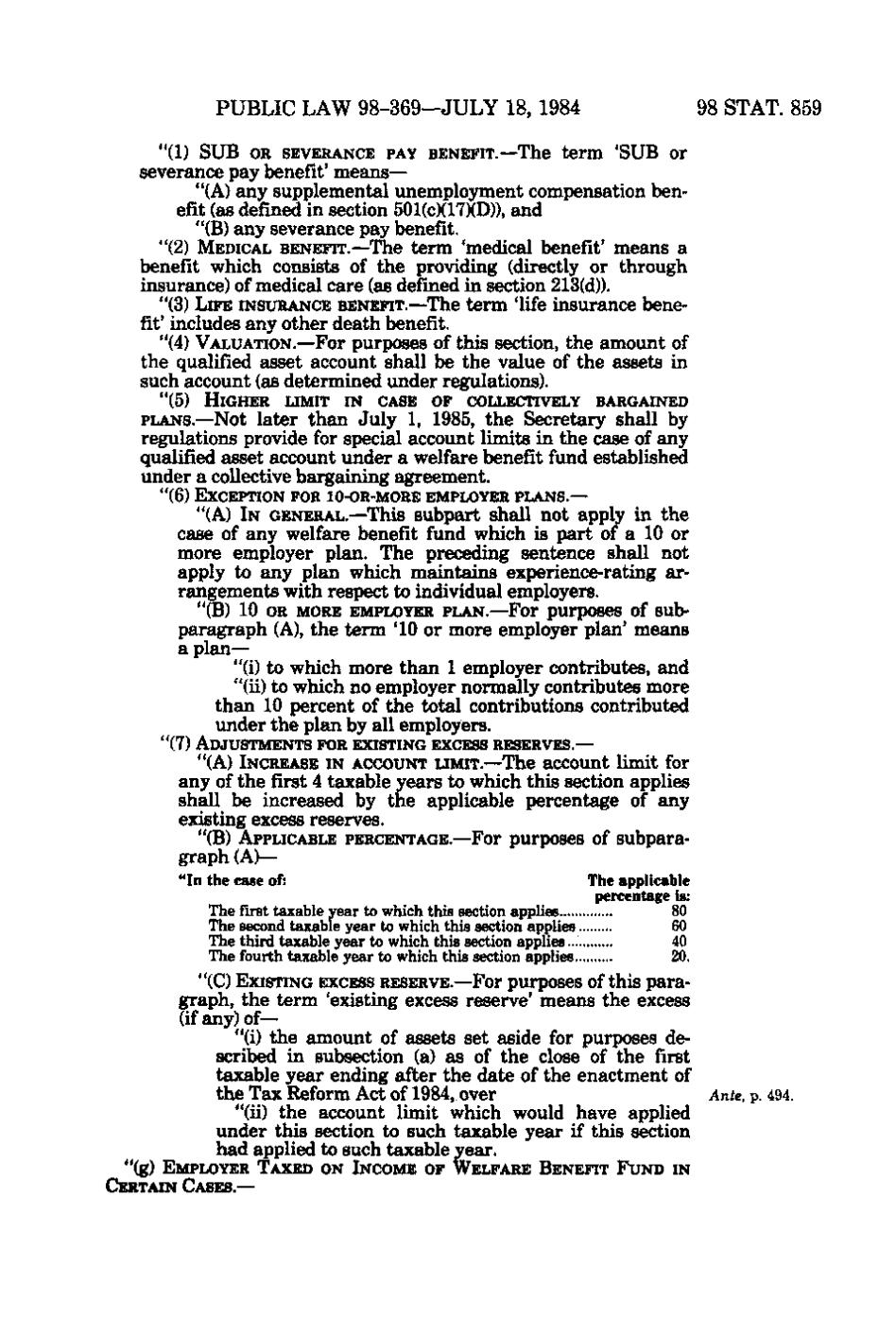

"(1) SUB O SEVERANCE PAY BENEFIT.—The term 'SUB or R severance pay benefit' means— "(A) any supplemental unemployment compensation benefit (as defined in section 501(c)(17)(D)), and "(B) any severance pay benefit. "(2) MEDICAL BENEFIT.—The term 'medical benefit' means a benefit which consists of the providing (directly or through insurance) of medical care (as defined in section 213(d)). "(3) LIFE INSURANCE BENEFIT.—The term 'life insurance benefit' includes any other death benefit. "(4) VALUATION.—For purposes of this section, the amount of the qualified asset account shall be the value of the assets in such account (as determined under regulations). "(5) HIGHER LIMIT IN CASE OF COLLECTIVELY BARGAINED

PLANS.—Not later than July 1, 1985, the Secretary shall by regulations provide for special account limits in the case of any qualified asset account under a welfare benefit fund established under a collective bargaining agreement. "(6) EXCEPTION FOR IO-OR-MORE EMPLOYER PLANS.—

-MM" u

"(A) IN GENERAL.—This subpart shall not apply in the case of any welfare benefit fund which is part of a 10 or more employer plan. The preceding sentence shall not apply to any plan which maintains experience-rating arrangements with respect to individual employers. "(B) 10 OR MORE EMPLOYER PLAN.—For purposes of subparagraph (A), the term '10 or more employer plan' means a plan— "(i) to which more than 1 employer contributes, and "(ii) to which no employer normally contributes more than 10 percent of the total contributions contributed under the plan by all employers.

- i)£

"(7) ADJUSTMENTS FOR EXISTING EXCESS RESERVES.— "(A) INCREASE IN ACCOUNT LIMIT.—The account

limit for any of the first 4 taxable years to which this section applies shall be increased by the applicable percentage of any existing excess reserves. "(B) APPLICABLE PERCENTAGE.—For purposes of subpara-

graph (A)— u '3d '

««in the case of: The The The The

..,

The applicable percentage is: first taxable year to which this section applies 80 second taxable year to which this section applies 60 third taxable year to which this section applies... 40 fourth taxable year to which this section applies 20.

"(C) EXISTING EXCESS RESERVE.—For purposes of this paragraph, the term 'existing excess reserve' means the excess (if any) of— "(i) the amount of assets set aside for purposes described in subsection (a) as of the close of the first taxable year ending after the date of the enactment of the Tax Reform Act of 1984, over Ante, p. 494. "(ii) the account limit which would have applied under this section to such taxable year if this section had applied to such taxable year.

"(g) EMPLOYER 'TAXED ON INCOME OF WELFARE BENEFIT FUND IN CERTAIN CASES.—

�